Morning Market Update - 12 May 2022

Cutcher & Neale

11 May 2022

17 July 2023

minutes

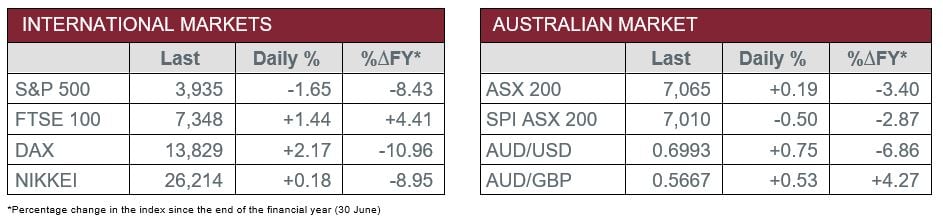

Pre-Open Data

Key Data for the Week

- Wednesday – US – Consumer Price Index rose by 0.3% in April, to be up 8.3% over the year.

- Wednesday – China – Consumer Price Index rose year on year to 2.1% in April, ahead of the expected 1.8%.

- Thursday – UK – Gross Domestic Product

Australian Market

The Australian sharemarket inched into positive territory on Wednesday, up 0.2%, to snap its three-day losing streak. The blue chip index was spurred on by the Health Care sector, which jumped 1.7%, pushed higher by heavyweight CSL Limited (2.1%).

The REITs sector was another major contributor in yesterday’s session, broadly ahead 1.1%, driven higher by its primary constituent Goodman Group (1.4%). Other notable performers included GPT Group (1.9%), Scentre Group (0.7%) and Stockland (0.5%).

The Financials sector ended the session down 1.1%, after NAB (-3.9%) traded ex-dividend. The other major banks also lost ground, with Westpac (-1.6%), ANZ (-1.5%) and Commonwealth Bank (-0.2%) in the red. Meanwhile, others within the sector outpaced the market, most notably Macquarie Group (1.2%), Australian Ethical Investment (4.6%) and Magellan Financial Group (0.8%).

The Information Technology sector was the other key detractor, broadly down 0.6%, with a significant loser being Link Administration Holdings (-15.1%). Its shares entered a trading halt during the session after its sudden drop to $4.22 per share, with no clear reason as to why. It seemed shareholders became skeptical its $5.50 per share takeover offer from Canadian company Dye & Durham (DND) would come to fruition.

The Australian futures market points to a 0.50% decline today, led lower by the US sharemarket.

Overseas Markets

European sharemarkets climbed on Wednesday, as they locked in gains for a second straight session, supported by consumer products and services stocks, which were broadly ahead 4.2%. Additionally, the Oil and Gas, Materials and Automobiles sectors were all up between 3.2%-3.6%. Other notable movers included Airbus (2.8%), Barclays (2.6%) and Veolia Environnement (4.3%). By the close of trade, the STOXX Europe 600 (1.7%), German DAX (2.2%) and UK FTSE 100 (1.4%) all advanced.

US sharemarkets fell on Wednesday, after higher than expected inflation data was released, which reinforced the view that the US Federal Reserve will require further monetary policy tightening to keep prices under control. Core inflation, which strips out food and energy prices, rose by 0.6% in April to be up 6.2% on the year. Most sectors closed in the red, except Energy (1.4%), Utilities (0.8%) and Materials which closed flat. Information Technology and Consumer Discretionary sectors were key detractors, down 3.3% and 3.6% respectively, with important movers being Microsoft (-3.3%), Meta Platforms (-4.5%), Netflix (-6.4%) and Amazon (-6.4%). By the close of trade, the Dow Jones (-1.0%), S&P 500 (-1.7%) and NASDAQ (-3.2%) all declined.

CNIS Perspective

The biggest battle for global economies at present is containing inflation levels not seen since the 1980s. Overnight, we saw the much anticipated US Consumer Price Index results for April announced, with CPI rising at an annual pace of 8.3%.

The good news was that Consumer Price Index looks to have peaked, with last night’s result being the first decline in eight months, a slight step down from the 8.5% increase recorded in March, however, higher than economists’ expectations for an 8.1% rise.

A big jump in food prices was the main news out of the result, with prices up 11% year on year, while airlines ticket prices hit a record monthly gain, up 18.6%, as higher fuel prices and demand for travel accelerated, which also added to the elevated inflation result.

The result shows that over the short term increased efforts to contain price pressures in the US will be required by the Federal Reserve, validating their first half-point rate rise in more than two decades at the start of this month. Further 50 basis point rises are also expected in June and July, with the federal funds rate expected to reach 2.7% by the end of the year.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.