Morning Market Update - 8 June 2022

Cutcher & Neale

07 June 2022

17 July 2023

minutes

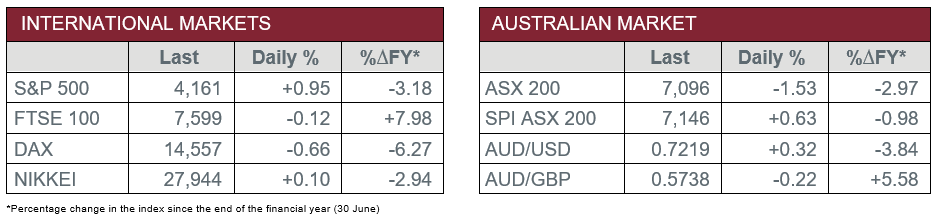

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – Interest Rate Decision – The RBA decided to increase the Official Cash Rate by 50 basis points, to 0.85%.

- Tuesday – US – Trade Balance – The trade deficit narrowed to US$87.1 billion in April, from US$107.7 billion in March.

- Wednesday – EUR – Gross Domestic Product

- Wednesday – EUR – Industrial Production

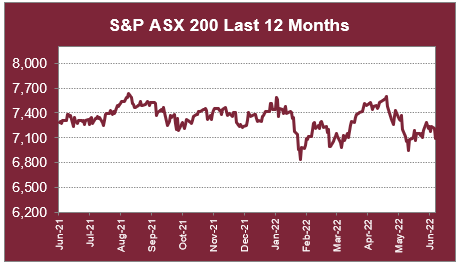

Australian Market

The Australian sharemarket weakened 1.5% on Tuesday, in response to a larger than expected rise in the Official Cash Rate by the RBA. In an effort to tackle rising inflation, the RBA lifted the cash rate 50 basis points to 0.85%, marking the largest rise in 22 years.

The Information Technology sector, which is sensitive to movements in interest rates, was the main market detractor, down 3.0%. WiseTech Global tumbled 5.3%, while accounting software provide Xero gave up 5.0% and artificial intelligence company Appen slid 0.7%. Buy-now-pay-later providers also declined; Zip Co shed 14.4% and Sezzle lost 5.2%, while Afterpay owner Block fell 2.9%.

Weakness amongst all major banks weighed on the Financials sector, which closed down 2.3%. NAB was the main underperformer, down 3.2%, followed by Commonwealth Bank, which fell 2.6%, while Westpac and ANZ gave up 2.1% and 1.5% respectively. Insurers also closed lower; Suncorp fell 0.7% and Insurance Australia Group slid 0.2%, however, QBE Insurance bucked the trend to gain less than 0.1%.

The Materials sector was the top performer, down just 0.2%. Mining heavyweights were mixed; Fortescue Metals slid 1.1% and BHP fell less than 0.1%, while Rio Tinto lifted 0.7%. Gold miners also posted losses; Evolution Mining closed 2.4% lower and Newcrest Mining retreated 1.5%, while Northern Star Resources slipped 0.6%.

The Australian futures market points to a 0.63% rise today.

Overseas Markets

European sharemarkets posted losses overnight, as investors remain concerned further interest rate rises may contribute to a slowdown in economic growth. Interest rate sensitive sectors fared the worst, as Information Technology slid 1.1% and Real Estate fell 0.3%. However, renewable energy stocks enjoyed gains; Vestas Wind Systems lifted 1.2% and Siemens Gamesa Renewable Energy rose less than 0.1%. By the close of trade, the German DAX gave up 0.7% and the STOXX Europe 600 lost 0.3%, while the UK FTSE 100 slipped 0.1%.

US sharemarkets advanced on Tuesday. The Information Technology sector gained 1.2%; Fortinet added 2.8% and Apple lifted 1.8%, while Microsoft and NVIDIA rose 1.4% and 0.8% respectively. The Energy sector was the strongest performer, up 3.1%; ExxonMobil and ConocoPhillips both gained 4.6%, while Chevron rose 1.9%. Consumer Discretionary was the only sector to weaken, down 0.4%, as Target slid 2.3% after the retailer stated it has again trimmed margin forecasts.

By the close of trade, the Dow Jones and NASDAQ added 0.8% and 0.9% respectively, while the S&P 500 gained 1.0%.

CNIS Perspective

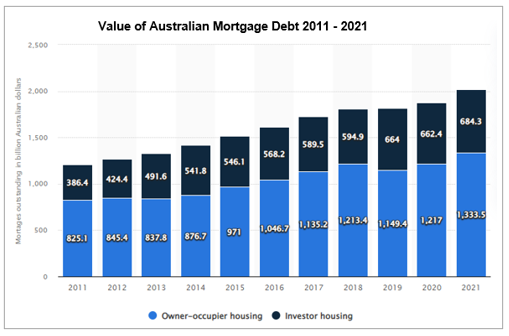

Yesterday’s unexpected 0.50% rise in the Official Cash Rate has apparently taken mortgage holders by surprise.

While the 0.50% was largely unexpected, the trajectory of interest rates is clearly upward and whether the RBA rose 0.50% in one month or over two months of 0.25%, the same effect is had on mortgage rates, which should be no surprise.

During the low interest rate driven housing boom, banks were meant to be testing borrowers’ sensitivity to higher interest rates, to ensure there were no surprises when rates eventually rose.

Mortgage defaults have a cascading effect on the economy, and the mortgage default rate has become a key leading indicator for that reason.

The graph illustrates the growth in Australian mortgages since 2011 and hopefully within this data are minimal defaults.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.