Morning Market Update - 6 May 2021

Cutcher & Neale

05 May 2021

17 July 2023

minutes

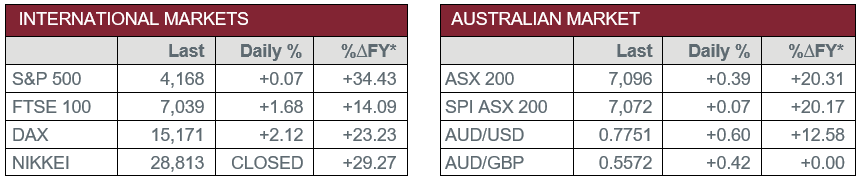

Pre-Open Data

Key Data for the Week

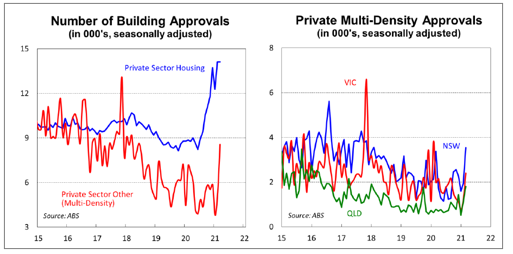

- Wednesday – AUS – Building Approvals rose 17.4% in March, up 47.4% year-on-year.

- Wednesday – EUR – Producer Price Index rose 1.1% in March, up 4.3% over the year.

- Thursday – EUR – Retail Sales

- Thursday – UK – Interest Rate Decision

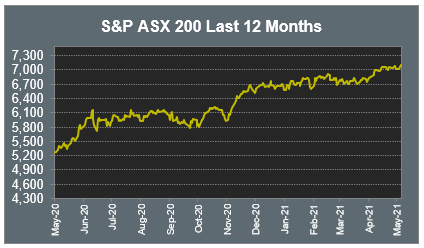

Australian Market

The Australian sharemarket advanced for a third consecutive day on Wednesday to close up 0.4%. Gains were broad based, with the Health Care sector the strongest performer, while Information Technology and Consumer Discretionary were the only sectors to decline.

The Health Care sector lifted 1.0%, boosted by strong gains from CSL. The biotechnology giant added 2.4% following an investor presentation, which stated intentions to grow plasma collection networks, with 25 new centres planned to open in the US in FY21 and a further 40 new centres in FY22. However, Sonic Healthcare slipped 1.0% and Ramsay Health Care gave up 4.4% following the release of the company’s Q3 trading update.

The Financials sector gained 0.6%, with mixed performances among the major banks. Commonwealth Bank and NAB added 2.5% and 0.4% respectively, while Westpac slipped 0.1% and ANZ shed 3.2%, despite the bank’s first half profit release, which stated cash profit was up 112%. Insurers were stronger; Insurance Australia Group rose 2.2%, while QBE Insurance climbed 4.1%, after the company confirmed expectations it will resume dividend payments in 2021 and reported an 8.9% premium rate increase in Q1 2021.

Gains among mining heavyweights lifted the Materials sector. Rio Tinto and BHP both improved 1.1%, while Fortescue Metal added 0.3%.

The Australian futures market points to a 0.07% rise today.

Overseas Markets

European sharemarkets advanced overnight to post their strongest day in nearly two months. The Energy sector rallied 3.2%; BP rose 3.3% and Royal Dutch Shell added 1.8%. Financials also outperformed; Barclays climbed 3.4% and HSBC added 3.0%, while Lloyds Bank gained 2.7% and Deutsche Bank rose 2.5%. By the close of trade, the German DAX rallied 2.1%, while the STOXX Europe 600 and UK FTSE 100 gained 1.8% and 1.7% respectively.

US sharemarkets were mixed on Wednesday. The Energy sector was the top performer; Chevron added 2.7%, while ExxonMobil gained 3.0%. The Information Technology sector was mixed; Facebook fell 1.1% and Microsoft slipped 0.5%, while NVIDIA and Fortinet gained 0.8% and 1.3% respectively.

By the close of trade, the Dow Jones rose 0.3% and the S&P 500 lifted 0.1%, while the NASDAQ fell 0.4%.

CNIS Perspective

Yesterday’s release of building approvals numbers continues to paint a positive recovery picture for the Australian economy.

Building approvals added to recent gains, up 17.4% in March. Total building approvals are now at their second highest level on record.

The pick-up was driven largely by a 63.6% surge in approvals for private multi-density dwellings (apartments and townhouses). The jump was well above the expectations of economists, with the median estimate pointing to a 3.0% rise.

The increase in approvals was generally broad based across the states. Growth was the strongest in NSW (32.3%), followed by Victoria (24.8%) and Queensland (15.7%). However, there were modest declines in WA (-6.4%) and Tasmania (-4.8%). Approvals in WA are coming off a very high level and are still up 129.2% over the year, boosted by a housing stimulus package from the state government.

The ongoing strength in building approvals points to a solid construction pipeline, which is good news as we emerge from the COVID-19 recession as it will bolster jobs growth and government tax revenues.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.