Morning Market Update - 22 October 2020

Cutcher & Neale

21 October 2020

17 July 2023

minutes

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Wednesday – AUS – Retail Sales fell 1.5% for September.

- Wednesday – UK – Consumer Price Index rose 0.4% for September, while the annual rate rose to 0.7%.

- Thursday – US – Existing Home Sales

- Thursday – US – Initial Jobless Claims

Australian Market

The Australian sharemarket closed up 0.1% yesterday, in a mixed session of trade. The Health Care sector was amongst the weakest performers, as CSL lost 1.3% and Sonic Healthcare slipped 1.4%.

The Consumer Staples sector was also weaker; Coles fell 1.9%, Wesfarmers slipped 1.5% and Woolworths lost 1.3%.

The Energy sector saw the largest gains following a rise in global oil prices; Oil Search and Santos added 3.5% and 2.0% respectively, while Woodside Petroleum rose 1.6%.

The Financials sector also outperformed, led higher by the big four banks; NAB and ANZ lifted 1.6% and 1.4% respectively, while Westpac gained 1.0% and Commonwealth Bank added 0.8%. Westpac announced after the close of trade it will be selling its 10.7% stake in Zip Co, the day after it announced its new deal with Afterpay to offer customers access to their banking service.

Toll road operator Atlas Arteria slipped 0.3%, after the company reported Q3 toll revenue was down 4.0% compared to 2019. The company stated traffic and revenue recovered strongly following the impact of various government policy responses to the COVID-19 pandemic implemented during Q2 2020.

The Australian futures market points to a 1.13% fall today, driven by weaker overseas markets overnight.

Overseas Markets

European sharemarkets fell on Wednesday, as the broad based STOXX Europe 600 closed down 1.3%. Industrials stocks were amongst the weakest performers; Vinci and CRH fell 3.2% and 2.6% respectively, while Eiffage and Veolia Environnement were down 1.7% and 1.5%. Consumer stocks also underperformed; HelloFresh lost 3.3%, while Nestlé and Tesco fell 0.8% and 0.5% respectively.

US sharemarkets also weakened overnight, with the Energy sector the worst performer. PayPal lifted 5.5% after the company announced it will launch a new service offering users access to cryptocurrencies in its digital wallet. Teradyne added 4.7% after Q3 revenue beat expectations. Information Technology stocks were mixed; Facebook, Sportify and Alphabet added 4.2%, 4.0% and 2.4% respectively, while Apple fell 0.5% and Netflix slumped 6.9% after Q3 subscriber additions missed consensus.

By the close of trade, the Dow Jones fell 0.4%, the NASDAQ slipped 0.3% and the S&P 500 lost 0.2%.

CNIS Perspective

With less than two weeks until the US presidential election, polls are indicating voters prefer Biden over Trump on almost all major issues.

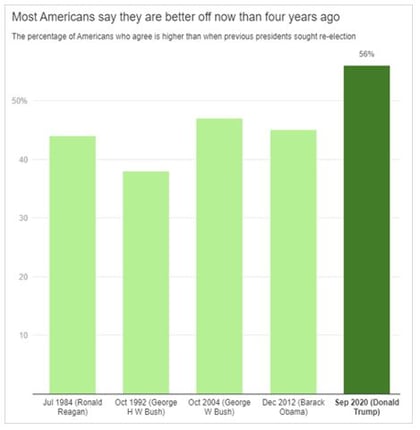

However, an interesting poll recently undertaken asked the question "Are you better off today than you were four years ago?" (when Trump was first elected).

This was a question first posed by Ronald Reagan during the 1980 presidential campaign, and since then has become a common yardstick to measure the performance and potential re-election of presidents.

Despite the turmoil of the pandemic, 56% of Americans asked in late September said they are better off now than they were four years ago.

With Americans feeling this way, it’s hard to see the election result being as one sided as the polls would have us believe. As we have witnessed previously, the problem with a non-compulsory voting system is that anything can happen!

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.