Morning Market Update - 14 July 2021

Cutcher & Neale

13 July 2021

17 July 2023

minutes

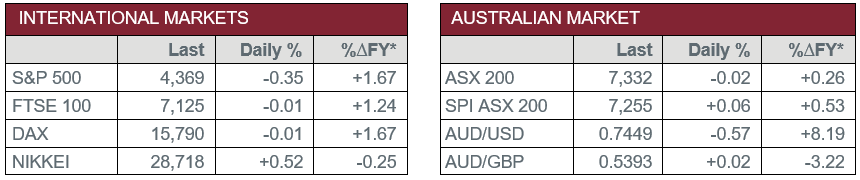

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions and Confidence both declined in June due to extended COVID lockdowns in NSW.

- Tuesday – US – Consumer Price Index was stronger than expected and rose 0.9% in June, to beat expectations of 0.5%.

- Wednesday – AUS – Consumer Sentiment

- Wednesday – EUR – Industrial Production

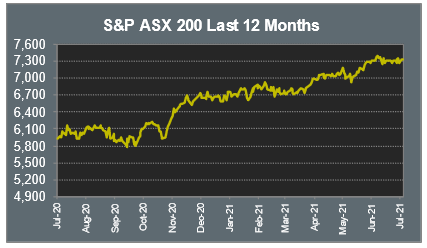

Australian Market

The Australian sharemarket slipped less than 0.1% yesterday, despite a strong start to the day’s trade. Shares were originally helped higher by record closing highs in the US, although lost ground throughout the day to close in the red.

The REITs sector weakened the market, down 0.9%. Retail shopping centre providers Stockland and Scentre Group fell 1.5% and 1.1% respectively, while Charter Hall Long WALE REIT conceded 0.4%, and Centuria Industrial REIT lost 0.5%.

The Materials sector closed up 0.2% as the major miners were mixed. BHP lost ground to close 0.7% lower, while Rio Tinto added 0.6% and Fortescue Metals jumped 2.1%.

The big four banks were mostly lower yesterday; Commonwealth Bank shed 0.8%, while ANZ and Westpac lost 0.5% and 0.7% respectively. NAB bucked the downward trend to eke out a less than 0.1% gain.

Information Technology stocks were also lower; accounting software provider, Xero, lost 0.6%, while buy-now-pay-later provider, Afterpay, conceded 0.2%.

The Australian futures point to a 0.06% rise today.

Overseas Markets

European sharemarkets were relatively flat overnight as the Financials sector lost ground. Barclays and ING Groep both lost 1.6%, while Deutsche Bank shed 2.0%. By the close of trade, the pan-European STOXX 600 was largely unchanged despite hitting all time highs during the session.

US sharemarkets fell on Tuesday as the start of earnings season was overshadowed by higher-than-expected inflation data. Despite positive results, the major banks fell; Goldman Sachs lost 0.2% and J.P. Morgan dropped 1.5%. By the close of the session, the Dow Jones lost 0.3%, while the S&P 500 and the NASDAQ both fell 0.4%.

CNIS Perspective

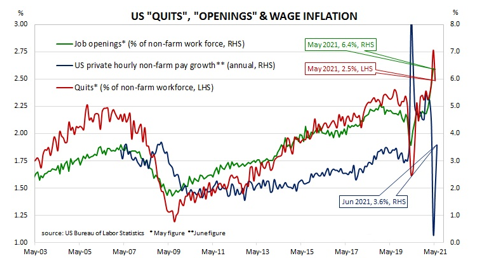

Former US Federal Reserve Chief and current Treasury Secretary Janet Yellen is known to pay close attention to the ‘Quit Rate’ time series. The Quit Rate data is produced by the Job Openings and Labor Turnover Survey (JOLTS) and is a leading indicator of US hourly wages.

As wages account for around 55% of a product’s or service’s price in the US, wage inflation and overall inflation rates should be closely related.

Interestingly, a high Quit Rate indicates the employment market is strong and suggests wage inflation should be imminent. The theory suggests that when employees see greater opportunity elsewhere, they quit their job to secure a higher wage.

When COVID hit in March 2020, employment opportunities dried up, so the Quit Rate plummeted.

In April 2021, the Quit Rate rose to a new series high of 2.5%, which is considered elevated and suggests that people with jobs are continuing to take advantage of the strong labour demand conditions to improve their position.

However, at the moment at least, this isn’t translating into wages growth inflation.

The graph shows the correlation between quits, job openings and hourly non-farm wage growth, which suggests disruption to employment markets caused by COVID is still evident and flowing into inflation forecasts.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.