Morning Market Update - 24 June 2022

Cutcher & Neale

23 June 2022

17 July 2023

minutes

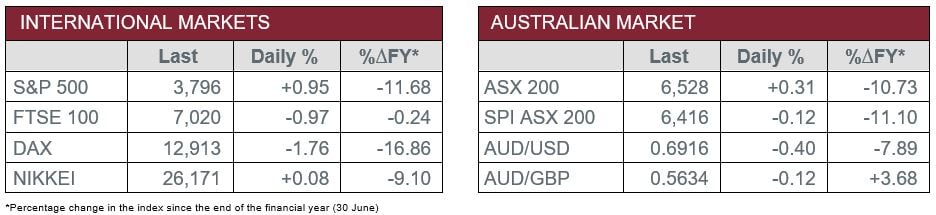

Pre-Open Data

Key Data for the Week

- Thursday – EUR – Markit Manufacturing PMI fell from 54.6 to 52, weaker than expected.

- Thursday – US – Markit Manufacturing PMI fell to 52.4 from 57.0, weaker than expected.

- Thursday – UK – Markit Manufacturing PMI held stable at 53.4, weaker than expected.

- Friday – US – New Home Sales

Australian Market

The Australian sharemarket firmed 0.3% on Thursday, after strong performances from the REITs (2.6%) and Health Care (2.0%) sectors. Notable contributors included index heavyweights Goodman Group (4.9%) and CSL Limited (2.2%). However, the local sharemarkets performance was suppressed by lower commodity prices, which resulted in widespread losses in the Materials (1.5%) and Energy (-2.1%) sectors. Key detractors were BHP Group (-1.3%), Fortescue Metals Group (-2.1%) and Woodside Energy (-2.6%).

Lithium stocks experienced further selling pressure, as it seemed investors remained concerned about future supply and demand conditions. Goldman Sachs’ recent broker report predicts a sharp price correction to ~US$16,000 per tonne in 2023, with their thesis based on overinvestment in the long term electric vehicle demand megatrend, which will generate, “an outsized supply response well ahead of the demand trend in focus”. Liontown Resources (-9.3%) and Allkem (-3.6%) dropped, while Pilbara Minerals only edged down 0.5%, supported by an announcement that it sold a shipment of spodumene concentrate, prior to their digital auction, at a 30% premium to the spot price in China.

Meanwhile, the index heavy Financials sector outperformed the broader market, up 0.7%, as all four major banks clawed back some of the losses made after the RBA’s rate rise. ANZ led gains, up 1.1%, while Commonwealth Bank inched 0.2% higher and both Westpac and NAB rose 0.5%.

The Australian futures market points to a relatively flat open today, down 0.12%.

Overseas Markets

European sharemarkets lost ground, as economic growth worries resurfaced due to weak Purchasing Managers Index readings in the Eurozone. Banks were major detractors in the session, broadly down 3.4%, with Deutsche Bank (-12.2%) and Commerzbank (-11.8%) being notable movers. By the close of trade, the STOXX Europe 600 shed 0.8%, the German DAX fell 1.8% and the UK FTSE 100 lost 1.0%.

US sharemarkets recovered on Thursday, supported by strong performances from the defensive Utilities (2.4%), Consumer Staples (2.0%) and Health Care (2.2%) sectors. This offset losses in the cyclical Energy (-3.8%) and Materials (-1.4%) sectors, which have suffered amid recession fears. Meanwhile, bond yields slipped, which provided reprieve for the interest rate sensitive Information Technology (1.4%) sector. Notable contributors included Fortinet (2.0%), Apple (2.2%) and Microsoft (2.3%). By the close of trade, the Dow Jones rose 0.6%, the S&P 500 gained 1.0% and the NASDAQ jumped 1.6%.

CNIS Perspective

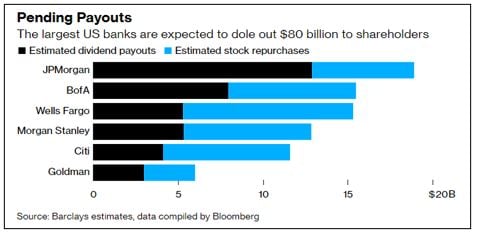

Some of the largest banks in the US are set to return tens of billions of dollars to investors after all lenders passed the Federal Reserve’s annual capital stress test.

The banks examined showed they had enough capital to handle a cocktail of surging unemployment and a collapse in real-estate prices. The pass mark effectively gives the banks a green light to return billions of dollars to investors in dividends and share buybacks. “Banks continue to have strong capital levels, allowing them to continue lending to households and businesses during a severe recession”, the Federal Reserve said in a statement released overnight.

Lenders use the stress tests to assess how much capital they can afford to payout to investors without falling below the amount they are required to hold as a cushion. If a lender breaches its capital buffer at any point in the year following the test, the Fed can apply sanctions, including restrictions on capital distributions and bonus payments to executives.

With their results in hand, banks can announce their payout plans starting Monday. Estimates by Barclays analysts indicate that JPMorgan is set to lead the way with US$18.9 billion in combined dividends and share buybacks, followed by Bank of America Corp. and Wells Fargo & Co. with US$15.5 billion and US$15.3 billion respectively.

In all, US banking giants are set to return US$80 billion to shareholders this year and this should bode well for their share prices.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.