Morning Market Update - 16 October 2020

Cutcher & Neale

15 October 2020

17 July 2023

minutes

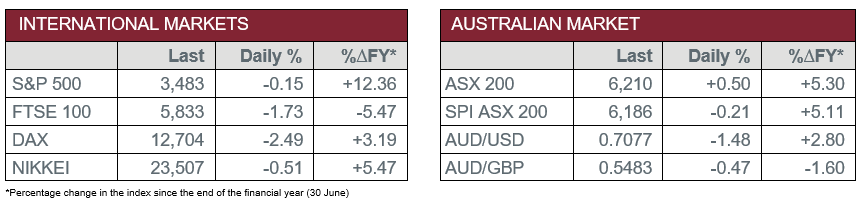

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Thursday – AUS – Unemployment Rate in September rose to 6.9%, from 6.8% in August.

- Thursday – CHINA – Consumer Price Index fell to 0.2% in September, from 0.4% the previous month.

- Thursday – US – Initial Jobless Claims were higher than expected at 898,000 for the week ending 10 October, compared to 845,000 for the previous week.

- Friday – EUR – Consumer Price Index

- Friday – US – Industrial Production

- Friday – US – Retail Sales

Australian Market

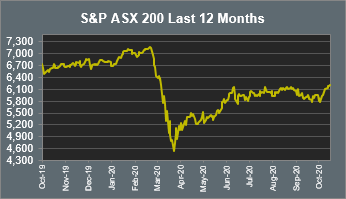

The Australian sharemarket lifted 0.5% yesterday to close at a seven-month high. Prior to Thursday’s trade, RBA Governor Philip Lowe announced the central bank is considering additional monetary easing policy to support Australia’s economic recovery, with many interpreting this as a further cut to the cash rate.

The Materials sector closed higher, up 1.2%. Whitehaven Coal led the gains, up 11.6%, after the company reported that September production and coal sales were up on the same period last year. BHP rose 2.1%, while Fortescue Metals gained 1.4% and Rio Tinto added 1.0%.

The Information Technology sector was the weakest performer, as all buy-now-pay-later stocks closed in the red. Zip Co slumped 7.5% after the company released a quarterly update on Wednesday. Sezzle dropped 6.7%, while Splitit and Afterpay slipped 2.7% and 1.1% respectively.

The Australian futures market points to a 0.21% fall today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets saw sharp losses overnight, as a resurgence of COVID-19 cases across Europe caused France to declare a public health state of emergency and the UK to impose tighter restrictions in London. Travel and leisure stocks were weaker; French hospitality company, Accor, fell 5.3%, while Ryanair dropped 4.3% after the company announced it would cut planned capacity by a third. The STOXX Europe 600 sunk 2.1%, while the German DAX slumped 2.5% and the UK FTSE 100 fell 1.7%.

US sharemarkets were also weaker on Thursday after hopes faded for pre-election stimulus and new claims for jobless benefits reached a two-month high last week. The Information Technology sector was among the weakest performers. Facebook lost 1.9% after the Financial Times reported potential EU plans to limit the power of big tech firms. NVIDIA and Alphabet slipped 0.9% and 0.6% respectively, while Spotify bucked the trend to close 1.5% higher. The Financials sector saw gains; Morgan Stanley added 1.3% after the company announced it beat third-quarter profit estimates, while JP Morgan Chase and Citigroup lifted 1.5% and 1.3% respectively. However, financial services were weaker as Visa slipped 1.3%, MasterCard fell 1.2% and PayPal lost 0.2%. By close of trade, the NASDAQ fell 0.5%, the S&P 500 slipped 0.2% and the Dow Jones lost 0.1%.

CNIS Perspective

There are two fundamental approaches or styles to investing in equities, growth and value. Simplistically, growth investors seek companies that offer strong earnings growth, whilst value investors seek stocks that appear to be undervalued.

Prior to 2007, value investing had outperformed growth for the best part of the century, with investors consistently looking for bargains. However, since the GFC, growth strategies have outperformed value strategies by nearly 8%, with that spread further widening in 2020 as growth stocks, led by the Technology sector, have materially outperformed. The decision by central banks to cut interest rates has exacerbated this divergence, with investors willing to pay premiums for fast growing businesses. The fallout from this has been seen this week, as major US value fund AJO closed its doors stating that the drought in value, currently the longest on record, has created insurmountable headwinds, which resulted in the fund no longer being viable.

Traditionally, as countries move to an improving economic landscape, the market would see a rotation back into more value-style investing as government spending and company capital expenditure increases. However, unless the economic improvement is accompanied by interest rate rises, it will be difficult to see growth investing taking a back seat.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.