Morning Market Update - 3 June 2021

Cutcher & Neale

02 June 2021

17 July 2023

minutes

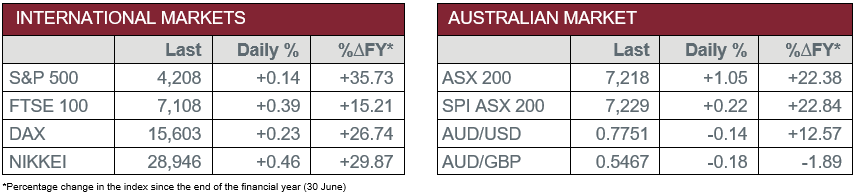

Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Gross Domestic Product – The Australian economy rose by 1.8% in the quarter, to beat expectations of 1.5%.

- Thursday – AUS – Trade Balance

Australian Market

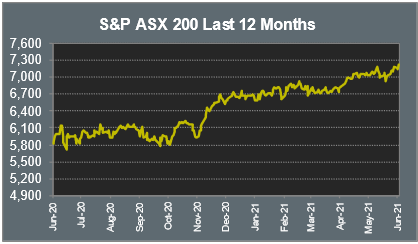

The Australian sharemarket climbed 1.1% on Wednesday as the local ASX 200 reached an all-time high of 7,217.8. This was despite the announcement of an additional seven days of lockdown in Melbourne as the number of COVID-19 cases continue to grow.

Materials shares were the most sought after, adding 1.9%, as the price of iron ore returned to the heights of US$200 per tonne. As a result, BHP added 3.1%, Rio Tinto lifted 1.9% and Fortescue Metals gained 2.0%. In May, the Chinese Government declared a ‘crackdown’ on rising commodity prices, however it has had little effect on the prices, as analysts suggest that Chinese steel-makers will continue to demand iron ore as their economic development continues.

Energy shares also benefited from rising commodity prices as Santos soared 6.5%, while Woodside Petroleum and Oil Search both added 4.6%. It was a positive trading session for uranium miners, as Paladin Energy gained 19.0% to reach a new high and Boss Energy lifted 6.1%.

Gains were also seen in the Financials sector; Commonwealth Bank was the best of the big four, up 0.9%. NAB and ANZ added 0.6% and 0.1% respectively, while Westpac eked out a less than 0.1% gain.

The Australian futures market points to a 0.22% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets hovered around record highs on Wednesday as strong economic data from the US lifted investor sentiment. Airbus continued its recent rally to lift 1.8% in the day’s trade and is now up 86.2% in the last 12 months. The positive news of an increase in European factory activity in May led the automaker industry higher; Bayerische Motoren Werke (BMW) added 1.5%, while Volvo gained 3.5%. By the end of trade, the broad based STOXX Europe 600 added 0.3%.

US sharemarkets closed relatively flat on Wednesday ahead of key data set to be released later in the week that may spark inflationary fears. The Energy sector continued its surge as oil prices continued to rise; BP added 2.3%. Renewables were mixed; NextEra Energy added 0.8%, while Tesla shed 3.0%.

By the close of the session, the Dow Jones added less than 0.1%, while the S&P 500 and the NASDAQ both lifted 0.1%.

CNIS Perspective

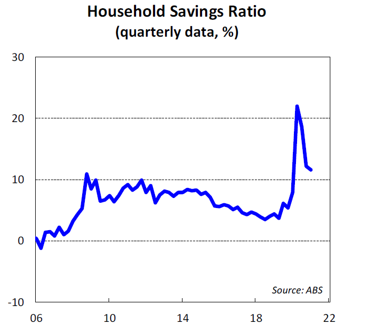

The less we save, the more we spend and the more we spend, the stronger the economy.

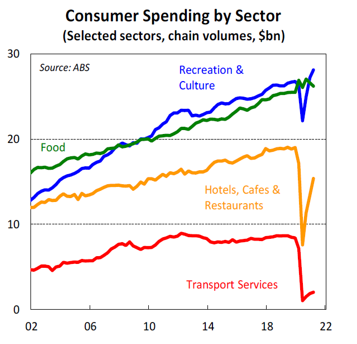

It’s therefore no surprise that during the March quarter as the household saving ratio edged down to 11.6% from 12.2%, household consumption rose 1.2% and in turn the Australian economy grew by a stronger than expected 1.8%.

Obviously, businesses benefitting from the reopening of the economy had the strongest growth in the quarter, with business investment surging 3.6% from the additional help of government tax incentives.

There are winners and losers, but a growth rate of 1.8%, exceeding expectations of 1.5%, confirms most industries grew in the March quarter.

The household savings ratio is still above pre-pandemic levels, so continued economic growth is therefore dependant on household consumption. Instead, households may opt, somewhat more wisely, to repaying debt and strengthening their balance sheets, which would provide less support for economic growth than money spent on goods and services.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.