Morning Market Update - 10 September 2021

Cutcher & Neale

09 September 2021

17 July 2023

minutes

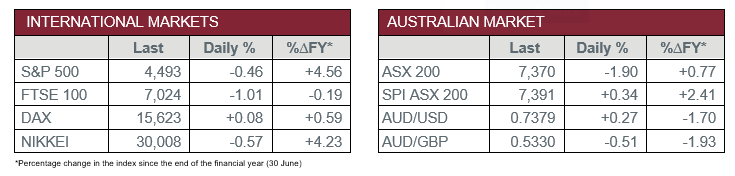

Pre-Open Data

Key Data for the Week

- Thursday – CHINA – Consumer Price Index

- Thursday – US – Initial Jobless Claims fell by 35,000 to 310,000.

- Friday – UK – Industrial Production

- Friday – US – Producer Price Index

Australian Market

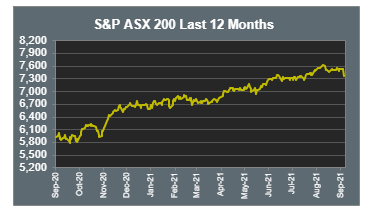

The Australian sharemarket experienced a broad sell-off yesterday, which fell in line with overseas markets on Wednesday night. Equity analysts expressed that such a cooling-off session was inevitable, given such a hot year, especially due to the unprecedented macroeconomic environment.

All sectors lost ground, with Technology being the weakest performer, down 3.2%. Resource stocks continued their descent, dragged down by weakened commodity prices. The Materials, Industrials and Energy sectors all lost around 2.1%. Unsurprisingly, the more defensive sectors, Consumer Staples (-0.7%), Real Estate (-1.1%) and Health Care (-1.3%), were the most resilient.

China increased its measures to reduce steel production, which further softened iron ore prices. As a result, mining stocks fell broadly. Mining heavyweights, BHP and Rio Tinto, lost 1.7% and 2.5% respectively, while others like Orocobre and Pilbara Minerals conceded between 5-6%.

Travel stocks lost recent gains, as COVID-19 cases showed no sign slowing down. The NSW Government revealed 1,405 new daily cases yesterday, while Victoria recorded 324. Flight Centre, Webjet and Qantas all dropped between 2-3%.

The four major banks did not escape the sell-off, as they all fell within the 1.6-2.3% range.

The Australian futures point to a 0.34% recovery today.

Overseas Markets

European sharemarkets were mixed on Thursday, as the European Central bank announced its expected reduction in emergency bond purchases. The STOXX Europe 600 inched lower by 0.1%, the UK FTSE 100 fell further, down 1.0%, while the German DAX edged up 0.1%. Similarly, travel stocks suffered the most, as British airline easyJet plunged 10.2%. The rate-sensitive banking stocks rose by around 0.2%, while the Real Estate sector performed well, up 1.0%.

US sharemarkets retreated again overnight, for its fourth consecutive session, as most sectors closed down. While not in the red, the Financials, Energy and Materials sectors all closed relatively flat. The S&P 500, Dow Jones and NASDAQ all lost between 0.3-0.5%. Most notably, titans like Microsoft (-1.0%) and Amazon (-1.2%) weighed the most on the market indices. A major gainer was pharmaceutical manufacturer, Moderna, up 7.8%, after it announced the development of a single dose vaccine, which includes boosters against both COVID-19 and the common cold (influenza).

CNIS Perspective

Financial markets have been focused for months on when the US Federal Reserve, the world’s most influential central bank, will announce a reduction of its bond buying stimulus program, which has helped lower borrowing costs for US corporates and supported the economy throughout the coronavirus crisis.

The central bank’s main challenge is to avoid disruptions in financial markets, and they continue to reassure investors that reducing financial support measures does not mean interest rate hikes are around the corner.

This is in addition to the concerns of inflation re-emerging, which the Fed continues to see as transitionary, rather than a fundamental, structural change. Sustained periods of higher inflation will typically lead to higher interest rates.

The move by the Fed is likely to come in October and follows on from other global central banks like the Reserve Bank of Australia and European Central Bank, who have both announced tapering of stimulus measures this week.

Despite the recent resurgence in COVID-19 case numbers, as a result of the Delta variant, it is looking unlikely this will have any material impact on the Fed’s plan to start tapering bond purchases, which may trigger a level of uncertainty for investors.

As we all know, financial markets do not like uncertainty!

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.