Morning Market Update - 3 May 2021

Cutcher & Neale

02 May 2021

17 July 2023

minutes

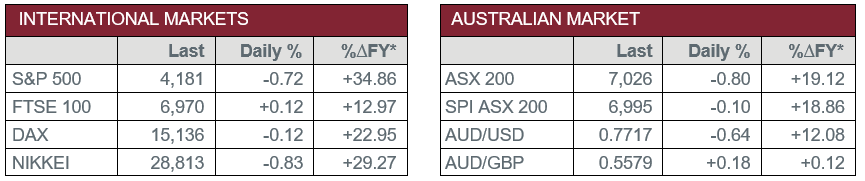

Pre-Open Data

Key Data for the Week

- Monday – AUS – MI Inflation Gauge

- Monday – EUR – Markit Manufacturing PMI

- Tuesday – AUS – Interest Rate Decision

- Tuesday – AUS – Trade Balance

- Tuesday – US – Trade Balance

- Wednesday – AUS – Building Approvals

- Wednesday – EUR – Produce Price Index

- Thursday – EUR – Retail Sales

- Thursday – UK – Interest Rate Decision

- Friday – CHINA – Trade Balance

- Friday – US – Unemployment Rate

Australian Market

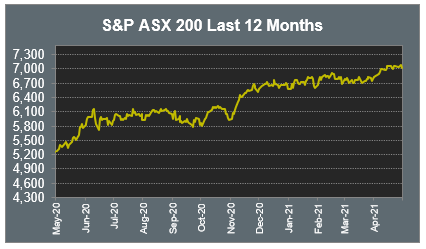

The Australian sharemarket closed down 0.8% on Friday, to slip 0.5% for the week, while over the course of April, the local market gained 3.5%. The Energy and Information Technology sectors were Friday’s weakest performers, while Utilities and Industrials were the only sectors to close higher.

Beach Energy plunged 24.1% after the oil and gas producer removed its five-year outlook and lowered its FY21 production guidance, as it expects to produce less oil from its sites in South Australia. Seven Group lost 4.8% due to its large holding in Beach Energy. Seven Group purchased an additional $50 million of Beach Energy on Friday to increase its stake by 1.5% and its total holding to above 30% for the first time.

Mining heavyweights were mostly weaker; BHP and Rio Tinto fell 2.0% and 1.7% respectively, while Fortescue Metals eked out a less than 0.1% gain.

The big four banks weighed on the Financials sector, with all down between 0.4% and 1.1%.

The Australian futures market points to a 0.10% fall today, driven by weaker overseas markets on Friday.

Overseas Markets

European sharemarkets were mixed on Friday, while the broad based STOXX Europe 600 gained 1.8% for April, to mark its third straight month of gains. The eurozone economy fell into its second technical recession in 12 months as GDP contracted 0.6% in the March quarter, weighed down by the ongoing impact of COVID-19. Barclays slumped 7.0% despite reporting quarterly profit had more than doubled.

US sharemarkets were mostly weaker on Friday, while the S&P 500 recorded its best month since November 2020. Apple fell 1.5% after the European Union said the company's App Store was breaching its competition rules, while Twitter slumped 15.2% after it offered a tepid revenue forecast for the June quarter.

US markets all posted strong gains for the month of April; the Dow Jones added 2.7%, the S&P 500 lifted 5.2% and the NASDAQ gained 5.4%.

CNIS Perspective

A few weeks ago, cryptocurrency pioneer Coinbase listed shares on the NASDAQ, which ended day one with a US$100 billion valuation, making it almost as valuable as Goldman Sachs. The people at Goldman’s must be asking themselves, how did we let this happen? As Wall Street firms now realise, they have ceded too much of a head start to compete in this space, with some similarities becoming apparent to another IPO that listed 25 years ago, Netscape.

The 1995 Netscape IPO effectively illuminated the emergent World Wide Web for millions of people who, until then, were only vaguely familiar with its potential and promise. As Coinbase provides access to the decentralised cryptocurrencies, Netscape allowed users via the web browser access to the digital future, prompting the major technology companies at the time like Microsoft, to ask themselves why they weren’t more proactive with this idea. The internet that Netscape precipitated changed the world, but the firm no longer exists, and Microsoft is now worth US$2 trillion. We now wonder, will history repeat itself?

What we did witness on day one of the Coinbase IPO was dumping of the stock by early invested venture capitalists and founders. Marc Andreessen, coincidently the lead investor and a significant shareholder, was one such seller. Insiders selling stock is never comforting for investors. The fact that Coinbase is the first cryptocurrency exchange to list at an extreme valuation does not always bode well for its future. Much the same as Netscape, challengers will be coming.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.