Morning Market Update - 20 June 2022

Cutcher & Neale

19 June 2022

17 July 2023

minutes

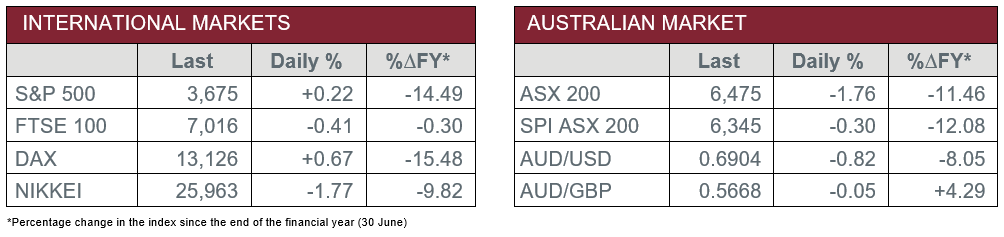

Pre-Open Data

Key Data for the Week

- Monday – UK – Rightmove House Prices

- Tuesday – AUS – RBA Board Meeting Minutes

- Wednesday – EUR – Consumer Confidence

- Wednesday – UK – Consumer Price Index

- Thursday – EUR – Markit Manufacturing PMI

- Thursday – US – Markit Manufacturing PMI

- Thursday – UK – Markit Manufacturing PMI

- Friday – US – New Home Sales

Australian Market

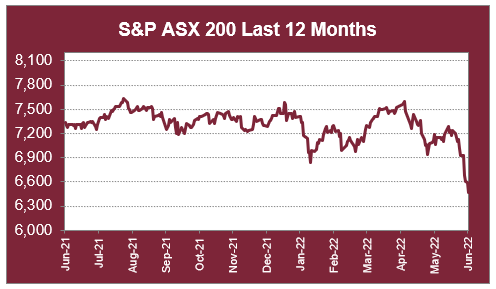

The Australian sharemarket closed lower on Friday for the sixth straight session, as the ASX 200 dropped 1.8% due to the impact of increasing inflation and interest rates.

The Materials sector was among the weaker performers, as it dropped 2.8% given the recent weakness in the price of iron ore. Fortescue Metals was the hardest hit, down 5.3%, while Rio Tinto and BHP conceded 4.2% and 3.4% respectively. However, gold miners bucked the downward trend to close in positive territory; Northern Star Resources added 5.1% and Evolution Mining lifted 5.4%.

There were also losses in the Information Technology sector, which closed 2.4% lower. Losses were led by Block, Afterpay’s parent company, which fell 7.8%, while accounting software provider, Xero, dropped 5.6% and Nuix lost 1.3%.

The only sector to post a gain on Friday was the Consumer Staples sector, as it added 0.6%. The gains were led by Woolworths and Endeavour Group, which added 0.2% and 2.8% respectively, while the Australian Agricultural Company jumped 9.9%, after it was announced Andrew ‘Twiggy’ Forrest had increased his stake in the business.

The Australian futures market points to a 0.30% fall today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets were slightly higher on Friday, however lost ground for the third straight week. The Financials sector increased; Barclays added 1.5%, while Banco Santander and BNP Paribas rose 2.3% and 0.5% respectively. The Information Technology sector also provided a bright spot on the market, as Infineon Technologies added 1.3% and Prosus lifted 3.4%. By the close of trade, the STOXX Europe 600 added 0.1% and the German DAX lifted 0.7%, while the UK’s FTSE 100 dropped 0.4%.

US sharemarkets finished mostly higher to end the week, with gains led by the Information Technology sector. Electric vehicle infrastructure providers enjoyed gains; ChargePoint Holdings added 11.8%, while Tesla rose 1.8%. Amazon rebounded off recent lows to add 2.5%, while NVIDIA and Apple lifted 1.8% and 1.2% respectively.

By the close of trade, the Dow Jones dropped 0.1%, while the S&P 500 added 0.2% and the NASDAQ lifted 1.4%. Over the week, the Dow Jones conceded 4.0% and the S&P 500 dropped 4.3%, while the NASDAQ slipped 1.7%.

CNIS Perspective

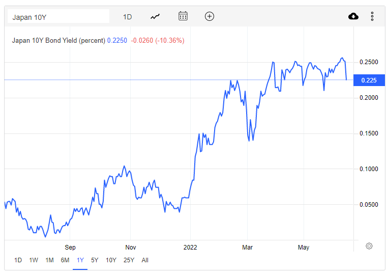

The Bank of Japan kept short and long-term interest rates unchanged on Friday, despite heightened speculation that Yen weakness and rising 10-year JGB yields would prompt some sort of response, even if only verbally.

There was no mention of the risk factors however, with the central bank’s guidance maintaining its easing bias and re-affirming their intention to conduct unlimited 10-year JGB purchases at 0.25% to create a floor in the market, ultimately sending money back into the economy.

On the economic outlook, they continue to expect a recovery, albeit constrained by rising commodity prices. The BOJ expects to see core CPI track at ~2% for the time being due to energy and food prices, but expects it to decelerate thereafter as the energy contribution wanes.

This leaves the BOJ more at odds with other major central banks worldwide, which are aggressively tightening policy to curb surging inflation levels that Japan, and some other Asian nations, are currently only experiencing a mild version of.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.