Cutcher's Investment Lens | 13 - 17 October 2025

Cutcher & Neale Wealth Management

19 October 2025

19 October 2025

minutes

Weekly recap

What happened in markets

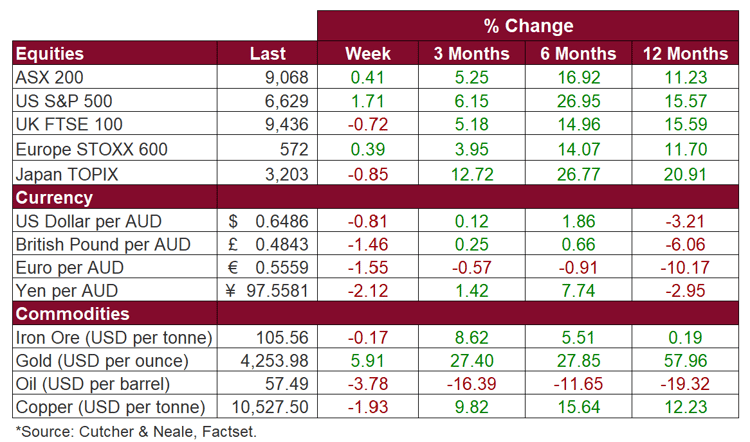

The Australian sharemarket posted a modest gain over the week, as the ASX 200 rose 0.4% despite Friday’s retreat. The industry sectors were volatile, however strength in Health Care (+1.3%), Materials (+4.0%) and REITs (+1.7%) supported the market, while the Energy (-1.7%) and Information Technology (-4.3%) sectors underperformed. Precious metals miners and copper names outperformed as gold prices continued to rally and copper strengthened on supply concerns. Softer domestic labour data and expectations of lower rates provided a tailwind for defensive sectors such as REITs, Utilities, and Consumer Staples. Overall, the week reflected a cautious but constructive tone, balancing global uncertainties with domestic support from defensives and commodity-linked sectors.

US sharemarkets posted strong gains last week, making up lost ground after last Friday’s sharp sell-off, as easing US-China trade tensions helped restore risk appetite. Optimism was supported by ongoing big-bank earnings and renewed enthusiasm for AI-related stocks. The S&P 500 (+1.7%) and NASDAQ (+2.1%) both advanced, as all of the major industry sectors finished the week in positive territory. As a result, the Information Technology (+2.1%) sector led the gains, while Consumer Staples (+2.0%) and Utilities (+1.5%) also rose. Economic data remained mixed, with signs of resilience in housing and manufacturing, despite the government shutdown. Gold prices rose over the week, supported by a weaker US dollar and softer Treasury yields, as investors sought safety amid lingering geopolitical and policy uncertainty.

European sharemarkets finished marginally higher last week, as the STOXX 600 added 0.4%. Investors weighed renewed US-China trade tensions against a mixed start to the Q3 earnings season. President Trump’s threat of 100% tariffs on Chinese goods initially rattled sentiment, though markets recovered after he later described the measures as “unsustainable”. Early results from major European corporates including LVMH, ASML, and Nestlé helped support the broader index. The Health Care (+3.7%) sector led the indices, while Retail (+2.1%) and Materials (+1.8%) also rose. In the UK, data showed rising unemployment alongside persistent wage pressures and softer retail sales, leading markets to price in further Bank of England rate cuts.

Stock & sector movements

What caught our eye

Rare Earths, Real Stakes: The New Trade Tension

There’s been another turn in the ongoing US-China trade saga, and while it’s not entirely unexpected, it’s certainly noteworthy. Late last week, US President Donald Trump announced a plan to impose a 100% tariff on Chinese imports, effective November 1, in response to Beijing’s decision to tighten export restrictions on rare-earth elements. These critical minerals, which are essential to a range of advanced technologies, from electric vehicles to defence systems, are an area where China holds significant market dominance, processing over 90% of global supply.

This latest move highlights just how strategic critical minerals have become. While tariffs and trade posturing have been recurring features of the US-China relationship over the past few years, the focus is now shifting to supply chains that underpin modern technology and national security. The likes of which has been exacerbated by the rapid development of artificial intelligence and robotics. The rare-earth sector, which once operated under the radar of global politics, is now front and centre.

Interestingly, both sides appear to be tempering their tone following their initial announcements. Beijing has indicated it will apply its new export rules “prudentially”, and the US is reportedly keen to avoid derailing upcoming talks between President Trump and President Xi Jing Ping later this month. There’s clearly a desire, at least for now, to avoid letting this escalation spiral out of control.

Closer to home, this newfound focus on rare earth minerals may lead to Australia stepping into a more active role in global trade politics. Ahead of Prime Minister Anthony Albanese’s visit to Washington this week, our government has been consulting on a plan for our critical minerals. The idea is to secure future supply through structured offtake agreements that reduce reliance on any one market, particularly China. It’s part of a broader push to ensure long-term access to materials seen as vital to the global energy transition and digital economy.

We’re also seeing the private sector align with this trend. JPMorgan Chase has committed US$10 billion of its own capital to invest in US-based companies considered critical to national security, including those in the rare-earth, AI and defence sectors. CEO Jamie Dimon pointed to the risks of overdependence on unreliable suppliers and the need to strengthen domestic capabilities.

What does this mean for investors?

For investors, this reinforces a few things. First, geopolitical risks remain firmly in play, even if markets have grown somewhat accustomed to the back-and-forth since Trump’s re-election. Second, there’s growing momentum, from both governments and financial institutions, to safeguard supply chains for important industrial inputs. The rare-earth standoff is more than another trade spat. It signals a structural shift in how nations think about economic security. And third, the intersection of geopolitics, resources and technology is likely to be an enduring investment theme where Australia has a role to play.

The week ahead

Locally, it is a quiet week in terms of economic data. Investors will await a speech from RBA Governor Michele Bullock for economic insights.

Overseas, GDP Growth and Retail Sales will be released in China. In the US, investors will receive the September Consumer Price Index and New Home Sales data.

A comprehensive investment strategy and strong asset allocation can assist with maximising the benefits and minimising the risk across your portfolio as part of achieving your individual goals and objectives. Supported by our dedicated investment team, we focus on communicating market developments and investment opportunities to our clients in a timely manner. We take the time to fully understand both your current financial position and goals. Then we tailor a comprehensive investment strategy to match and implement it on your behalf.

.png?width=352&name=Investment%20SnapShot%20Header%20-%20July%202025%20(1).png)