Morning Market Update - 28 June 2022

Cutcher & Neale

27 June 2022

17 July 2023

minutes

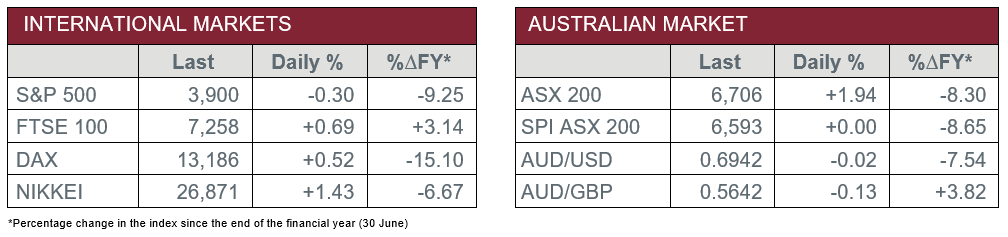

Pre-Open Data

Key Data for the Week

- Monday – CHINA – Industrial Profits fell 6.5% over the year to May.

- Tuesday – UK – Nationwide House Prices

- Tuesday – US – Consumer Confidence

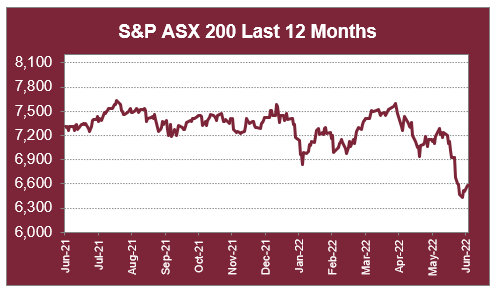

Australian Market

The Australian sharemarket enjoyed a near two percent rise yesterday, after the local index followed a solid lead from the US. As a result, all sectors closed the session in positive territory, led by gains from Materials and Financials.

The major banks all enjoyed gains yesterday, with Commonwealth Bank the best performer, up 4.0%. Among the other banks, NAB added 3.4% and ANZ lifted 3.0%, while Westpac rose 2.3%. Gains were also seen among local funds managers; Australian Ethical Investment lifted 3.1% and Challenger closed the session 4.5% higher.

The Materials sector also rose on the expectation of an increase in demand for iron ore, given the Chinese President pledged to increase measures to achieve his country’s economic goals. As a result, BHP added 3.0% and Fortescue Metals rose 3.5%, while Rio Tinto gained 2.4%. Despite this, goldminers suffered heavy losses as Evolution Mining fell 21.9%, after the company decreased its full-year output as a result of increased costs, while Northern Star followed suit to fall 12.1%.

Afterpay’s owner, Block, led the gains in the Information Technology sector to add 5.5%, while accounting software provider, Xero, rose 1.2%, while artificial intelligence provider, Appen, gained 2.4%.

The Australian futures market points to a flat open today.

Overseas Markets

European sharemarkets closed mostly higher overnight, with gains led by the Materials sector, as a result of the potential increase in demand for iron ore. London-listed Rio Tinto added 1.8%, while Glencore closed the session 2.3% higher. Airline providers also extended recent gains; International Consolidated Airlines Group added 1.3%, while easyJet lifted 1.1%.

By the close of trade, the STOXX Europe 600 and the German DAX both added 0.5%, while the UK’s FTSE 100 gained 0.7%.

US sharemarkets were lower on Monday, despite last week’s rally. Information Technology stocks were lower; Amazon shed 2.8% and Alphabet slipped 1.6%, while Netflix conceded 0.9%. Despite this, oil majors rose as the price of oil increased; ConocoPhillips added 2.2% and ExxonMobil rose 2.5%.

By the close of trade, the Dow Jones slipped 0.2% and the S&P 500 dropped 0.3%, while the NASDAQ lost 0.7%.

CNIS Perspective

Further signs of international pressure on Russia have seen the nation receive its first default notice on government bonds since the Russian Financial Crisis in the late 1990s.

About US$100 million worth of interest on Russian government bonds came due on Sunday, marking the end of a 30-day grace period during which the country unsuccessfully pursued ways to avoid a full default.

Under the terms of the bonds, if holders do not receive payment by the end of the grace period, then Russia enters default, triggering the immediate demand for payment on Russian debts.

Interestingly, what is different about this default is it’s not due to Russia’s refusal, or lack of funds to pay the interest instalment, as Russia is still flushed with cash.

If they had the ability to pay the interest, they would; it’s a forced default by NATO restrictions on access to the international banking system that have not allowed the funds to pass through to international investors.

While it is unlikely international creditors will go chasing Russia for the return of funds at this point in the war, it will add significant pressure on the country at some point in the future should they wish to enter the bond market again to borrow further funds, further tightening the financial constraints on Russia over the long term.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.