Morning Market Update - 3 November 2021

Cutcher & Neale

02 November 2021

17 July 2023

minutes

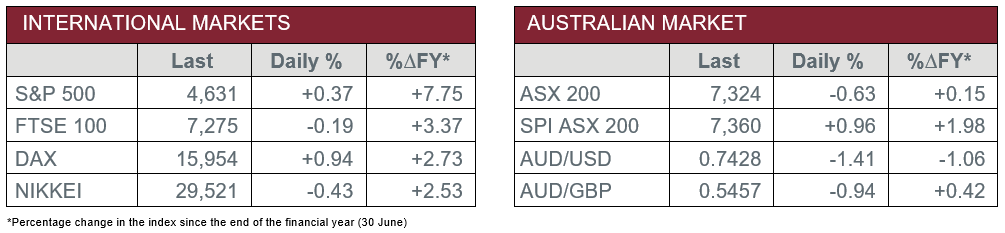

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Interest Rate Decision – The interest rate was left unchanged at 0.1%.

- Wednesday – UK – House Prices

- Wednesday – US – FOMC Rate Decision

- Wednesday – AUS – Building Approvals

- Wednesday – EUR – Unemployment Rate

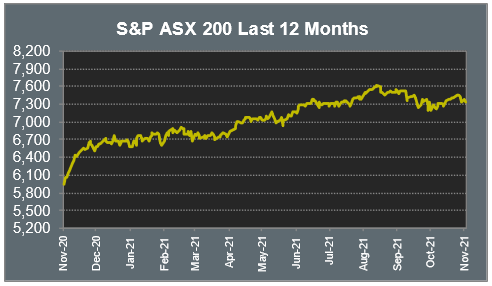

Australian Market

The Australian sharemarket closed 0.6% lower yesterday, as a media release from the Reserve Bank of Australia signalled the possibility of interest rate hikes prior to 2024. Despite this, the RBA will continue to buy $4 billion in bonds per week until mid-February.

The Materials sector tumbled, as it lost 2.1%. Fortescue Metals was the hardest hit, down 2.7%, while Rio Tinto and BHP conceded 2.5% and 2.3% respectively. Copper miners also lost ground; OZ Minerals shed 1.2% and Sandfire Resources lost 2.8%.

Despite a slight tick up following the RBA meeting, the Financials sector closed the session 1.3% lower. Westpac continued recent weakness to close down 2.7%. ANZ lost 1.1%, while NAB and Commonwealth Bank dropped 0.9% and 0.5% respectively.

Goodman Group, a commercial and industrial property group, jumped 5.6% during trading yesterday. This came as a result of the company raising full-year earnings forecast, as it benefitted from a shortage of supply of industrial property. Among the rest of the REIT sector, Dexus lost 1.2% and Stockland shed 1.8%, while Scentre Group dropped 0.3%.

The Australian futures market points to a 0.96% rise today.

Overseas Markets

European sharemarkets were relatively mixed on Tuesday, as losses in the Materials sector outweighed gains among Health Care stocks. The iron ore price slipped and the Materials sector dropped 2.9%. London-listed BHP and Rio Tinto shed 2.9% and 2.2% respectively, while Glencore lost 3.1%. Leading hearing care company, Demant, boosted the Health Care sector as the company gained 3.6% after they unexpectedly increased annual profit outlook. HelloFresh soared 17.2% as it posted third-quarter revenue ahead of expectations, along with a 39% jump in active customers.

By the close of trade, the UK’s FTSE 100 lost 0.2%, while the German DAX rose 0.9% and the STOXX Europe 600 rose 0.1%.

US sharemarkets lifted on Tuesday as strong earnings continued to boost investor sentiment. Pfizer added 4.1% following news the company expect 2021 sales of the COVID-19 vaccine to reach US$36 billion. The payment services companies lagged; Visa shed 1.6% and MasterCard lost 1.7%. The Information Technology sector lifted 0.8%, as Alphabet rose 1.5% and Microsoft closed the trading session 1.1% higher.

By the close of trade, the Dow Jones closed up 0.2%, while the S&P 500 and NASDAQ gained 0.2% and 0.3% respectively.

CNIS Perspective

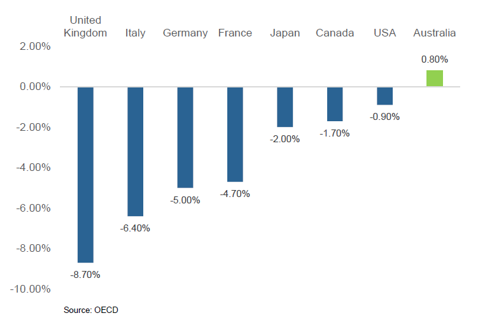

There are a number of scorecards being used to determine how well various countries have not only survived COVID but recovered post the pandemic.

Most analysis suggests Australia has survived relatively unscathed, unlike many of our developed market peers.

The graph illustrates the difference in GDP between pre-COVID days, i.e., fourth quarter 2019 to now.

Australia’s recovery is outstanding when compared to other developed economies.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.