Cutcher's Investment Lens | 29 September - 3 October 2025

Cutcher & Neale Wealth Management

06 October 2025

06 October 2025

minutes

Weekly recap

What happened in markets

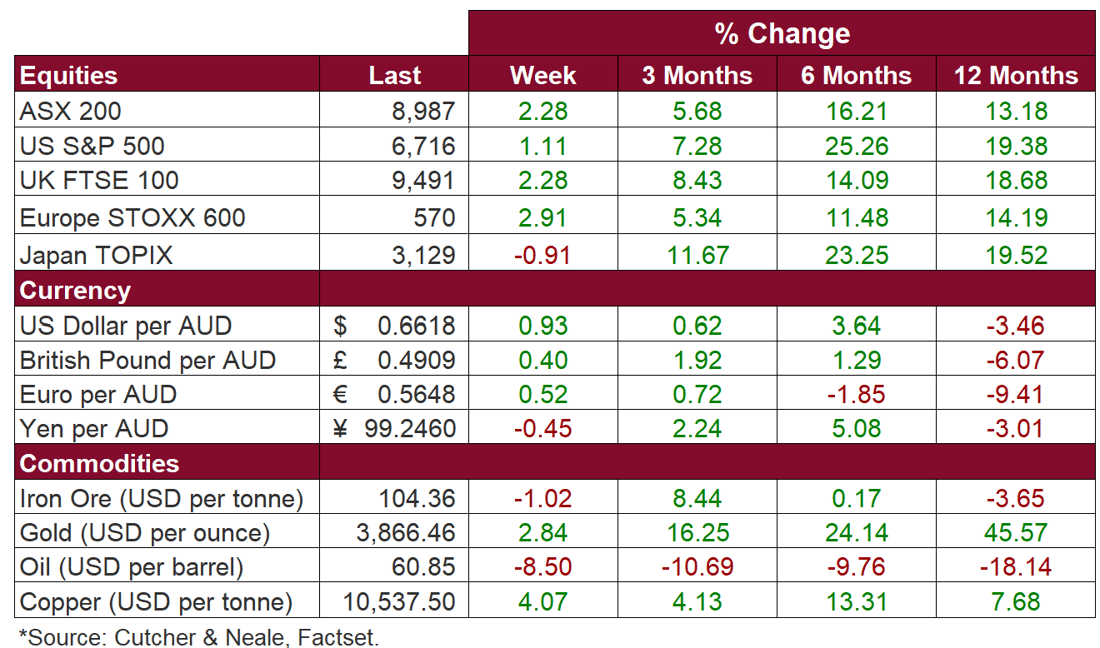

The Australian sharemarket edged higher last week, with the ASX 200 gaining 2.3% to finish near record highs. Gains were broad-based, led by the Health Care (+4.6%), Financials (+3.0%), Industrials (+2.8%) and Materials (+2.6%) sectors, as sentiment improved following the RBA’s decision to hold rates steady while acknowledging persistent inflation risks. The Consumer Discretionary (+1.1%) and Information Technology (+0.6%) sectors also strengthened on positive company updates and global risk appetite. The Energy sector (–2.0%) lagged as oil prices softened amid expectations of higher OPEC+ output, while the Utilities (–0.5%) and Consumer Staples (–0.3%) sectors eased as investors rotated toward cyclical and growth exposures.

US sharemarkets rose last week, more than recovering the prior week’s losses, with the S&P 500 and NASDAQ reaching record highs. Gains were broad-based, led by the Health Care (+6.8%), Utilities (+2.4%) and Information Technology (+2.3%) sectors, while the Energy (-3.3%) and Communication Services (-2.1%) sectors lagged. The US Dollar softened, while gold surged to new record highs and oil slumped -8.5% amid expectations of increased OPEC+ production. Despite the government shutdown, investor optimism held on prospects of further Fed rate cuts and solid corporate earnings, supported by strength in AI-driven technology stocks and softer labour data, offsetting cautious Federal Reserve commentary.

European sharemarkets rallied last week, with the STOXX Europe 600 gaining 2.9% and both the STOXX and FTSE 100 reaching record highs. Gains were broad-based, led by the Health Care (+8.7%), Technology (+4.9%), and Automakers (+4.0%) sectors, while the Travel & Leisure (-0.2%) sector lagged. Sentiment improved as Europe benefitted from stronger global markets, easing Fed expectations, and stabilising earnings revisions. The Health Care sector outperformed based on robust pharmaceutical results and easing regulatory risks, while the Technology sector gained based on the global semiconductor rally. Despite lingering political and fiscal uncertainty in the UK and France, improving macro conditions and solid inflows supported the regional rebound.

Stock & sector movements

What caught our eye

Gold’s Glitter, Copper’s Comeback, and Iron’s Insecurity: What’s Driving Commodity Prices?

It’s not every day you see gold soaring to record highs while equity markets are rallying. What caught our eye last week was the gold price reaching an all-time high of US$3,886, just as the US S&P 500 Index hit its all-time high of 6,716 points. Looking closer, that’s just the tip of the commodities iceberg for 2025.

Gold is Shining Again – Why now?

Gold has rocketed more than 47% so far in 2025, hitting all-time highs above US$3,850 per ounce. That’s not entirely surprising given the cocktail of falling US interest rates, a structurally weaker US Dollar and heightened geopolitical tension.

That said, normally strong equity sentiment saps gold demand, as investors rotate into riskier growth assets. This time, however, gold is acting more like a portfolio hedge than a fear gauge. Market participants are worried about the US Dollar’s value, driven by concerns about the US Federal Reserve’s independence and US President Donald Trump’s inflationary tariff policies.

With the Fed cutting rates and more easing expected, near-term interest rate expectations have fallen sharply, a classic tailwind for gold as the opportunity cost of holding it declines. Inflation adjusted interest rates and gold prices tend to move in opposite directions.

Copper’s Comeback

Meanwhile, copper prices have rebounded strongly from lows seen earlier in the year and have markedly stepped up over the last few years. Unlike gold, the near-term copper price driver has been more of supply than demand.

Global supply of copper has been sluggish and recent events like a deadly mudslide at Freeport-McMoRan’s Grasberg mine, the world’s second-largest copper source, has disrupted things and pushed prices above US$10,500 per tonne.

Longer-term, the structural demand for copper is compelling. The clean energy transition, electric vehicles and artificial intelligence all point to rising structural demand. Add in expectations for US interest rate cuts and copper is well positioned to join gold in a broader commodity rally.

Iron’s Insecurity

Iron ore is telling a more complicated story. Prices have been range bound, trading around US$90-US$110 per tonne, and are noticeably lower than the 5-year average of US$124 per tonne.

The world’s largest buyer of iron ore, China, has been slowing down in recent years. It’s booming property sector has lost steam and the outlook for iron ore is far less clear.

Last week China reportedly instructed buyers to halt new shipments from BHP in a standoff over pricing terms. Meanwhile, iron ore supply in the next few years is expected to be boosted by the West African Simandou project. Once operational, Simandou could add 90-120 million tonnes per year to global supply, enough to rival some of the largest existing exporters and put downward pressure on prices. Hence, from an investment perspective we see the iron ore landscape as notably more precarious.

What it Means for Investors

For Cutcher & Neale clients, exposure to rising commodity prices has been a tailwind in 2025. Our model portfolios include names like Capstone Copper, Agnico Eagle Mines and Newmont, all of which have benefitted from this year’s commodity movements.

Looking ahead, we remain constructive on select commodities, particularly where supply is constrained and demand is structurally underpinned. But we’re also mindful of price froth, especially in gold. As always, timing and diversification matter and so does understanding the macro narrative behind the headlines.

The week ahead

Locally, attention turns to fresh data on inflation, consumer confidence, and job advertisements, which will provide insight into household sentiment and labour market conditions following the RBA’s steady policy stance.

Globally, focus will centre on the release of the US Federal Reserve’s September meeting minutes and a series of key inflation and employment indicators that could shape expectations for future rate cuts. Markets will also monitor commentary from central bank officials in the US, Europe, and the UK for further guidance on policy direction amid signs of moderating global growth.

A comprehensive investment strategy and strong asset allocation can assist with maximising the benefits and minimising the risk across your portfolio as part of achieving your individual goals and objectives. Supported by our dedicated investment team, we focus on communicating market developments and investment opportunities to our clients in a timely manner. We take the time to fully understand both your current financial position and goals. Then we tailor a comprehensive investment strategy to match and implement it on your behalf.