Morning Market Update - 17 December 2021

Cutcher & Neale

16 December 2021

17 July 2023

minutes

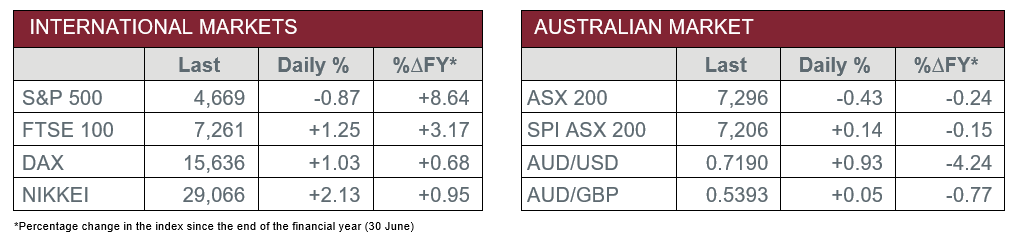

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Unemployment Rate fell to 4.6% in November, below the expected 5.0%.

- Thursday – UK – BoE Interest Rate Decision raised the cash rate to 0.25%.

- Friday – UK – Retail Sales

- Friday – EUR – Consumer Price Index

Australian Market

The Australian sharemarket slipped 0.4% on Thursday, despite a strong lead from international markets overnight and news that the domestic jobless rate had fallen to 4.6% in November.

The market was held back by significant losses made in the Health Care sector (-5.1%), dragged lower by its primary constituent, CSL (-8.2%). This came after CSL completed its $6.3 billion capital raise to acquire Vifor Pharma, a Swiss pharmaceutical company. To fund the acquisition, CSL also implemented a $750 million share purchase plan, acquired $8.4 billion in debt and utilised cash reserves.

On the other hand, the Information Technology sector (2.1%) rebounded from Wednesday’s losses to be the strongest performer on Thursday. WiseTech Global (6.9%), a logistics software provider, was a key contributor. Other notable movers included Xero (2.1%) and Afterpay (1.7%).

The Financials sector closed relatively flat, after a mixed performance from the big banks. NAB added 0.6%, while ANZ (-0.6%), Commonwealth Bank (-0.1%) and Westpac (-0.1%) edged lower. The sector was buoyed by Macquarie Group, which advanced 1.8%.

The Australian futures market points to a relatively flat open today.

Overseas Markets

European sharemarkets had their best day in over a week, led by gains from banks and miners. Key contributors included major UK banks, Lloyds Banking Group (4.6%) and Barclays (3.2%). This came after the Bank of England surprised markets by increasing the cash rate to 0.25%, the first rise in three years, in response to inflation pressures. Another important mover was Airbus, which advanced 2.4%, after both Qantas and Air France KLM struck deals with the plane maker. By the close of trade, the STOXX Europe 600 (1.2%), German DAX (1.0%) and UK FTSE 100 (1.3%) advanced.

US sharemarkets were weaker on Thursday, after the S&P 500 (-0.9%) and NASDAQ (-2.5%) fell, while the Dow Jones edged 0.1% lower. Losses were led by the Technology sector (-2.9%), as Apple (-3.9%), Microsoft (-2.9%) and NVIDIA (-6.8%) all sank. Unsurprisingly, the Financials sector (1.2%) was a key contributor, as the stance on interest rates taken by central banks around the world has shifted. Another notable contributor was telecommunications provider AT&T, which surged 7.0%.

CNIS Perspective

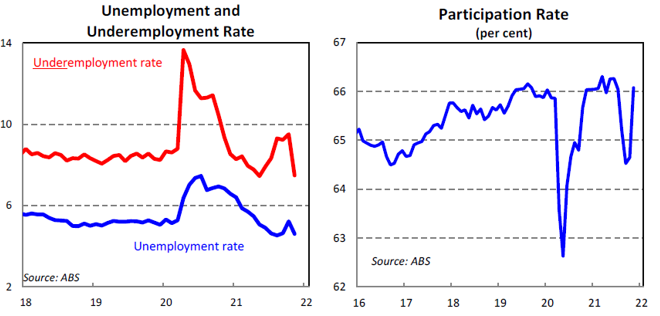

Exceeding market expectations, the Australian labour force saw a creation of 366,000 new jobs in November, the largest increase in employment in a single month on record.

The dramatic surge saw the unemployment rate fall to 4.6%, near its lowest level in more than a decade. At the same time, the participation rate increased to 66.1% from 64.6% in October, just shy of the record high of 66.3%.

The result speaks to the strength of the underlying momentum in the economy underpinned by government stimulus, low interest rates, and high vaccination coverage that has allowed the relaxation of restrictions. Household balance sheets are in good shape and both business and consumer confidence have held up well throughout the most recent lockdowns.

Jobs growth is set to continue as economic activity picks up and economists forecast the unemployment rate will be sub 4.0% by the end of next year. The unemployment rate hasn’t consistently held around these levels since the 1970s!

However, the rapid spread of the Omicron variant must be observed as we head into 2022. It presents a downside risk to short term economic growth if it leads to a rise in hospitalisations and, in turn, a return to lockdowns.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.