Morning Market Update - 7 October 2021

Cutcher & Neale

06 October 2021

17 July 2023

minutes

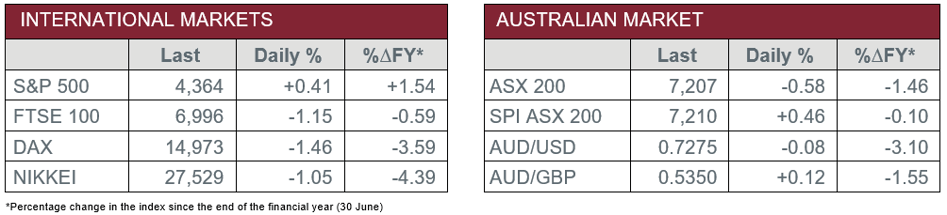

Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Retail Sales rose 0.3% in August, below expectations.

- Thursday – AUS – Weekly Payroll Jobs

- Friday – US – Unemployment Rate

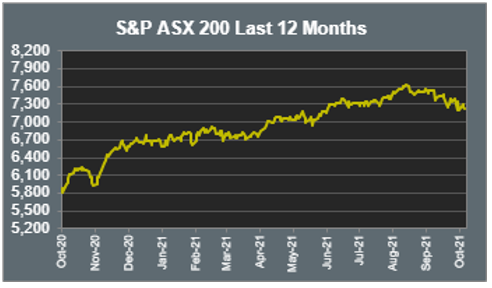

Australian Market

The Australian sharemarket closed down 0.6% yesterday, close to a four-month low, despite its strong start early in the session. Local shares have lacked enthusiasm since the highs reached in August. All sectors finished lower, except Energy (0.6%) and Information Technology (0.5%).

The Energy sector continued to benefit from tighter global supply, with oil prices near seven year highs, which supported key performers for the day, Santos (2.3%) and Oil Search (2.5%). Elevated coal prices also pushed Whitehaven Coal 4.1% higher.

The Financials sector (-0.9%) struggled on Wednesday, after the Australian Prudential Regulation Authority (APRA) increased the minimum interest rate buffer expected when assessing the serviceability of home loan applications. Commonwealth Bank led the tumble, down 2.0%, followed by ANZ (-1.1%), NAB (-0.8%) and Westpac (-0.6%).

Travel related stocks eased their recent share price rally, as market expectations settled. Flight Centre fell 6.6%, still ~70% higher in one and a half months, while Webjet and Qantas conceded 6.2% and 2.1%.

A notable mover included the a2 Milk Company (-7.7%), the session’s weakest performer, after it was served a class action notification by the Supreme Court of Victoria due to an alleged breach of continuous market disclosure rules.

The Australian futures point to a 0.46% increase today.

Overseas Markets

European sharemarkets declined on Wednesday, as all major sectors fell. The German DAX lost 1.5%, after recent data showed factory orders slumped 7.7% in August, while the UK FTSE 100 and STOXX Europe 600 closed down 1.2% and 1.0%. Market performance was driven by higher oil and gas prices, which increased concerns over the eurozone’s inflation and economic growth. Tesco (6.0%) was a key mover, which surged after it raised its full-year outlook and announced a £500 million share buyback.

US sharemarkets rose on Wednesday, as concerns around US debt were alleviated by a potential deal presented by US Senate Minority Leader Mitch McConnell. This was offset by strong September jobs data, which supported bets the US Federal Reserve might soon begin reining in monetary stimulus. The Dow Jones, S&P 500 and NASDAQ all gained between 0.3%-0.5%. The more defensive Utilities (1.5%) and Consumer Staples (1.0%) sectors led performance yesterday, while Energy (-1.1%) and Materials (-0.3%) were the primary laggards. Key movers included Microsoft (1.5%) and Amazon (1.3%).

CNIS Perspective

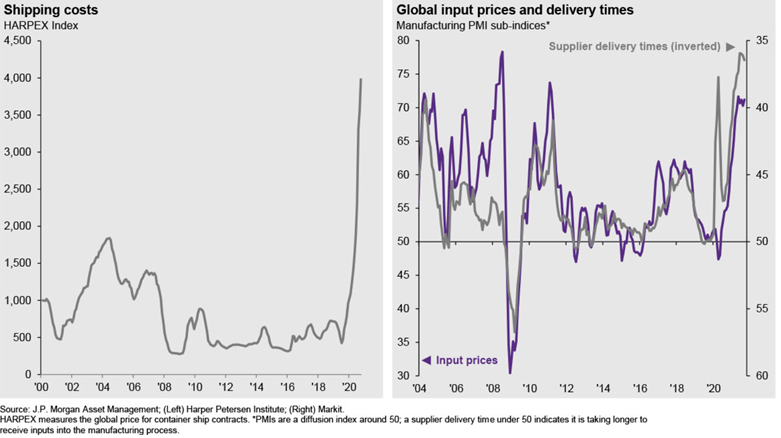

The fear of inflation emerging on the horizon is gaining momentum, but not due to the usual suspect of rising wages growth, however, instead due to rising supply chain costs and delays.

Pandemic related disruptions has seen a dramatic rise in shipping costs, which will probably be passed down the line to the end consumer, making products more expensive.

In addition to higher shipping costs, delivery times have also become longer – time is money. Input prices are also more expensive and both factors are adding to the cost of doing business.

The correlation between stagnant wages growth and inflation has held true for over a decade, but it could be broken should the supply chain add time and costs to the end consumer.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.