Morning Market Update - 23 June 2022

Cutcher & Neale

22 June 2022

17 July 2023

minutes

Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Consumer Confidence fell to -23.6 in June, the weakest level seen since early 2020 when COVID-19 took hold.

- Wednesday – UK – Consumer Price Index surged 0.7% in May, to be 9.1% year on year.

- Thursday – US – Markit Manufacturing PMI

- Thursday – UK – Markit Manufacturing PMI

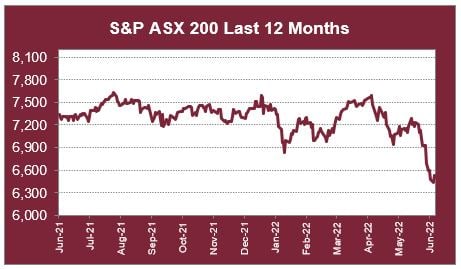

Australian Market

The Australian sharemarket edged down 0.2% on Wednesday, as gains in the Utilities (2.1%) and Energy (1.5%) sectors were offset by the Consumer Discretionary (-1.4%) and Information Technology (-1.5%) sectors.

Utilities heavyweight APA Group, Australia’s largest natural gas infrastructure business, was a standout performer, up 4.2%. Meanwhile, Ampol drove the Energy sector higher, after it advanced 3.8%. Other notable movers included Woodside Energy, which advanced 2.0%, and Paladin Energy, which lost 4.9%.

In company news, Zip Co. plummeted 11.4%, despite its media release which attempted to reassure shareholders that the company was well positioned to respond to higher interest rates. This followed after it reaffirmed its acquisition of its peer, Sezzle (-8.8%), was on track. It seemed investors remained concerned around the company’s future earnings amid the increased likelihood of more bad debt as household affordability concerns mount.

The Consumer Staples sector outperformed the broader market, up 0.5%, pushed higher by major constituents Woolworths Group (1.9%) and Metcash (1.5%). However, performance was mixed, as The A2 Milk Company shed 3.3% and Blackmores slumped 8.9%.

The Australian futures market points to a 0.36% increase today.

Overseas Markets

European sharemarkets closed lower on Wednesday, after British inflation data indicated soaring food prices had pushed annualised inflation in May to a 40-year high of 9.1%, which reignited investor anxiety. A slump in commodity prices, partly attributable to worries around economic growth in China, also deflated markets, particularly major steelmakers, which sold-off after broker downgrades from JPMorgan. Oil and gas stocks broadly lost 3.3%, while the more defensive Health Care and Food and Beverage sectors cushioned losses, both ahead 0.6%. By the close of trade, the STOXX Europe 600 shed 0.7%, the German DAX fell 1.1% and the UK FTSE 100 gave up 0.9%.

US sharemarkets finished relatively flat after a volatile session on Wednesday, as investors digested commentary from the US Federal Reserve Chairman Jerome Powell to the Senate, in which he bluntly conceded higher interest rates could lead to a recession. Seven out of eleven industry sectors lost ground; however, the key detractor was the Energy (-4.2%) sector, which fell in response to lower oil prices. Netflix outperformed, up 4.7%, despite the Information Technology sector being broadly down 0.4%. By the close of trade, the Dow Jones, S&P 500 and NASDAQ all inched ~0.2% lower.

CNIS Perspective

The RBA has made two hikes to the Official Cash Rate (OCR) over the past two months as they try to return the OCR to a more normal level of around 2.5%.

However to date, the Governor of the RBA hasn’t seen first order impacts from the rate hikes, which suggests they will go hard to get to 2.5% sooner rather than later.

The RBA notes the effect of the rate hikes on Australian households will be largely pushed into next year given significant cash savings and still-elevated household savings rate, the low-and middle-income tax offset, the high portion of borrowers with fixed rate mortgages (40 per cent) and on variable mortgages able to absorb a 200bp interest rate rise (24 per cent) (Source: RBA).

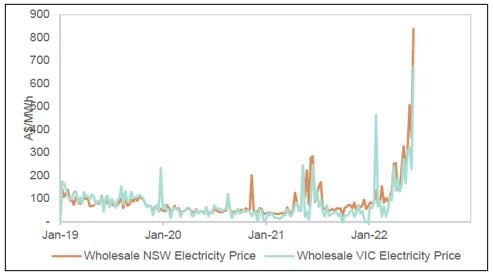

The major variable for the RBA is the little control they have over energy prices, which are flowing through to households and businesses via surging electricity prices and petrol prices back above $2/litre.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.