Morning Market Update - 19 July 2022

Cutcher & Neale

18 July 2022

17 July 2023

minutes

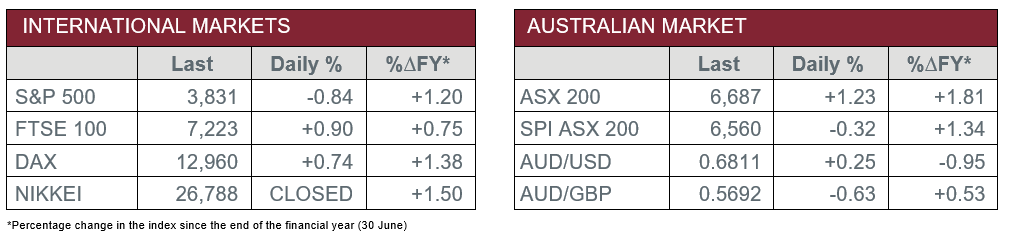

Pre-Open Data

Key Data for the Week

- Monday – UK – Rightmove House Prices advanced 0.4% in July, up from a 0.3% gain in June.

- Tuesday – AUS – RBA Board Meeting Minutes

- Tuesday – EUR – Consumer Price Index

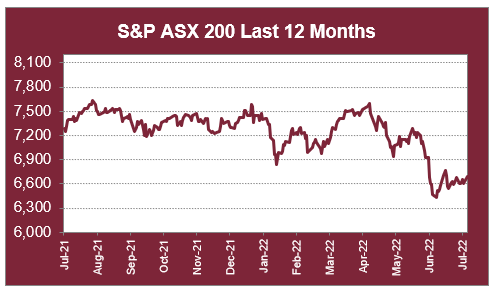

Australian Market

The Australian sharemarket enjoyed gains yesterday, to rise 1.2% in what was the local index’s best day in three weeks.

The Financials sector outperformed, as it followed a solid lead from the US due to better-than-expected earnings reports from Citigroup and Wells Fargo. In addition to this, ANZ entered a trading halt after the company announced their intention to purchase Suncorp’s banking arm. Suncorp closed the session 6.1% higher following the announcement. Among the major banks, NAB added 1.9%, Westpac lifted 1.3%, while Commonwealth Bank and Macquarie Bank rose 1.0% and 3.2% respectively.

Positive earnings reports from local coalminers also boosted the Energy sector, which added 2.2%. Whitehaven Coal announced an increase to full-year earnings and lifted 5.2%, while Yancoal and Coronado followed suit to rise 1.9% and 0.6% respectively.

The Information Technology sector also posted gains, after being heavily weakened in prior months. Accounting software provider Xero added 2.0%, while WiseTech Global jumped 7.2%.

The Australian futures market points to a 0.32% loss today.

Overseas Markets

European sharemarkets finished higher overnight, boosted by the Energy sector, which was buoyed by an increase in the price of oil. The Financials sector also rose on positive earnings reports from the US; Barclays lifted 2.6% and Santander gained 0.3%. By the close of trade, the STOXX Europe 600 and the UK’s FTSE 100 both lifted 0.9%, while the German DAX added 0.7%.

US sharemarkets lost ground overnight, as the major technology stocks were mixed. Alphabet dropped 2.9% in the first trading session after its stock-split, while Netflix lifted 1.0%. By the close of trade, the Dow Jones dropped 0.7%, while the S&P 500 and the NASDAQ both lost 0.8%.

CNIS Perspective

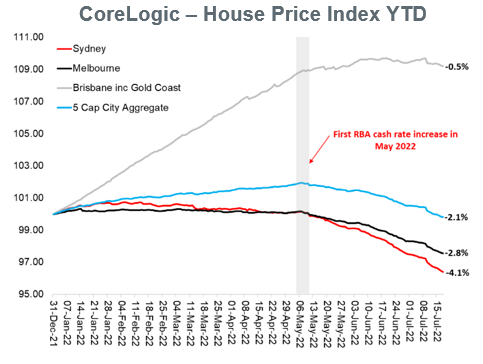

There are no real surprises in the data coming out of CoreLogic in recent weeks regarding Australia’s house prices. As we continue on the upward cycle of rate rises, the purchasing power of every dollar reduces as the servicing of debt increases.

This is flowing through to house prices, especially across the east coast, in property markets that have generated significant returns since the onset of COVID-19’s zero interest rate environment.

While prices remain significantly higher than pre-pandemic levels, in June, Sydney home values fell 1.6% and have given up a further 0.7% over the first 11 days of July, while in Melbourne, home prices fell 1.1% for June and another 0.4% in July so far.

Higher home prices have provided a level of security for owners, a boost to consumers’ net wealth and allowed confidence to spend and boost economic growth.

However, it would be reasonable to expect this recent deterioration in prices to continue for the time being, as the RBA is setting itself up to increase rates by another 50 basis points in August, in their continued response to inflation data.

If the property market tailwinds experienced over the past two years soon become a drag on Australia’s economic growth, we may see this reduce the RBA’s Official Cash Rate expectations, which are currently priced at peaking at 3.5% by end of March 2023, up from 1.35% today.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.