Morning Market Update - 25 February 2021

Cutcher & Neale

24 February 2021

17 July 2023

minutes

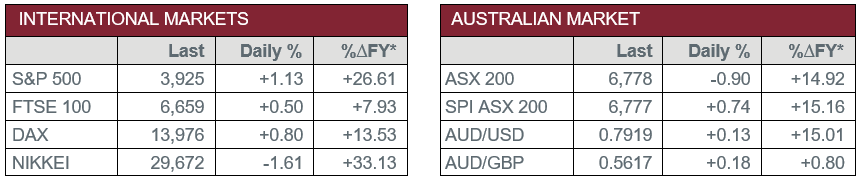

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Wednesday – AUS – Construction Work Done fell 0.9% in Q4, below expectations for a 1.0% rise.

- Wednesday – US – New Home Sales lifted to 923,000 for January, above expectations of 855,000.

- Thursday – EUR – Consumer Confidence

- Thursday – US – Gross Domestic Product

- Thursday – US – Initial Jobless Claims

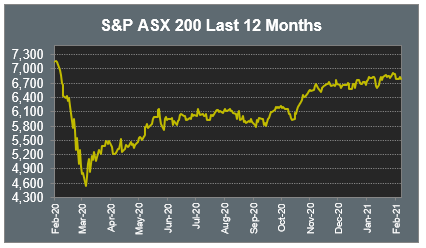

Australian Market

The Australian sharemarket slipped 0.9% yesterday, to close at a three-week low. The Information Technology, Materials and Telecommunications sectors were the weakest performers, all down over 2%.

Mining heavyweights underperformed; BHP and Rio Tinto slumped 3.1% and 2.7% respectively, while Fortescue Metals was down 1.5%.

The Consumer Staples sector outperformed. Woolworths rose 1.1% after the company posted an 8.0% rise in first half sales and 15.9% lift in NPAT. Coles added 0.5%, while Wesfarmers slipped 1.1%.

Travel stocks were also stronger due to the vaccine rollout which started on Monday. Auckland International Airport lifted 4.1% and Sydney Airport rose 2.5%.

Health Care stocks were mixed; CSL and Ramsay Health Care closed flat, while Sonic Healthcare lost 0.6%. The Telecommunications sector was weighed down by Telstra, which slipped 3.1%.

The Australian futures market points to a 0.74% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets were stronger on Wednesday, with the broad based STOXX Europe 600 up 0.5%. Travel stocks outperformed as Airbus added 3.8% and Air France jumped 5.3%. Barclays continued its recent strength to add 3.4%, while renewable energy companies Vestas Wind Systems and Siemens Gamesa slipped 4.9% and 1.5% respectively.

US sharemarkets also closed higher overnight, with the Energy, Financials and Industrials sectors the best performers, while Utilities underperformed. Energy stocks recovered from recent weakness; Enphase Energy and SolarEdge lifted 5.8% and 4.3% respectively. Financial services companies MasterCard and Visa added 4.8% and 3.5% respectively, while PayPal added 0.4%. Bristol-Myers Squibb rose 3.1% and Johnson & Johnson gained 1.3% to help lift the Health Care sector.

Technology stocks were mixed; Amazon, Apple, Facebook and Spotify all fell between 0.4% and 1.0%, while Microsoft and Alphabet bucked the trend to rise 0.6% and 1.2% respectively.

By the close of trade, the NASDAQ rose 1.0%, the S&P 500 added 1.1% and the Dow Jones rose 1.4%.

CNIS Perspective

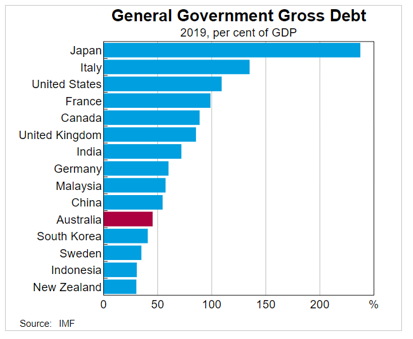

The post-COVID recovery of global economies is now starting to play out, and what is becoming obvious is the relationship between economic recovery and the level of government debt prior to the pandemic.

Countries with lower debt to GDP ratios at the start of COVID-19 have had better opportunity to increase budget deficits to fund stimulus and relief programs, while those with the higher debt/GDP ratios were already exacerbated.

The subsequent result of high government indebtedness further anchors interest rates at low yields, with central banks hesitant to increase cash rates to pre-COVID levels, due to higher debt financing expenses detracting from future economic expenditure.

The question is, why would a central bank increase cash rates if it makes it more expensive for their government to repay their own debt?

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.