Morning Market Update - 3 August 2021

Cutcher & Neale

02 August 2021

17 July 2023

minutes

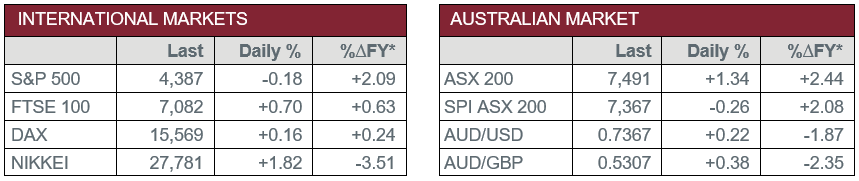

Pre-Open Data

Key Data for the Week

- Monday – AUS – Dwelling Prices surged 1.6% in July.

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Producer Price Index

Australian Market

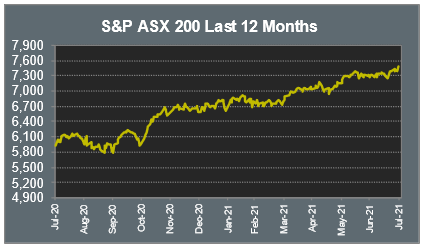

The Australian sharemarket jumped 1.3% yesterday to reach another record high. The Information Technology sector was the best performer after it soared 6.5% following a takeover deal for Afterpay.

US payments provider, Square, proposed a $39 billion offer for the buy-now-pay-later provider, which led to an 18.8% increase in the company’s share price. This news also flowed through to other buy-now-pay-later providers, Zip and Sezzle, as they rose 9.0% and 3.8% respectively.

The Financials sector also enjoyed gains yesterday to rise 1.9%. NAB was the best of the big four, up 2.4%, while Commonwealth Bank lifted 2.0% to rise above $100 per share. Westpac closed the session 2.1% higher, while ANZ gained 1.8%.

Energy shares benefitted from Oil Search’s takeover offer deal from Santos at $4.52 per share which led to a 4.7% increase for the company. Gains were also seen in other oil companies, Beach Energy added 2.9% and Woodside Petroleum rose 1.1%.

The Australian futures point to a 0.26% decline today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets closed higher on Monday, also aided by takeover activity. British aero-engineer, Meggitt, jumped 56.7% after it was announced that a US industrial firm would buy the company in a deal valued at US$8.76 billion. Mixed performances were seen among insurers, as Axa, Europe’s second-largest insurer, added 4.2% after better-than-expected first-half results, while Allianz slipped 7.8% after the US Department of Justice began an investigation into losses in its funds management division.

US sharemarkets weakened overnight as an increase in the Delta variant of COVID overshadowed earnings season. Weaker than expected economic data released during the day also weighed on the market, as US manufacturing slowed for the second straight month. The Information Technology sector was mixed; Amazon added 0.1%, while Spotify lost 0.1% and Apple shed 0.2%.

By the close of trade, the NASDAQ added 0.1%, while the S&P 500 and Dow Jones slipped 0.2% and 0.3% respectively.

CNIS Perspective

The extension of Sydney’s lockdown, including greater enforcement in high-risk areas, along with Brisbane joining in lockdowns over the weekend, is stifling economic growth across the eastern seaboard.

Yet financial markets have taken the lockdowns in their stride, yesterday posting an all-time record, with the ASX 200 index breaking through 7,500 points for the first time.

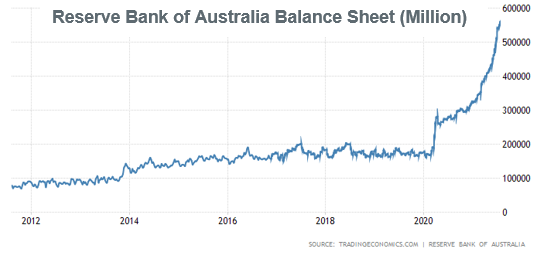

It’s going to be some time before interest rates rise here in Australia, and while the Delta COVID-19 strain continues to dominate Australia’s economic hubs, this will be pushed out even further.

The RBA meets today to discuss monetary policy. While no change will occur in interest rates, their stance on winding back quantitative easing could backflip. After announcing a reduction last month, which would have seen bond purchases reduced from $5 billion to $4 billion per week, the RBA is all but certain to reverse the decision, to maintain liquidity during the expected slowdown in the Australian economy.

This will continue to extend the flow of money into growth assets and could see the sharemarket continue to enjoy accommodative monetary policy for some time to come.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.