Cutcher's Investment Lens | 3 - 7 November 2025

Cutcher & Neale Wealth Management

10 November 2025

10 November 2025

minutes

Weekly recap

What happened in markets

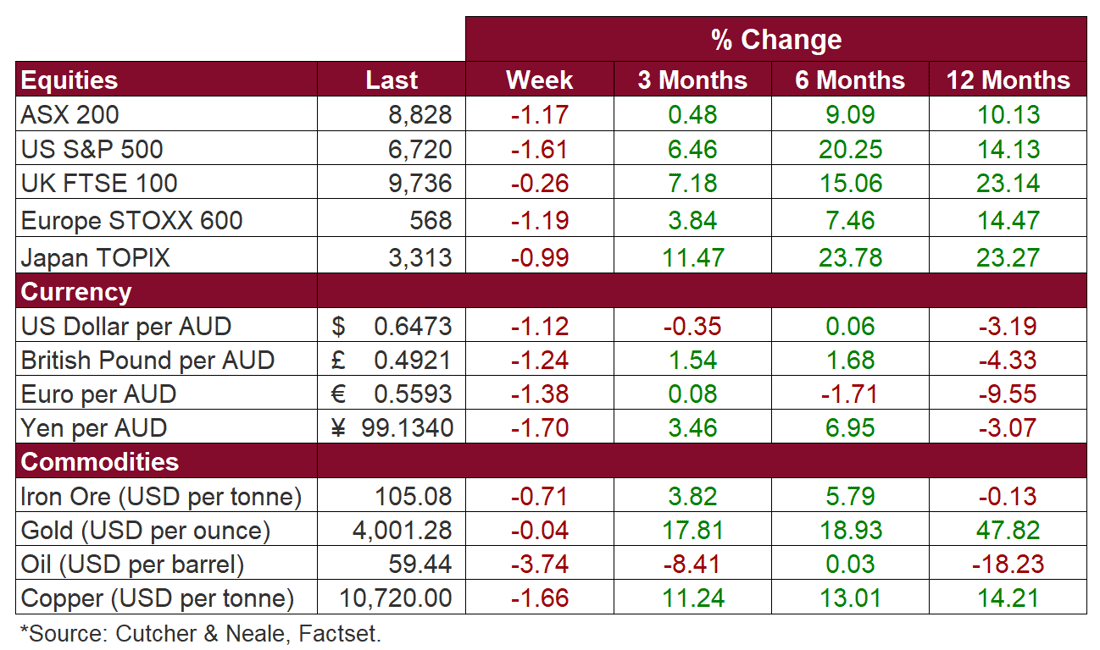

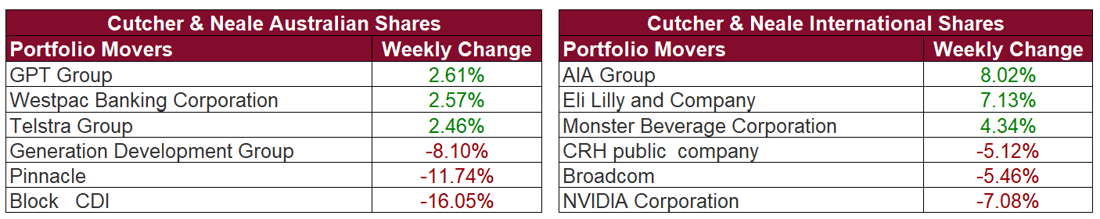

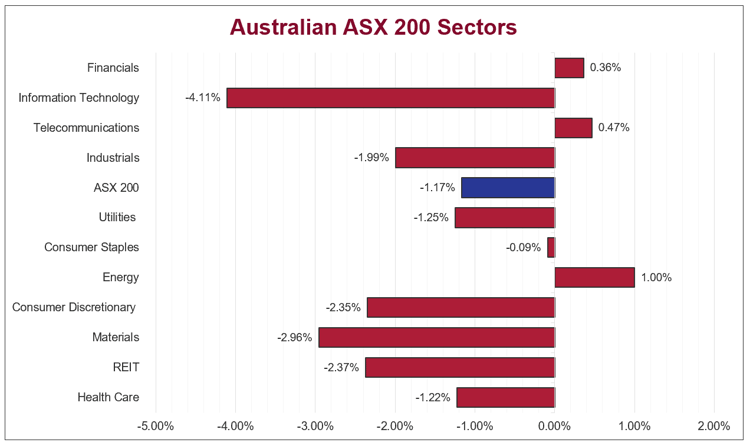

The Australian sharemarket declined last week, with the ASX 200 falling 1.2% to 8,828, marking a second consecutive weekly loss and a six-week low. Early gains faded after the RBA held the cash rate at 3.60%, with commentary indicating inflation is likely to remain elevated for longer, while rate cuts are not expected until mid-2026. Losses were broad-based across most sectors, led by Materials (-3.0%), Information Technology (-4.1%) and REITs (-2.4%) sectors. In contrast, the Energy (+1.0%), Telecommunications (+0.5%), and Financials (+0.4%) sectors recorded gains, supported by strength among the major banks and selective defensive names.

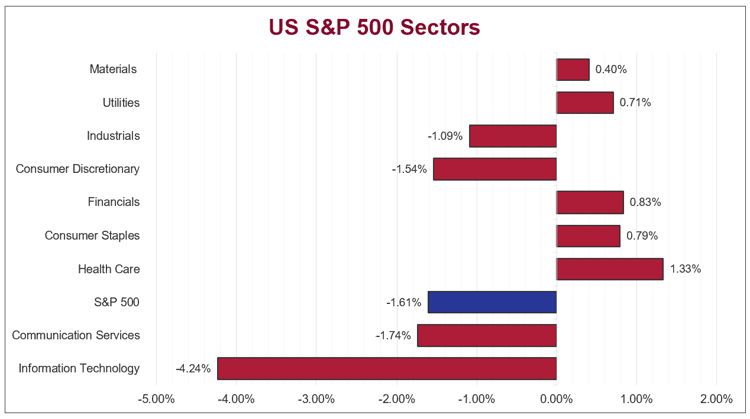

US sharemarkets declined last week, snapping a three-week winning streak as the S&P 500 (-1.6%) and NASDAQ (-3.0%) both finished lower. Losses were led by the Information Technology sector (-4.2%), as investors rotated out of high-growth names amid renewed concerns over AI-related valuations and stretched earnings expectations. In contrast, stronger results from regional banks and insurers supported the Financials (+0.8%) and Energy (+1.5%) sectors, which outperformed. Treasury yields were firmer, with the curve steepening modestly, while the US Dollar weakened against major peers as investors reassessed the timing of future Federal Reserve policy easing.

European sharemarkets fell last week, with the STOXX Europe 600 down 1.2%, extending its losing streak to a second week and marking the lowest close since mid-October. Tracking weakness in US markets, the Technology (-4.4%) sector led declines, as AI-linked names came under pressure amid renewed concerns over valuations, while the Basic Resources (-2.6%) sector fell on softer Chinese demand and weaker commodity prices. Financial Services (-2.4%), Health Care (-2.7%), and Retail (-2.4%) sectors also weighed on performance, while Automobiles & Parts (+2.6%) outperformed on easing chip export tensions and upbeat earnings from major manufacturers.

Stock & sector movements

What caught our eye

RBA’s Reality Check

If you were still holding out hope for a surprise interest rate cut from the RBA on Melbourne Cup Day, that dream was officially scratched last week.

On Tuesday last week, the central bank held the cash rate target at 3.6%, but it wasn’t the hold that caught our attention, it was the message that came with it. Governor Michele Bullock made it clear that any further easing may be off the table altogether.

In fact, the RBA now expects inflation to remain outside its 2–3% target band through 2026. Underlying inflation is forecast to hover around 3.2% this financial year, significantly above earlier expectations of 2.6%.

Bullock herself called recent inflation data a “material” upside surprise and conceded that the RBA may have underestimated the imbalance between demand and supply. She even floated the possibility that the current rate isn’t as restrictive as previously thought.

So, what’s changed?

That troublesome word “transitory” is once again under serious review. It’s true that one-offs and seasonal factors, like travel, fuel and council rates, have influenced price growth numbers recently. However, persistent inflationary pressure stemming from services, construction and dining out is worrying.

Something we’ve also been watching is home prices, given the flow through wealth effect on household spending. That is, as one’s assets rise in value, they feel more confident in their financial situation and are willing to spend more. In turn, that spending puts upward pressure on prices.

Recent data from Cotality (formerly CoreLogic) indicates that Australian property values jumped 1.1% in October, the fastest monthly gain since June 2023. The explosive month has been attributed to the government’s expansion of the 5% home deposit guarantee, implemented on the first of October. The national Home Value Index increased 2.8% in the last three months and 6.1% year-on-year. So, the wealth effect could well be contributing to the uptick in consumer spending we’re seeing.

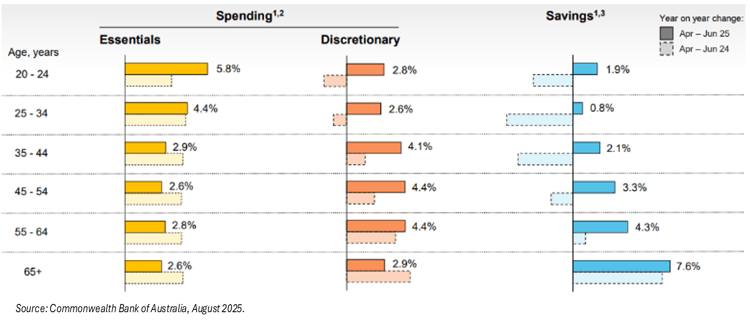

That can’t be the whole story though. More detailed spending data from Commonwealth Bank shows that discretionary spending growth for Australians aged under 34 has turned positive this year. While most of the discretionary spending is still being done by those older, we’re clearly seeing a more broad-based recovery in willingness and ability to spend.

For investors, what does this mean?

These developments reaffirm that monetary policy is likely no longer to be a reliable tailwind for asset prices and perhaps we’re at, or at least approaching, the end of the interest rate cutting cycle. Of course, that depends on what we see elsewhere in the economy. Commodity prices, private sector demand and household spending will be critical. Whether those seasonal forces Bullock outlined stick around will also be important.

Sectors most vulnerable to higher interest rates have unsurprisingly weakened since the latest inflation print just over a week ago. Those being the Information Technology (-6.1%), Consumer Discretionary (-8.0%) and Real Estate (-4.4%) sectors. For context, the broader ASX 200 index declined 1.7%.

From a portfolio perspective, the news acts as a reminder to stay nimble and diversified. Persistent inflation means nominal assets like cash and bonds face headwinds, especially if the cash rate remains unchanged. On the flip side, equities with pricing power and exposure to real assets could provide better inflation hedges.

The week ahead

In Australia this week, attention turns to a speech by Reserve Bank Deputy Governor Andrew Hauser on Monday, providing an update on the economic outlook. Key data releases include the Commonwealth Bank’s household spending insights and September quarter lending indicators released on Wednesday, followed by labour force figures on Thursday, where unemployment is expected to ease to 4.4%.

Overseas, the focus will be on a series of US data releases, led by the October CPI report and Retail Sales figures, both of which may be delayed due to the ongoing government shutdown. These updates will provide further insight into inflation trends and the outlook for Federal Reserve policy.

A comprehensive investment strategy and strong asset allocation can assist with maximising the benefits and minimising the risk across your portfolio as part of achieving your individual goals and objectives. Supported by our dedicated investment team, we focus on communicating market developments and investment opportunities to our clients in a timely manner. We take the time to fully understand both your current financial position and goals. Then we tailor a comprehensive investment strategy to match and implement it on your behalf.

.png?width=352&name=Investment%20SnapShot%20Header%20-%20July%202025%20(1).png)