Morning Market Update - 15 October 2020

Cutcher & Neale

14 October 2020

17 July 2023

minutes

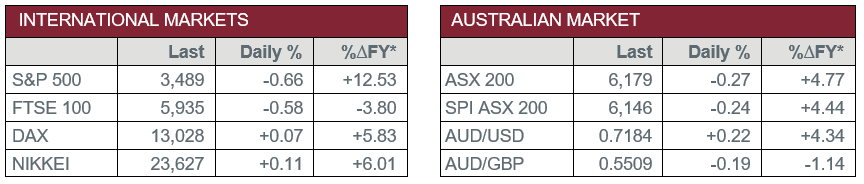

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Wednesday – US – Producer Price Index rose 0.4% in September, following a 0.3% rise in August.

- Thursday – AUS – Unemployment Rate

- Thursday – CHINA – Consumer Price Index

- Thursday – US – Initial Jobless Claims

Australian Market

The Australian sharemarket fell 0.3% yesterday, to snap seven-straight sessions of gains. The Financials sector was the weakest performer, as the big four banks all lost between 1.0% and 1.4%. Westpac announced it plans to consolidate its international operations, leaving Beijing, Shanghai, Hong Kong, Jakarta and Mumbai. The bank said this would not have a significant impact on earnings. Australian Ethical Investment lifted 4.9% after the company announced third quarter capital inflows of $150 million.

Materials stocks fell on the back of iron ore weakness; BHP, Rio Tinto and Fortescue Metals all lost between 0.8% and 1.3%.

Travel stocks weakened as concerns over increased community transmitted COVID-19 cases could impact the re-opening of interstate borders; Flight Centre and Webjet fell 7.7% and 4.1% respectively.

The Health Care sector was the strongest performer, led higher by Sonic Healthcare and CSL, which closed up 2.3% and 1.4% respectively. CSL announced it has narrowed FY21 guidance on net profit growth to be between 3% - 8%.

James Hardie Industries rose 1.6% after the company provided a trading update and increased its expected FY Net Operating Profit After Tax to be in the range of $380 - $420 million.

The Australian futures market points to a 0.24% fall today, driven by weaker overseas markets overnight.

Overseas Markets

European sharemarkets closed slightly lower Wednesday as surging coronavirus cases stoked fears of more lockdowns. The broad based STOXX Europe 600 fell 0.1%.

US sharemarkets also finished lower overnight, as Treasury Secretary Steven Mnuchin said added stimulus was unlikely prior to the US election. Consumer and communication stocks were amongst the weakest performers, led lower by Amazon, down 2.3%. Financials also underperformed, Wells Fargo & Co. slumped 6.0% after the company reported a 56% fall in profit, while Bank of America fell 5.3% after the company announced profit fell 16% during the September quarter.

CNIS Perspective

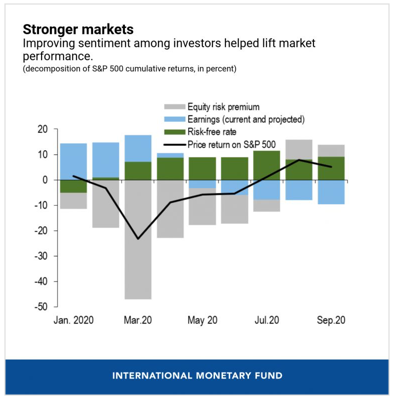

The International Monetary Fund (IMF) flagship Global Financial Stability Report released this week revealed dramatic measures implemented by policy makers helped reduce a potentially destructive near-term financial meltdown. Founded in 1944 by the United Nations, the IMF’s primary mission is to ensure the stability of the international monetary system by building a framework for international economic cooperation.

The bi-annual report acknowledges many economies had pre-existing vulnerabilities that are now intensifying, which may create headwinds to the recovery. Forecasting the economic future remains precarious, amid huge uncertainties. A disconnect persists between the buoyancy of financial markets and the weakness of the real economy. If the recovery is delayed, optimism may wane causing periodic bouts of market volatility.

The downbeat prognosis came despite an upward revision to the IMF’s growth forecasts for 2020. This is due to better than expected second quarter recessions that proved shallower than feared. The IMF now foresees a 4.4% contraction of the global economy in 2020, compared to a 5.2% contraction estimated in June.

The IMF is known for its often gloomy outlook, however, with US indices reaching fresh all-time highs, it’s a friendly reminder of the sombre economic challenges we face.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.