Morning Market Update - 31 August 2021

Cutcher & Neale

30 August 2021

17 July 2023

minutes

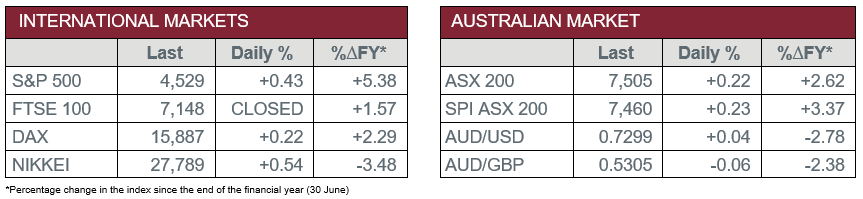

Pre-Open Data

Key Data for the Week

- Monday – EUR – Consumer Confidence was -5.3 in August, down from -4.4 last month.

- Tuesday – EUR – Consumer Price Index

- Tuesday – AUS – Building Approvals

- Tuesday – AUS – Current Account

Australian Market

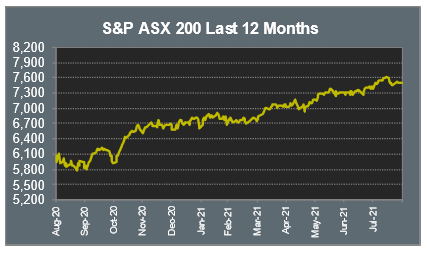

The Australian sharemarket closed 0.2% higher on Monday, largely aided by gains in the Materials sector. Fortescue Metals soared 6.6% after announcing their full-year profit and final dividend had more than doubled. The other miners were buoyed by a slight increase in the price of iron ore; BHP rose 2.5%, while Rio Tinto added 3.1%.

All four big banks weighed on the Financials sector and closed 0.7% lower. Commonwealth Bank and ANZ both conceded 1.1%, while Westpac lost 0.7% and NAB slipped 0.4%. Fund managers were mixed; Australian Ethical Investment added 4.8%, while Magellan Financial Group fell 1.7%.

The Information Technology sector slipped 0.5%, largely weakened by Altium, which dropped 14.3%, following global chip shortages. Data analytics software provider, Nuix, fell 10.8% after announcing a full-year loss of $1.6 million.

Wesfarmers further weighed on the Consumer Discretionary sector, as it fell 3.2% after Friday’s annual profit figure failed to meet expectations. Other retailers were mixed; JB Hi-Fi added 0.5% and Super Retail Group gained 1.2%, while Dusk Group fell 6.3%.

The Australian futures point to a 0.23% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets closed relatively flat overnight, as a result of the British Summer Bank holiday. Renewable Energy stocks rose; Infineon Technologies added 0.3%, while Siemens Gamesa and Vestas Wind Systems rose 0.5% and 0.1% respectively. By the close of trade, the German DAX added 0.2% and the STOXX Europe 600 gained 0.1%.

US sharemarkets reached new record highs on Monday, aided by gains in the Information Technology sector. PayPal rose 3.6% after a report showed the company is exploring ways to let US customers trade stocks on its platform. Apple reached an all-time high, up 3.0%, while Spotify and Amazon added 3.1% and 2.2% respectively.

By the close of trade, the Dow Jones shed 0.2% and the S&P 500 gained 0.4%, while the NASDAQ added 0.9%.

CNIS Perspective

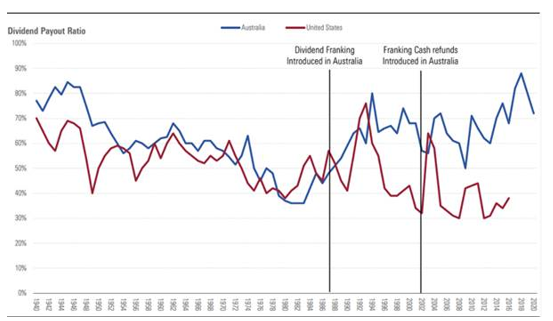

There is a noticeable contrast in the way Australian businesses invest and return capital to shareholders.

The dividend imputation system in Australian has encouraged companies to return capital to shareholders via dividends. Over the years, this has led to relatively high payout ratios, where roughly 70% of company profits are returned to shareholders as dividends, while just 30% is re-invested into the business.

Alternatively, under 40% of company profits in the US are returned to shareholders as dividends. This allows more capital to be directed towards other uses, such as reinvestment in the business, growth by acquisitions, or on-market share buybacks, with a view to compounding the profits within the business to provide greater share price return.

There are various benefits in allocating profits under both circumstances. However, in the ultra-low interest rate environment we look to be stuck in, returning 70% of profits to shareholders bank accounts, where the return on cash is next to 0%, maybe something Australian CEOs should take a moment to re-consider.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.