Morning Market Update - 11 May 2022

Cutcher & Neale

10 May 2022

17 July 2023

minutes

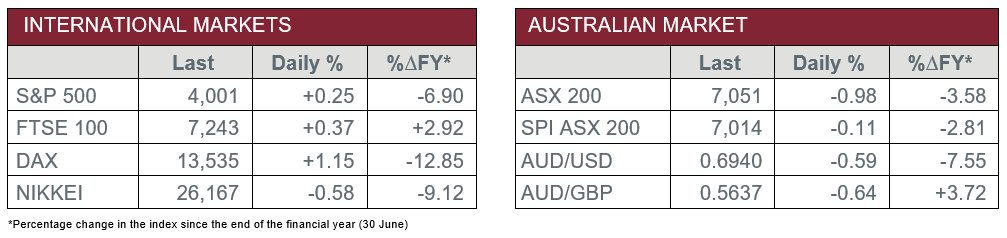

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions & Confidence – Conditions jumped 5 points in April, while Confidence fell 6 points.

- Wednesday – US – Consumer Price Index

- Wednesday – CHINA – Consumer Price Index

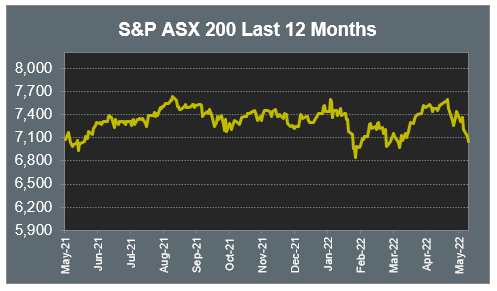

Australian Market

The Australian sharemarket closed 1.0% lower yesterday, despite falling as much as 2.5% in early morning trade. This marks the local market’s third straight day of declines, as the majority of sectors finished the session in the red.

The Materials sector saw a 2.4% loss, as the price of iron ore dropped to US$128 per tonne. Rio Tinto was the worst performer of the major miners, down 3.6%, while BHP and Fortescue Metals dropped 2.6% and 2.7% respectively. Gold miners lost ground; Northern Star Resources conceded 3.6% and Evolution Mining shed 2.5%.

Pendal Group was the main outperformer in the Financials sector, as it rose 8.1% after the company announced they would increase their interim dividend by 24%. The major banks were mixed; NAB and Westpac added 0.3% and 0.2% respectively, while Commonwealth Bank and ANZ both closed the session 0.9% lower.

The Australian futures market points to a 0.11% fall today.

Overseas Markets

European sharemarkets finished higher overnight. The Financials sector was the main outperformer; however, gains were limited by losses in the Materials and Travel and Leisure sectors. By the close of trade, the UK’s FTSE 100 added 0.4% and the German DAX rose 1.2%, while the STOXX Europe 600 lifted 0.7%.

US sharemarkets were mixed on Tuesday, as the NASDAQ broke a three-day losing streak. As a result, the Information Technology sector rose; Netflix added 2.6% and Microsoft lifted 1.9%, while Apple finished the session 1.6% higher. By the close of trade, the Dow Jones shed 0.3%, while the S&P 500 added 0.3% and the NASDAQ rose 1.0%.

CNIS Perspective

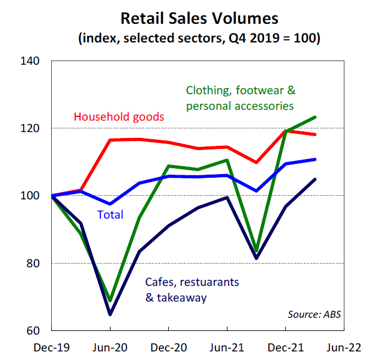

Australia’s strong retail sales data released yesterday reveals that signs of rising prices and inflation are emerging within Australia’s consumer spending.

Retail sales volumes rose by 1.2% in the March quarter, while retail sales jumped 2.9%, implying that 1.7% of the gain was due to higher prices.

In other words, the majority of the increase in nominal sales reflects higher prices, rather than households purchasing more goods or services.

The biggest quarterly jump was in cafés, restaurants and takeaway services, up 8.3%, following an 18.3% leap in the December quarter.

Spending volumes in this category are now almost 5% higher than their pre-pandemic level.

Spending patterns across industries were consistent with the easing of restrictions. There was a rise in sales volumes in the quarter across most discretionary sectors, despite higher prices.

There was also fresh data which showed we are continuing to shop more online than before the pandemic. Online sales accounted for 11.1% of retailing in March, unchanged from February, compared with around 6% before COVID.

Consumer spending will be supported by robust household balance sheets and the strong jobs market. However, there are growing headwinds. Consumer sentiment has taken a hit in recent months as cost-of-living pressures rise and households anticipate increases in interest rates.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.