Morning Market Update - 20 July 2022

Cutcher & Neale

19 July 2022

17 July 2023

minutes

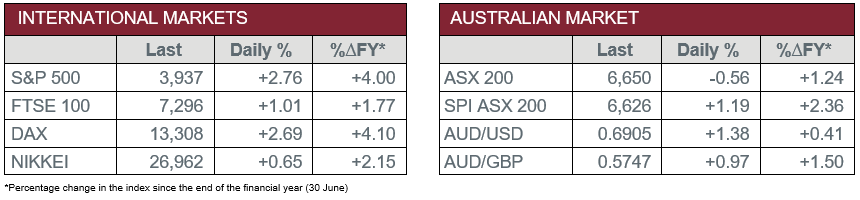

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Board Meeting Minutes stated “further increases in interest rates will be needed to return inflation to the target over time”.

- Tuesday – EUR – Consumer Price Index was 8.6% in June, up from 8.1% in May.

- Wednesday – EUR – Consumer Confidence

- Wednesday – UK – Consumer Price Index

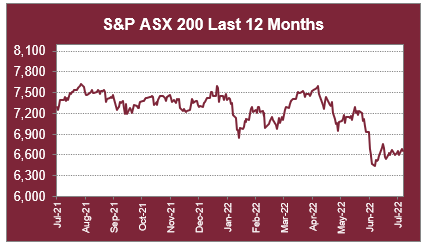

Australian Market

The Australian sharemarket weakened 0.6% on Tuesday, weighed down by the Information Technology and Health Care sectors, which fell 2.9% and 2.3% respectively. Losses were broad based, with Utilities and Energy the only sectors to advance, while the Financials sector finished the session flat.

Despite strong gains early in the session, the Materials sector closed 0.9% lower. Iron ore heavyweight BHP fell 1.0% after the company reported financial year production guidance for iron ore, energy coal, copper and metalogical coal was achieved. Meanwhile, Fortescue Metals added 0.7% and Rio Tinto gained 0.5%.

Most of the major banks advanced; NAB lifted 1.4%, while Commonwealth Bank and Westpac rose 0.8% and 0.7% respectively. However, ANZ remained in a trading halt as it commences a capital raising to fund its acquisition of Suncorp Bank. Insurers were weaker; Suncorp gave up 5.0% and Insurance Australia Group shed 2.9%, while QBE Insurance slipped 1.1%.

In company news, electronics and appliances retailer JB Hi-Fi gained 2.2% after the company reported its unaudited preliminary financial results, in which total sales for FY22 increased by 3.5% to $9.2 billion and full year FY22 EBIT was up 6.9%.

The Australian futures market points to a 1.19% gain today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets lifted overnight, following a report Russian gas flows through the Nord Stream 1 pipeline, which supplies over a third of European Union imports of Russian natural gas, is seen restarting as scheduled. Notable gainers include Veolia Environnement (3.5%), Bayerische Motoren Werke (BMW) (2.8%), Barclays Bank (2.6%) and LVMH Moët Hennessy Louis Vuitton (2.3%).

US sharemarkets also advanced as companies began to report earnings. Technology majors contributed gains; Netflix added 5.6% and NVIDIA rose 5.5%, while Alphabet and Apple lifted 4.3% and 2.7% respectively. By the close of trade, the Dow Jones, S&P 500 and NASDAQ all added between 2.4% to 3.1%.

CNIS Perspective

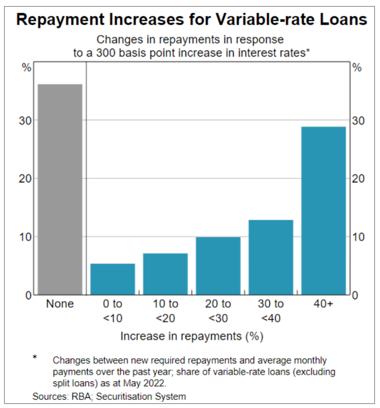

The Reserve Bank of Australia (RBA) has indicated that the majority of Australian households are in a “fairly good position” when it comes to mortgage serviceability.

It came as the RBA released their July meeting minutes yesterday, where the Board supported the 50-basis point hike, stating the Official Cash Rate at the time of the announcement was “well below the lower range of estimates of the nominal neutral rate” and noted that “further increases in interest rates will be needed to return inflation to the target over time”.

However, the main news came in the breakdown of their analysis, where the stress test of raising rates to 3% would not cause a broad financial pain according to the RBA.

Despite this, RBA data paints a less rosy picture; three in ten mortgage holders will pay 40% more to service their loans if rates rise to 3%, while half of fixed-rate borrowers would see their repayments increase by more than 40% when their fixed term ends. However, to absorb the higher repayments, just 45% of owner occupiers have more than a three-month liquidity buffer.

We need to get back to a more neutral stance on interest rates. To do so, will cause a significant tightening of the belt of at least a third of mortgage holders, and in turn, slow the economy.

If this is the case, the market prediction of the Official Cash Rate getting to 3.5% by March next year (as mentioned yesterday) seems a stretch, and if actually achieved, for how long before cuts are required?

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.