Morning Market Update - 4 August 2021

Cutcher & Neale

03 August 2021

17 July 2023

minutes

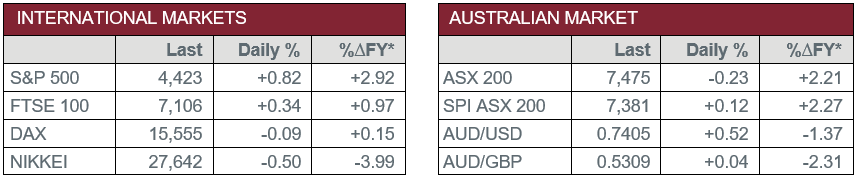

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Interest Rate Decision – The RBA maintained the cash rate and intends to commence tapering of bond-buying in September.

- Tuesday – EUR – Producer Price Index

- Wednesday – AUS – Retail Sales

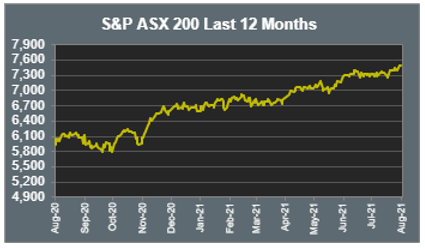

Australian Market

The Australian sharemarket shed 0.2% yesterday, easing from record highs as the RBA stated it intends to uphold its decision to reduce bond-buying in September.

The big four banks weighed on the Financials sector as Westpac fell 0.9% and NAB conceded 0.8%. ANZ closed 0.7% lower, while Commonwealth Bank slipped 0.2%. Fund managers were mixed as Magellan Financial Group and Australian Ethical Investment both lifted 0.5%, while Challenger closed the session 0.4% lower.

Mining heavyweights weakened the Materials sector, as the price of iron ore fell considerably. As a result, Fortescue Metals conceded 1.6%, BHP lost 1.4% and Rio Tinto shed 0.6%. Gold miners also lost ground; Northern Star dropped 1.0% and Evolution Mining slipped 3.3%.

The Information Technology sector outperformed again to lift 4.4%. This was largely due to an 11.4% increase in Afterpay following news of Square’s takeover deal. Other buy-now-pay-later providers continued to benefit from the news, as Zip gained 7.5% and Openpay Group added 8.9%.

The Australian futures point to a 0.12% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets rose overnight, aided by strong earnings updates. BP added 5.6% after it lifted its dividend and increased its share buyback program as a result of a rise in quarterly profit. Also, Royal Dutch Shell lifted 2.1%, which helped the Energy sector outperform during the day’s trade. As a result, the pan-European STOXX 600 rose 0.2%.

US sharemarkets lifted on Tuesday, although gains were limited as COVID-19 Delta variant cases increased. A gain in Apple (1.3%) led the NASDAQ higher, although this was limited as Netflix (-0.8%) and Facebook (-0.2%) continue to slide.

By the close of the session, the S&P 500 and the Dow Jones both lifted 0.8%, while the NASDAQ added 0.6%.

CNIS Perspective

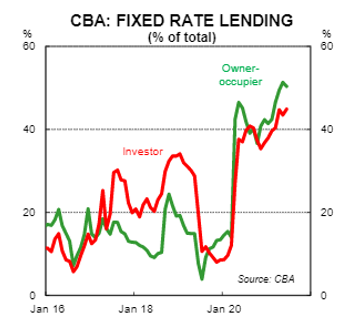

When it comes to buying and selling money, it really is difficult to beat the banks. This is after all their bread and butter.

Over the past 18 months or so, there has been a surge in the number of borrowers trying to beat the banks by locking in fixed rate mortgages, as opposed to the usual majority weighting of variable (floating) rate mortgages.

Borrowers have been of the opinion that interest rates are too low and are going to move higher within the next 2 to 5 years. By locking in the fixed rate, they avoid higher rates in the future, when they perceive the variable rate will rise.

Initially, the fixed interest rate is often higher than the variable.

For the banks, their funding costs haven’t increased as most traditional term deposit holders will attest. In fact, term deposit interest rates have fallen over the past 18 months, providing a juicy increase in Net Interest Margin (i.e. the difference between the cost of funds and the price of funds), for the banks.

This should probably hold true for at least the next few years and once again fuel healthy bank profits.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.