Steady Your Wealth Management: The Benefits of a Financial Advisor

Wade Johnson, Partner, Investment Services

17 September 2023

07 March 2024

minutes

A lot of us are interested in building our wealth and securing our financial future. Less of us, however, are interested in the minutiae of the stock market or inclined to study commerce recreationally, leaving us uncertain of our options. Due to this, it can be overwhelming to start your financial investment journey alone, which can stop many people before they even begin.

Having a financial advisor by your side to guide you can help reduce the cognitive overload and stress experienced not only when you get started, but also going forward. Having a trusted advisor to turn to when you need to make difficult and impactful financial decisions can ease the burden of uncertainty.

What does a financial advisor do?

Simply put, a financial advisor helps you make decisions about how best to use or invest your money. However, their benefits go beyond simply making stock market trades on your behalf, recommending products, and explaining financial issues.

How can they help?

Financial advisors have the experience, knowledge, and expertise to assist you in the following ways:

- Clearly articulate your needs, objectives, and purpose for investing

- Create a tailored investment strategy aimed at achieving both your short and long-term goals

- Keep your goals specific, measurable, achievable, relevant, and time-based (which is critical for success)

- Broaden the scope of your financial planning beyond investment to consider budgets, savings, superannuation, estate planning, insurance, and taxation implications

- Regularly monitor and adjust your wealth management strategy to ensure it remains appropriate as your situation, the markets, and regulation changes

- Offer a disciplined and rational approach to financial decision-making

That final point is extremely important. It can be difficult to remain unbiased or not give in to emotion when it comes to financial decisions, particularly as time progresses and your situation changes. A trusted financial advisor can be a port in the storm during turbulent times, keeping you steady and aligned with achieving your financial goals.

When market conditions worsen in the short term, investors are compelled to act as they attempt to protect their wealth and avoid losses. However, research shows that short-term and emotionally loaded decision-making can adversely impact long-term outcomes.

When COVID-19 emerged and threatened to disrupt the global economy, share markets experienced significant volatility amid considerable uncertainty. Without a financial advisor to act as an experienced and trustworthy guide, events such as these can easily influence you to approach your wealth management emotionally and inadvertently add unnecessary risk to your financial future.

CASE STUDY

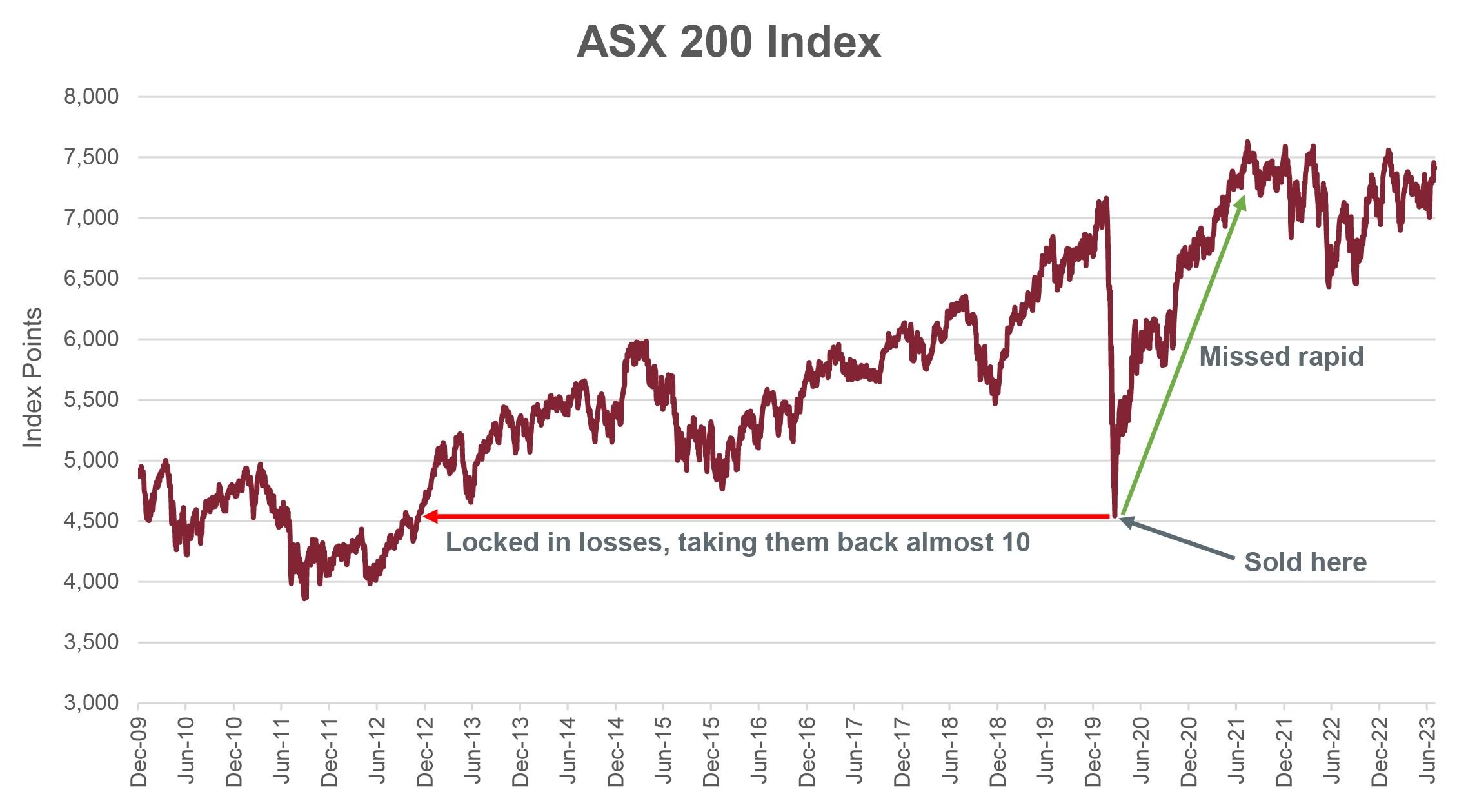

John had been investing in the ASX 200 Index for several years.

John was following the news of the spread of COVID-19 during the early stages of the global pandemic and became panicked. Worried his investment would make him suffer a loss if the situation worsened, he decided to sell it in March 2020.

By reacting emotionally and not consulting a financial advisor before making his decision, John suffered significant losses by selling when he did and set his investment growth back by almost 10 years. He also failed to reinvest quickly and missed the rapid recovery that the stock market experienced shortly after he sold his investment.

With hindsight, this sort of investment decision seems irrational. However, at the time the economic outlook was dire, and understandably, investors certainly did panic sell their investments at what we now know was the worst possible time.

Financial advisors are able to understand the forecasts during such circumstances to see beyond the storm clouds, keeping you moored steadily amid the waves of uncertainty that are inevitable during your investment journey. With the guidance of one, you won’t be steered away from your financial goals.

Are you ready to start investing or looking for help with financial planning? Speak to one of our Investment Advisors today.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.