Morning Market Update - 4 May 2021

Cutcher & Neale

03 May 2021

17 July 2023

minutes

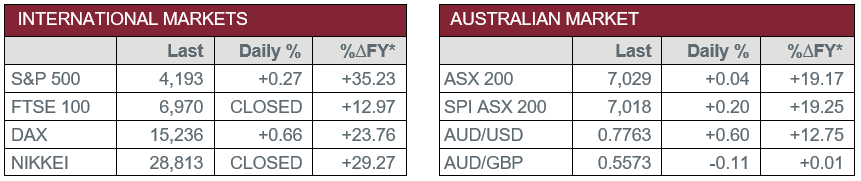

Pre-Open Data

Key Data for the Week

- Monday – AUS – MI Inflation Gauge was stable at 0.4%.

- Monday – EUR – Markit Manufacturing PMI reached a record high of 59.7 in April.

- Tuesday – AUS – Interest Rate Decision

- Tuesday – AUS – Trade Balance

- Tuesday – US – Trade Balance

Australian Market

The Australian sharemarket closed relatively flat on Monday, after mixed performances from the major sectors. The Financials sector was the best performer, closing 1.4% higher, while the Information Technology sector lost 1.9%.

The uplift in the Financials sector was mainly due to gains in Westpac, which added 5.0% to close at $26.23. The bank reported first-half cash earnings of $3.5 billion, with this rebound in earnings increasing confidence among investors that the other banks due to report later this week will announce similar results. As a result, Commonwealth Bank added 0.7%, ANZ gained 1.3% and NAB increased 2.1%.

The Materials sector closed lower, weighed down by the major miners. BHP shed 1.4%, Fortescue Metals lost 0.5% and Rio Tinto dropped 0.9%. Major goldminers also closed the session lower, with Newcrest Mining losing 0.9% and Northern Star Resources falling 0.3%.

The Health Care sector underperformed with the market leaders weighing on the sector. Ramsay Health Care and Sonic Healthcare lost 0.3% and 0.4% respectively, while CSL closed 0.1% lower.

The Australian futures market points to a 0.2% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets closed higher on Monday, buoyed by the European Commission’s plan to loosen COVID-19 restrictions in the near future. As a result, European travel stocks closed the session 0.2% higher, with Deutsche Lufthansa adding 2.6% and Air France-KLM lifting 1.4%. The broad-based pan-European STOXX 600 closed 0.6% higher.

US sharemarkets were mixed on Monday. The Health Care sector outperformed, with Moderna adding 4.0% following the news of a COVID-19 supply deal with COVAX, and Pfizer gaining 3.1% after announcing that they will begin to export US manufactured vaccines. The NASDAQ lagged the other major indexes as the rotation into cyclical stocks continued. As a result, PayPal dropped 1.2%, Amazon lost 2.3% and Tesla slumped 3.5%.

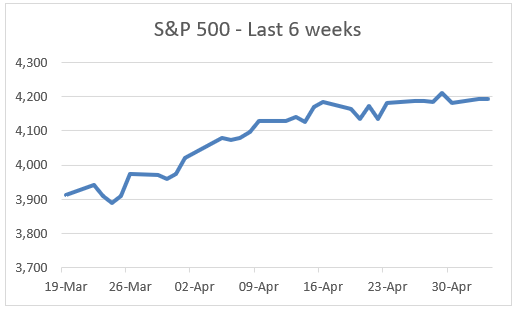

By the close of trade, the Dow Jones rose by 0.7%, the S&P 500 closed 0.3% higher, while the NASDAQ lost 0.5%.

CNIS Perspective

So far so good for US corporate earnings. As it stands, 60% of the S&P 500 companies have reported so far, with 86% of those beating earnings expectations, comfortably above the 5-year average of 74%.

It’s therefore a little surprising that share prices haven’t continued on their strong trajectory, having levelled out over recent weeks, with no apparent reason for it.

The US first quarter GDP surprised on the upside, with a solid 6.5% annualised growth rate underpinned by the latest round of stimulus cheques that boosted consumer spending. The bad news is that an annualised growth rate of 6.5% is unlikely to be repeated any time soon, so maybe all the good news is factored into the market already.

Or maybe it’s a case of buyer exhaustion.

Whether it’s a fully priced market or buyer exhaustion, the US Federal Reserve has reiterated its view that it’s too early to talk about tapering bond purchases, or bringing forward rate increases, so there is still plenty of pent up demand and growth in the economy to play out.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.