Morning Market Update - 2 December 2020

Cutcher & Neale

01 December 2020

17 July 2023

minutes

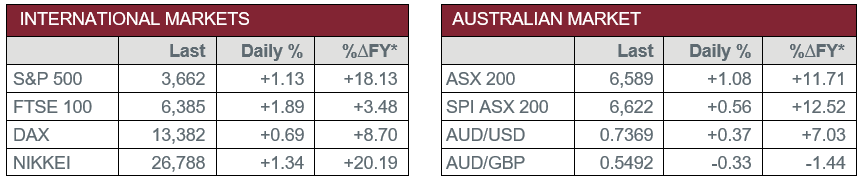

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – RBA Interest Rate Decision – The RBA Cash Rate remained unchanged at 0.1%.

- Tuesday – EUR – Consumer Price Index fell 0.3% in November, to be down 0.3% over 12 months.

- Wednesday – AUS – Gross Domestic Product

- Wednesday – EUR – Unemployment Rate

Australian Market

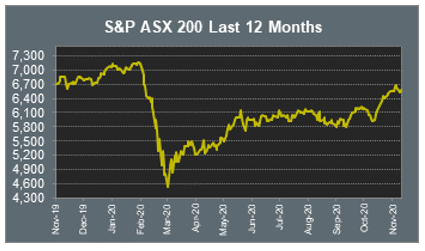

The Australian sharemarket saw a strong start to the month after the ASX 200 climbed 1.1% yesterday. Gains were broad based, with the Information Technology, Consumer Discretionary and Materials sectors the strongest performers.

The Materials sector was lifted by gains across the mining heavyweights; BHP added 1.3% and Rio Tinto rose 1.5%, while Fortescue Metals closed 0.6% higher. Goldminers were also stronger on Tuesday; Newcrest Mining jumped 3.3% and Evolution Mining rose 3.2%, while Saracen Mineral and Northern Star lifted 2.8% and 2.0% respectively.

Dominos Pizza was a top performer on the market yesterday, up 12.4%, after the company held an investor day yesterday, while several broker upgrades and price target increases were announced. Collins Foods was also an outperformer yesterday, up 10.9%, after the company reported strong growth for the first half of FY 2021. Total revenue for the company rose 11%, lifted by a 15.6% jump in revenue for KFC Australia. Strong gains across these companies contributed to a 1.7% rise in the Consumer Discretionary sector on Tuesday.

The Australian futures market points to a 0.56% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets saw a positive start to the month following record gains in November. The STOXX Europe 600 and the German DAX both added 0.7%, while the UK FTSE 100 climbed 1.9%, its strongest day in three weeks. The Financials sector rallied on overnight; Lloyds Bank jumped 7.5% and Barclays climbed 6.5%, while HSBC gained 4.6%. The Industrials sector also saw strong gains; Veolia rose 3.5% and Vinci lifted 3.1%, while Eiffage closed up 1.7%.

US sharemarkets also advanced on Tuesday amid hopes for further US fiscal stimulus following the proposal of a US$908 billion COVID-19 relief bill. The Information Technology sector outperformed, up 1.3%. Facebook climbed 3.5% and Apple added 3.1%, while Alphabet gained 2.1%. However, Zoom Video Communications tumbled 15% after the company released Q3 earnings and warned of gross margin pressure.

By the close of trade, the Dow Jones rose 0.6% and the S&P 500 lifted 1.1%, while the NASDAQ gained 1.3%.

CNIS Perspective

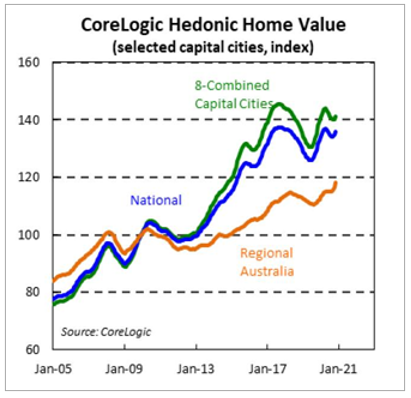

The COVID-19 induced working from home alternative is certainly becoming a major talking point. Is it a permanent trend or will we revert back to commuting to the office to work?

If yesterday’s housing data is anything to go by, working from home looks like a more permanent trend.

Dwelling prices in regional centres and smaller towns outpaced those of capital cities, as Australians moved away from larger cities to the more affordable and less densely populated areas.

Regional Australia posted a gain of 1.4% in November, to be up 10.6% over the past 12 months.

Also supporting property prices Australia-wide is the relative shortage of properties advertised for sale. In November 2020 there were 20% fewer properties advertised for sale than 2019, which is 24% below the five-year average.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.