Cutcher's Investment Lens | 10 - 14 November 2025

Cutcher & Neale Wealth Management

16 November 2025

17 November 2025

minutes

Weekly recap

What happened in markets

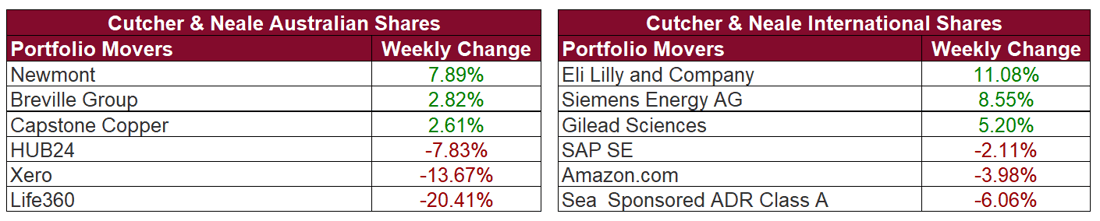

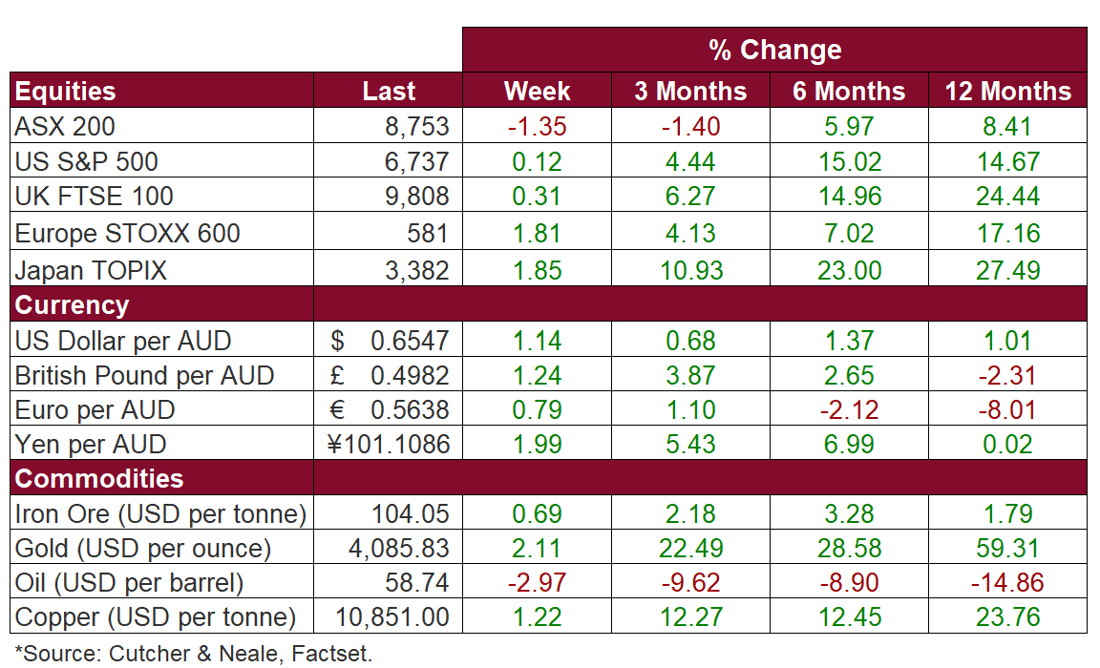

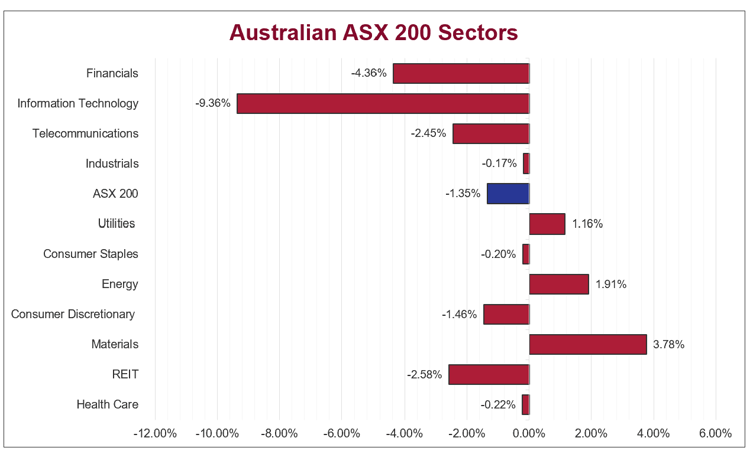

The Australian sharemarket finished lower last week, with the ASX 200 down 1.4% as stronger-than-expected labour market data and hawkish RBA commentary pushed bond yields higher and weighed on rate-sensitive sectors. The Information Technology (-9.4%) sector was the weakest performer, with broad selling in growth and AI-linked names. Xero (-13.7%) and Life360 (-20.4%) declined sharply following updates that raised concerns around cost discipline and user growth. The Financials (-4.4%) sector also dragged on the index, led by a 10.6% fall in Commonwealth Bank of Australia, amid softer margin trends and rising cost pressures. In contrast, the Materials (+3.8%) sector outperformed, supported by strong gains across lithium, copper and gold miners.

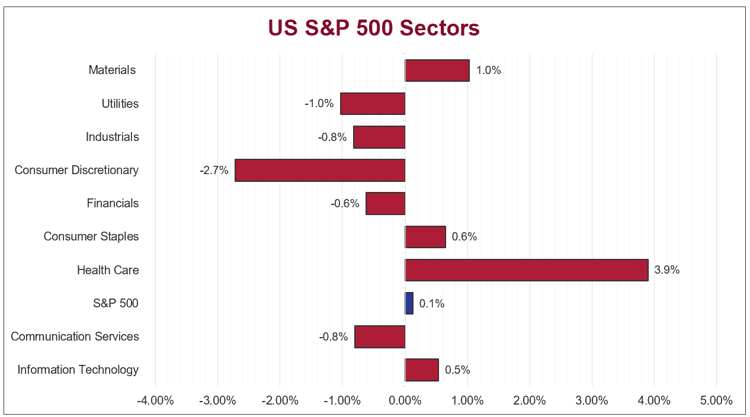

US sharemarkets were mixed last week, with the S&P 500 (+0.1%) posting modest gains, while the NASDAQ (-0.5%) declined. Strength was concentrated in the Healthcare (3.9%), Energy (2.8%), and the Materials (1.0%) sectors, supported by robust pharmaceutical and MedTech performance, higher oil prices benefitting energy producers, and gains across agricultural and commodity-chemical companies. In contrast, the Consumer Discretionary (-2.7%) and Utilities (-1.0%) sectors underperformed, with weakness across homebuilders, housing-related retail, and auto suppliers weighing on discretionary names, while nuclear-related utilities declined within the broader sector. The week also marked the official end of the 43-day government shutdown, with markets now awaiting the return of official economic data releases.

European sharemarkets advanced last week, with the STOXX Europe 600 rising 1.8%, though gains were tempered by escalating fiscal concerns in the UK following the Government’s unexpected reversal on income tax plans. Energy (+5.0%) led performance after Ukrainian strikes on Russian infrastructure supported Brent, while Health Care (+4.0%) benefitted from defensive inflows and stock-specific strength across major EU pharma names. Banks (+3.0%) also gained on improved risk sentiment and M&A activity, though UK lenders underperformed later in the week as falling gilt yields, driven by the fiscal backdrop, intensified pressure on net interest margin expectations. Financial Services (-1.1%) was the only major sector to finish lower, reflecting continued pressure on non-bank financials amid guidance cuts and valuation compression.

Stock & sector movements

What caught our eye

SK Hynix Rides the AI Infrastructure Wave

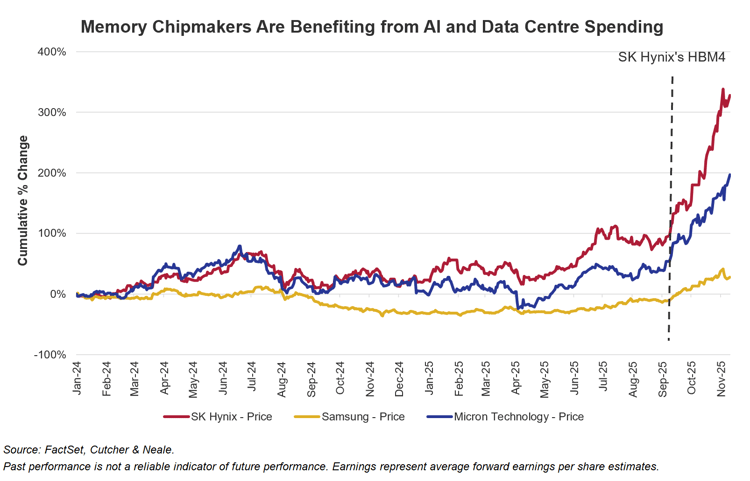

One of the standout performers in global equity markets this year has been SK Hynix, a South Korean memory chipmaker that’s found itself at the centre of the artificial intelligence (AI) infrastructure buildout.

SK Hynix is the world’s leading producer of high-bandwidth memory (HBM), a key technology that powers AI’s large language models and data centres more broadly. The company operates in an effective global oligopoly, with peers Samsung and Micron Technology. Together, it is estimated they hold ~90% market share. Recently, SK Hynix has captured increased market share, given its innovation in the HBM space.

SK Hynix recently announced that it had completed development and commercial viability of its next-generation HBM4 chip. This major milestone chip doubles the bandwidth and improves power efficiency by more than 40% compared to the previous generation! This improvement is critical for its customers, who continue to expand their AI capabilities at scale, compete to have the best technology and face public backlash due to increased energy consumption.

We added SK Hynix to the Cutcher & Neale International Shares Model in September, identifying the HBM4 development as a meaningful advantage at a time when global technology firms, particularly the hyperscalers like Microsoft, Alphabet (Google), Amazon and Meta, are spending aggressively on AI infrastructure and data centres.

Since it was added to clients’ portfolios, the stock has rallied 64%, a reflection of both strong investor sentiment and rising demand for AI memory chips. Major players like Nvidia and OpenAI are increasingly turning to SK Hynix for supply. Notably, the company recently signed a letter of intent to supply semiconductors for OpenAI’s massive Stargate project. The project, endorsed by US President Donald Trump and central to the US’ AI plan, plans to invest US$500 billion over the next four years.

More broadly, AI infrastructure spending has become a significant driver of economic growth. Harvard economist Jason Furman estimated that in 1H 2025, investments in data centres, software, and AI-related equipment accounted for more than 90% of US GDP growth.

For investors, companies like SK Hynix offer a way to gain exposure to the backbone of the AI economy, not through the headline-grabbing applications, but via the essential hardware enabling it all. While the share price has performed exceptionally well, we believe the company remains well-positioned in a market that continues to see structural demand for advanced memory solutions. It should be noted that these solutions do not solely rely on AI, but tap into cloud computing and the digitalisation of the world more broadly.

We acknowledge that the memory chip industry can be cyclical and new innovations will inevitably be adopted by peers in time. As such, we continue to monitor the situation closely. For now, SK Hynix has a clear advantage and has been a recent winner for our clients.

The week ahead

In Australia this week, focus turns to the release of the RBA Board meeting minutes on Tuesday, which will provide further insight into the Bank’s assessment of inflation pressures and the policy outlook following last week’s strong labour market data.

Overseas, markets will focus on the return of key US data releases following the government shutdown, providing long-awaited clarity on inflation and economic momentum ahead of upcoming Federal Reserve decisions. Nvidia’s earnings on Wednesday will be closely watched, given its significant influence on broader tech sentiment and the global outlook for AI-related investments.

A comprehensive investment strategy and strong asset allocation can assist with maximising the benefits and minimising the risk across your portfolio as part of achieving your individual goals and objectives. Supported by our dedicated investment team, we focus on communicating market developments and investment opportunities to our clients in a timely manner. We take the time to fully understand both your current financial position and goals. Then we tailor a comprehensive investment strategy to match and implement it on your behalf.