Morning Market Update - 19 October 2020

Cutcher & Neale

18 October 2020

17 July 2023

minutes

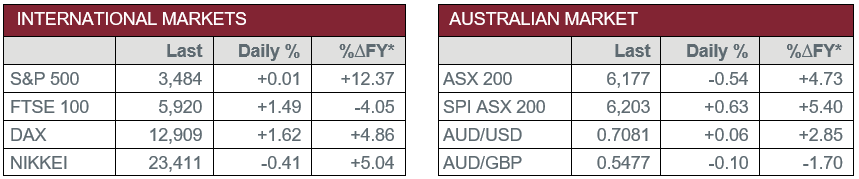

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – AUS – HIA New Home Sales

- Monday – CHINA – Gross Domestic Product

- Tuesday – AUS – RBA Meeting Minutes

- Tuesday – CHINA – PBoC Interest Rate Decision

- Wednesday – AUS – Retail Sales

- Wednesday – UK – Consumer Price Index

- Thursday – US – Existing Home Sales

- Thursday – US – Initial Jobless Claims

- Friday – UK – Retail Sales

- Friday – US – Markit Manufacturing PMI

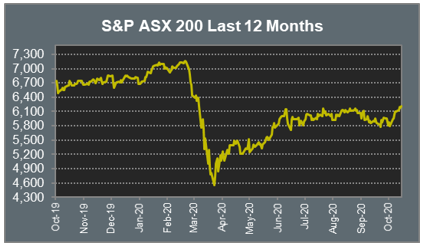

Australian Market

The Australian sharemarket closed lower on Friday, amid concerns of a possible increase in European lockdown restrictions after an increase in COVID-19 cases and a weaker lead from US markets following higher than expected US jobless claims. Losses were largely broad based, with Consumer Discretionary and Information Technology the only sectors to end the session in the positive.

Mining heayweights BHP and Rio Tinto fell 1.4% and 0.9% respectively, after iron ore prices slid for a fourth consecutive session on Thursday night on over-supply concerns. Rio Tinto also announced their September production update, with iron ore production and shipment slightly lower on the previous year and copper output down 18% following issues with the company’s US Kennecott smelter.

The big four banks all slipped between 0.1% and 0.6%, with Westpac the weakest performer, while property stocks also came under pressure, with REIT’s the worst performer, weighed down by Mirvac and Scentre Group, which both gave up 3.5%.

The Australian futures market points to a 0.63% rise today.

Overseas Markets

European sharemarkets rebounded on Friday, boosted by hopes for a COVID-19 vaccine, after US pharmaceutical giant Pfizer (+3.8%) announced it could file for US authorisation of the vaccine currently in development with German partner BioNTech as early as November. German auto maker Daimler rose 5.5% after the company posted third quarter results that beat forecasts. The broad based STOXX Europe 600 gained 1.3%, the UK FTSE 100 climbed 1.5% and the German DAX added 1.6%.

US sharemarkets were mixed on Friday, as negotiations continued towards further fiscal stimulus. Economic data was mixed; however, retail sales rose 1.9% in September, surpassing expectations of a 0.8% gain. Payment services companies rose in response; MasterCard (+0.3%), PayPal (+0.6%) and Visa (+0.4%) all strengthened. Health Care stocks led the improvements, boosted by Pfizer’s announcement; Illumina strengthened 0.8% and Johnson & Johnson added 0.6%. By the close of trade, the Dow Jones rose 0.4%, the S&P 500 closed flat and the NASDAQ slid 0.4%.

CNIS Perspective

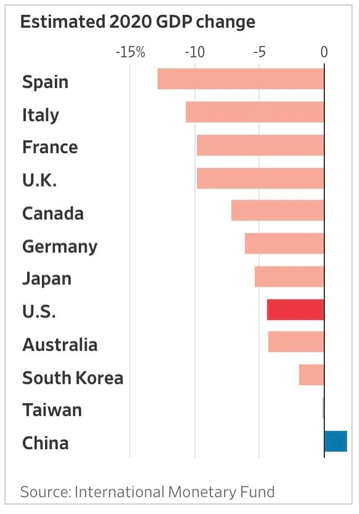

China’s National Bureau of Statistics will release data today to confirm if the country’s economic rebound from COVID-19 remains on track when its 3rd quarter GDP data is published at 1pm Australian time. While economic recovery for many countries is hard to fathom, with Europe’s second wave raising a threat of a double dip recession, China’s data today should not only confirm they have returned to its pre-COVID pace, but have expanded at 5% compared to last year’s 3rd quarter.

The key has been stamping out the virus and allowing life to return to as normal as possible. The Chinese stock market benchmark, CSI 300, has rallied 17% this year, compared to 7% for Wall Street’s S&P 500 Index.

While the world is stuck in recession, this economic feat has raised some doubts on the Chinese data. Scepticism over the accuracy of Chinese growth figures are not new. Despite economists’ arguments of the data’s integrity, most agree the rebound since then has been big. The anecdotal evidence of crowded streets and buzzing shops support this.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.