Morning Market Update - 13 August 2021

Cutcher & Neale

12 August 2021

17 July 2023

minutes

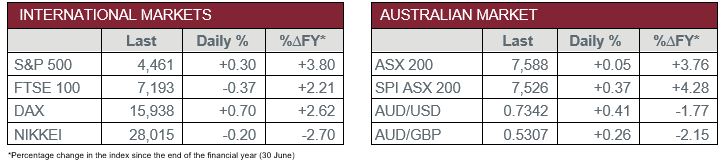

Pre-Open Data

Key Data for the Week

- Thursday – UK – Gross Domestic Product increased by 1.0% in June, which represented 4.8% growth for Q2 2021.

- Thursday – UK – Industrial Production fell 0.7% in June, while year-on-year production increased 8.3% (below expected 9.6%).

- Thursday – US – Initial Jobless Claims fell by 12,000 to 375,000 last week, in line with estimates.

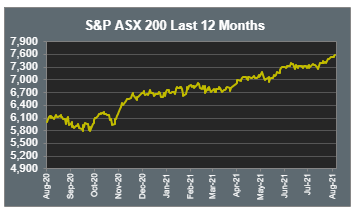

Australian Market

The Australian sharemarket edged up 0.1% yesterday to a record high. Performance was driven by earnings reports, which indicated solid profits from blue chip stocks. Telstra was a standout, it surged 3.7% following news that profits increased by 3.4%, to $1.9 billion, for the financial year end. The company also announced a $1.35 billion share buyback, which helped propel the Telecommunications sector ahead 2.3%.

The Information Technology sector was a major detractor, as it dropped 1.3%, joined by the Utilities sector, which was the worst performer, down 1.7%. Afterpay conceded 1.2% yesterday, suggesting some price adjustment following the hype around Square’s takeover. AGL fell 5.5%, dragging Utilities down, after the company reported a 10% reduction in revenue.

The Financials sector trimmed 0.1%, as most major banks lowered slightly. Commonwealth Bank was the exception, after it tumbled 2.1%, losing gains made yesterday. AMP’s share price jumped 3.2%, despite a poor earnings report, which revealed a 28.0% decline in profits and a 5.3% drop in revenue in 2H 2021.

The Australian futures point to a 0.37% advance today.

Overseas Markets

European sharemarkets were mixed on Thursday, as the German DAX rose 0.7%, while the UK FTSE 100 trimmed 0.4%. Meanwhile, the STOXX Europe 600 rose 0.1%. A key mover in the mixed session included UK-listed Rio Tinto, which tumbled 5.5%, as it traded ex-dividend, while BHP shed 1.4%.

US sharemarkets advanced overnight, with the S&P 500 securing a record high for the third consecutive day. Gains were led by Technology companies; Apple (2.1%), Tesla (2.0%) and NVIDIA (1.1%). Given the sector’s recent underperformance, some strategists attribute yesterday’s gains to being a good buying opportunity.

By the close of trade, the Dow Jones was relatively flat, while the S&P 500 and NASDAQ rose 0.3% and 0.4% respectively.

CNIS Perspective

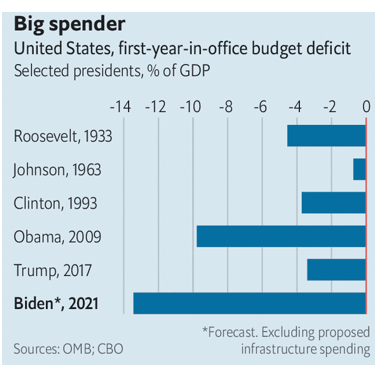

The US Senate this week passed a US$1 trillion infrastructure package, representing the largest spend on public works in decades and marking a significant victory for President Biden’s ‘Build Back Better’ economic agenda.

In a rare partnership of Democrats and Republicans joining forces, with a 69-30 vote, the outcome provides momentum for Biden’s next feat, a US$3.5 trillion package aimed at investing hundreds of billions of dollars on climate change research and electric vehicle charging stations. The package also intends to spend more than US$1 trillion on various safety net enhancements like extended child tax credits, subsidised childcare and family leave and educational benefits.

These spending packages would increase US deficits and debts beyond their already eye-popping levels. The Congressional Budget Office estimates the US economy will run a US$3 trillion deficit in Biden’s first year of office, and at 13.4% of GDP, the deficit will be the highest in the first year of any President.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.