Morning Market Update - 2 June 2021

Cutcher & Neale

01 June 2021

17 July 2023

minutes

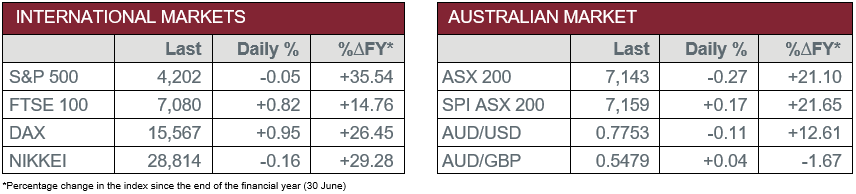

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Interest Rate Decision – The cash rate was left unchanged at 0.1%.

- Tuesday – EUR – Unemployment Rate fell 0.1% in April to 8.0%.

- Wednesday – AUS – Gross Domestic Product

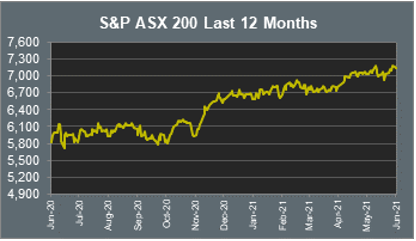

Australian Market

The Australian sharemarket slipped 0.3% on Tuesday, weighed down by the Financials sector, which lost 0.7%. ANZ was the worst of the big four banks and fell 1.4%; Commonwealth Bank slipped 0.3%, while NAB and Westpac both ended the session 0.8% lower. Fund manager Australian Ethical Investment lost 5.6% in the day’s trade, to be down just under 20.0% across the last five days, however, remains up 58.9% year to date.

The price of iron ore increased to US$198.35 per tonne after falling towards the end of May. This led mining heavyweights higher, as Fortescue Metals added 1.7%, Rio Tinto gained 0.7% and BHP lifted 0.1%. Gold miners weighed on the Materials sector; Northern Star shed 1.2%, while Evolution Mining lost 1.5%.

An additional three COVID-19 cases in Victoria is set to result in an extension of their seven-day lockdown. Despite this, Sydney Airport was the only major travel stock to close lower, down 0.3%, while Auckland International Airport added 0.9%. Webjet and Flight Centre Travel Group lifted 1.0% and 1.4% respectively.

The Energy sector was the only notable outperformer on the ASX yesterday, driven higher by strong oil prices to gain 1.3%. Sector giants Santos and Woodside Petroleum lifted 1.3% and 1.4% respectively.

The Australian futures market points to a 0.17% rise today.

Overseas Markets

European sharemarkets closed higher overnight, as strong oil and metal prices led to gains in the Materials and Energy sectors. Brent crude oil futures topped US$70 per barrel; BP added 2.8%, Total lifted 2.4% and Royal Dutch Shell gained 2.6%. By the close of the session, the pan-European STOXX 600 index lifted 0.5%.

US sharemarkets were mixed on Tuesday following the long weekend. The US Energy sector was also buoyed by increases in the price of oil, while the Financials sector also enjoyed gains as JP Morgan lifted 1.1% and Citigroup added 1.3%. The Information Technology sector finished the session lower; Microsoft lost 0.9% and Apple shed 0.3%.

By the close of the session, the Dow Jones added 0.1%, while the S&P 500 and the NASDAQ both gave up 0.1%.

CNIS Perspective

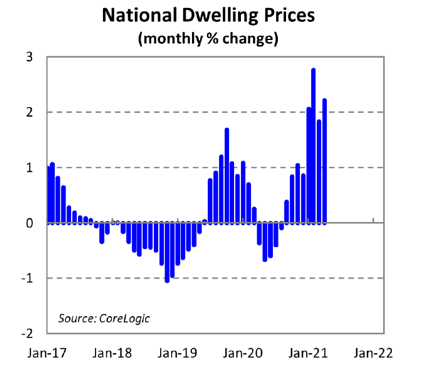

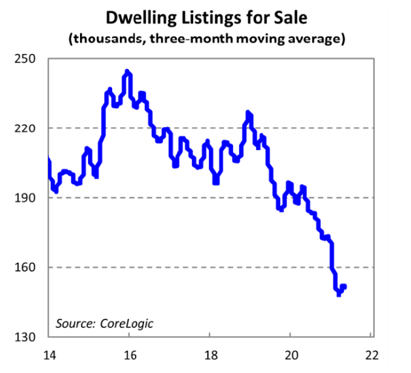

The housing boom continues to roll on, with data from CoreLogic confirming both sides of the price mechanism are working in unison.

Demand is being driven by low mortgage rates and the recovery in the labour market, while a low supply of available dwellings is continuing to drive prices higher.

Sydney is rapidly re-emerging as the nation’s housing hotspot, with housing prices up 9.3% in the past three months. This is the fastest growth rate over a three-month period in 32 years.

Auction clearance rates have held in the mid to high 70% range throughout May and remains well above the decade average of 64%.

The median time on the market also remains around its record low of 25 days.

The growth in lending to investors in recent months suggests it’s only a matter of time before controls over lending to investors will be tightened again, like they were in 2017. This should dampen house price growth in 2022.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.