Morning Market Update - 1 June 2021

Cutcher & Neale

31 May 2021

17 July 2023

minutes

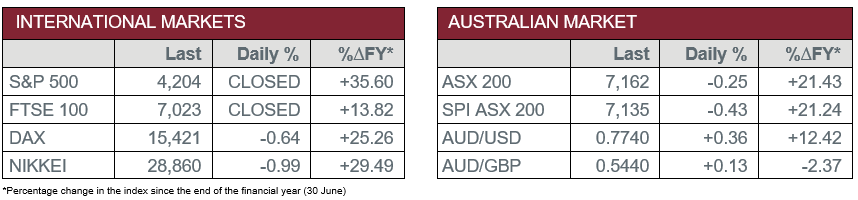

Pre-Open Data

Key Data for the Week

- Monday – CHINA – Manufacturing PMI fell to 51.0 in May, from 51.1 in April.

- Tuesday – AUS – Current Account

- Tuesday – AUS – RBA Policy Decision

- Tuesday – EUR – Unemployment Rate

Australian Market

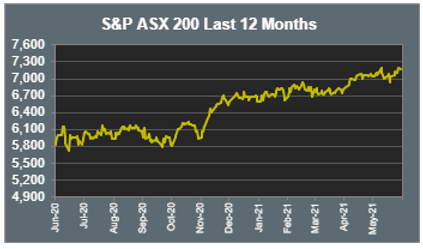

The Australian sharemarket eased 0.3% yesterday. The Energy sector was the weakest performer, down 1.6%, as investors awaited an OPEC meeting which would determine oil supply. Oil Search fell 2.2%, while Woodside Petroleum and Santos gave up 1.4% and 1.6% respectively. Despite Monday’s losses, the local ASX 200 gained 1.9% in May as the market enjoyed its eighth consecutive month of gains, a record not achieved since 2007.

The possibility of a Victorian lockdown extension weighed on travel stocks, as Victoria recorded another nine locally acquired COVID-19 cases on Monday. Webjet shed 2.6% and Qantas gave up 2.1%, while Helloworld Travel and Flight Centre lost 1.1% and 0.8% respectively.

Losses among the four major banks dragged the Financials sector lower. Commonwealth Bank fell 0.8%, while NAB and ANZ both lost 0.5% and Westpac slipped 0.2%. Asset managers underperformed; Australian Ethical Investment gave up 10.0%, while Magellan Financial Group eased 0.9%.

The Consumers Staples sector slipped 0.3%, as supermarket giants Woolworths and Coles closed down 0.7% and 0.2% respectively. However, Bega Cheese added 3.5%, horticultural company Costa Group gained 2.7% and Elders rose 0.3%.

The Australian futures market points to a 0.43% fall today.

Overseas Markets

European sharemarkets were weaker overnight. The Financials sector closed the session lower; Credit Suisse fell 0.6% and UBS slipped 0.8%, while Deutsche Bank shed 1.3% after the Wall Street Journal reported the US Federal Reserve addressed the German bank’s shortcomings in its anti-money-laundering controls. Renewable energy stocks also eased; Siemens Gamesa fell 0.9%, while Vestas Wind Systems lost 0.8%.

By the close of trade, the STOXX Europe 600 gave up 0.5%, while the German DAX fell 0.6%. Despite the losses overnight, the STOXX Europe 600 closed higher for the month of May to record its fourth consecutive month of gains.

US sharemarkets were closed on Monday. For the month of May, the Dow Jones gained 1.9% and the S&P 500 added 0.6%, while the NASDAQ fell 1.5%.

CNIS Perspective

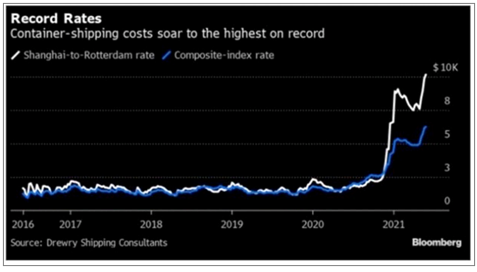

In another sign that supply chain constraints are affecting the price of goods, you must look no further than the surging price of shipping costs.

Container rates are surging as demand is outstripping the availability of the 20- and 40-foot steel boxes that carry the majority of global trade, especially at Asian ports.

A number of factors have caused this; strong consumer purchases, restocking, disruptions from the Suez Canal blockage in late March and port congestion.

Since November, the cost of shipping a 40-foot container from Asia to Europe more than quadrupled, from around US$2,200 to over US$10,000, the first time on record, while the Global Container index is up nearly 300% on this time last year, emphasising the current strain on supply chains that the industry wasn’t prepared for.

It goes to show how quickly things can change for some industries. A year ago, the container-shipping industry was struggling to stay afloat, as government-imposed lockdowns forced ships to remain idle and cancel routes. It is a far cry from that right now!

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.