Morning Market Update - 5 August 2021

Cutcher & Neale

04 August 2021

17 July 2023

minutes

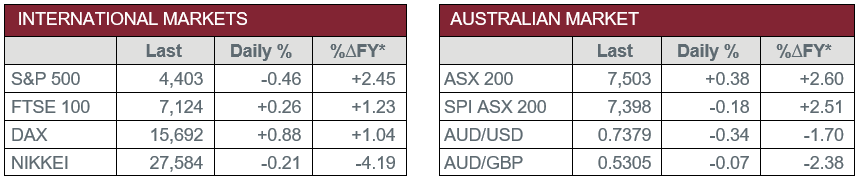

Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Retail Sales fell 1.8% in June, in line with market expectations, as lockdowns impacted consumer spending. Year-on-year retail sales volumes grew 9.2%, albeit partly due to a weak comparison period.

- Thursday – AUS – Trade Balance

- Thursday – UK – BoE Interest Rate Decision

- Thursday – US – Initial Jobless Claims

Australian Market

The Australian sharemarket edged ahead 0.4% yesterday, closing above 7,500 points for the first time. The record came on the back of continued positive earnings results and a mixed overseas session.

The Financials sector was mixed as Commonwealth Bank rose 0.8%, while Westpac and ANZ both climbed 0.2%. Meanwhile NAB shed 0.1%. Overall, the sector eased up 0.3%.

Numerous blue-chip stocks dragged market gains, with CSL falling 0.7%, Transurban conceding 0.1% and Macquarie Group losing 0.3%.

The Materials sector led performance, up 1.2%, driven partly by a minor rebound in the price of iron ore. Key advancers included BHP (2.1%), Rio Tinto (1.5%) and Fortescue Metals Group (0.4%). Gas producer Woodside Petroleum advanced 1.0% despite increasing cost forecasts for its Scarborough project in Western Australia.

The Information Technology sector close flat yesterday following large gains made on Tuesday.

The Australian futures point to a 0.18% decline today, following mixed overseas market sessions.

Overseas Markets

European sharemarkets rose to new highs on Wednesday, led by Technology stocks hitting a 20-year high. The pan-European STOXX 600 climbed 0.6%, continuing its advance for a third straight day. Technology stocks surged 1.9% to a level not seen since the dot-come bubble.

The German DAX lifted 0.9% and the UK FTSE 100 edged up 0.3%, indicating improved economic conditions following strong second-quarter earnings results.

US sharemarkets were mixed following economic data indicating a slowdown in jobs growth. Two standouts were retail trading platform Robinhood, which surged 50.4%, and General Motors, down 9.0%. Robinhood’s surge can be attributed to interest expressed from key fund manager Cathie Wood. This led to gains for a fourth consecutive session after an underwhelming entrance into the market last week.

By the close of the session, the S&P 500 and the Dow Jones declined 0.5% and 0.9%, while the NASDAQ eased 0.1%.

CNIS Perspective

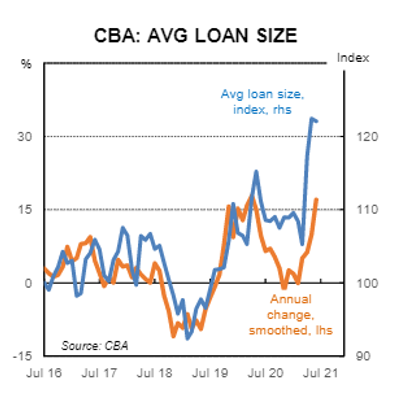

As highlighted yesterday, a significant increase in fixed rate mortgage applications has led to sizable growth in Net Interest Margins (NIM) of Australian banks. Recent data released from Commonwealth Bank supports this notion.

Over the past year or so, capital city house prices have increased dramatically, resulting in an increase in the average size of mortgages. So not only are banks locking in potentially higher NIM for multiple years into the future, they are doing so across larger mortgage balances.

The downside is that loan volumes shrink because of long term COVID-19 infections and ongoing lockdowns, but the more likely outcome is there could be a lot of upside to bank profitability, should the pandemic abate.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.