Morning Market Update - 13 September 2021

Cutcher & Neale

12 September 2021

17 July 2023

minutes

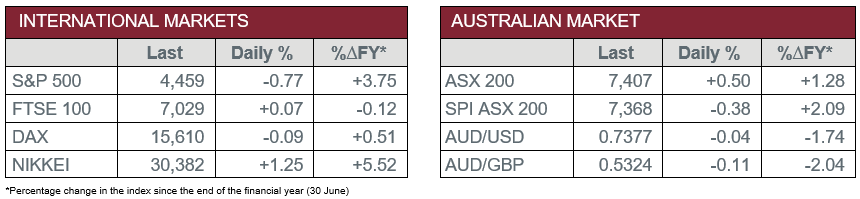

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – House Price Index

- Tuesday – AUS – NAB Business Confidence and Conditions

- Tuesday – US – Consumer Price Index

- Wednesday – AUS – HIA New Home Sales

- Wednesday – EUR – Industrial Production

- Thursday – AUS – Unemployment Rate

- Thursday – EUR – Trade Balance

- Friday – UK – Retail Sales

- Friday – EUR – Consumer Price Index

Australian Market

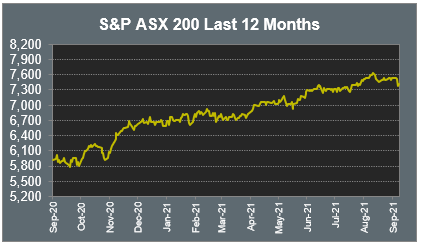

The Australian sharemarket improved 0.5% on Friday. Materials and Information Technology were the top performers, up 1.6% and 1.0% respectively, while Health Care was the main laggard as biotechnology heavyweight CSL eased 1.0%. Over the week, the local ASX 200 declined 1.5%.

The Energy sector lifted 0.9% on Friday following the announcement of a merger agreement between Oil Search (2.2%) and Santos (0.5%). However, the merger is still subject to regulatory and shareholder approvals. Woodside Petroleum and Ampol both gained 0.4%, while Beach Energy added 2.0%.

The major banks all closed higher; Commonwealth Bank rose 0.5% and ANZ added 0.3%, while NAB and Westpac both lifted 0.2%. Fund managers also enjoyed gains; Challenger rose 3.2% and Australian Ethical Investment closed up 3.0%, however, Magellan Financial Group fell 1.9%.

The Australian futures point to a 0.38% fall today.

Overseas Markets

European sharemarkets were weaker on Friday. Health Care stocks closed lower; French pharmaceutical company Sanofi gave up 1.7% and GlaxoSmithKline fell 0.7%, while AstraZeneca slipped 0.4%. Banking stocks also underperformed; Credit Suisse shed 1.5% and Barclays lost 0.8%, while Deutsche Bank and HSBC both closed down 0.3%. By the close of trade, the STOXX Europe 600 fell 0.3% and the German DAX slipped 0.1%, while the UK FTSE 100 added 0.1%.

US sharemarkets also eased on Friday, as every sector finished the session lower. The Information Technology sector was among the weakest performers; Fortinet slipped 0.1% and Microsoft fell 0.5%, while Apple shed 3.3% after a court ruling determined the company’s App Store policies are anti-competitive, with Apple required to allow developers alternative ways to link payment options outside of the App Store. However, Spotify and NVIDIA bucked the trend to close up 0.7% and 1.4% respectively. By the close of trade, the Dow Jones and S&P 500 both lost 0.8%, while the NASDAQ fell 0.9%.

CNIS Perspective

Last week Taro Kono, the most likely candidate to replace Yoshihide Suga as Prime Minister of Japan, said the nation needs to restart nuclear power plants, in order to realise its goal of achieving carbon neutrality by 2050. The comments are notable as Kono had been a vocal opponent of nuclear power in the past and Japan has still yet to bring several nuclear power plants back online post the devastating tsunami in 2011 that triggered the Fukushima nuclear accident.

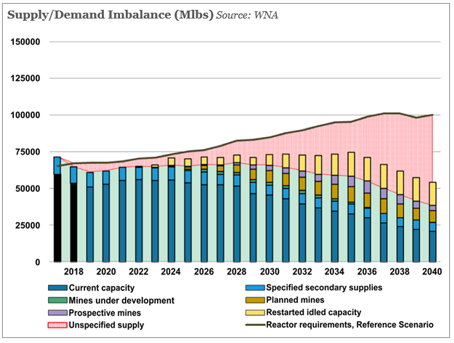

With the narrative around nuclear becoming a viable low carbon energy option, uranium prices are spiking after a decade long bear market. The spot price for uranium has shot up this year from US$30/lb to US$42/lb as of Friday, but still a long way short of the viable production price for most mines at ~US$55. Investors betting that nuclear power will become a key move away from fossil fuels have been a key driver behind the recent moves, scooping up the concentrate commonly known as yellow cake, which has seen the price pushed to its highest level since 2014.

Not only is the thematic of carbon free energy a driver, the production rates of uranium, given the low price hitting US$18/lb in 2016, have created a huge demand supply imbalance. This underinvestment in exploration and mine development is leading to a global production shortfall. China plans to triple its nuclear power capacity by 2030 and India have plans for the completion of 21 new nuclear reactors by the end of this year, which will also create huge new demand at a time when supply has dwindled. These reasons, along with many operating mines having significant disruptions due to the global COVID-19 pandemic, have set up a potential major bull run for the commodity.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.