Cutcher's Investment Lens | 9-13 June 2025

Wade Johnson & Ryan Thompson

15 June 2025

15 June 2025

minutes

Weekly recap

What happened in markets

The Australian sharemarket lifted 0.4% last week. The market started the week off positive, hitting a new high on Tuesday, thanks to continued trade talks between China and the US. However, later in the week the market paired back some of these gains, driven by geopolitical concerns. A key detractor on Thursday were Mining stocks, following a 0.8% fall in the price of iron ore. As a result, benchmark heavyweight BHP lost 2.3% for the week. On the other hand, the price of Oil rose 4.2% helping the Energy sector to advance 6.5%. NextDC was the standout, after the technology company announced it will be building a $2 billion AI factory and technology campus in Melbourne.

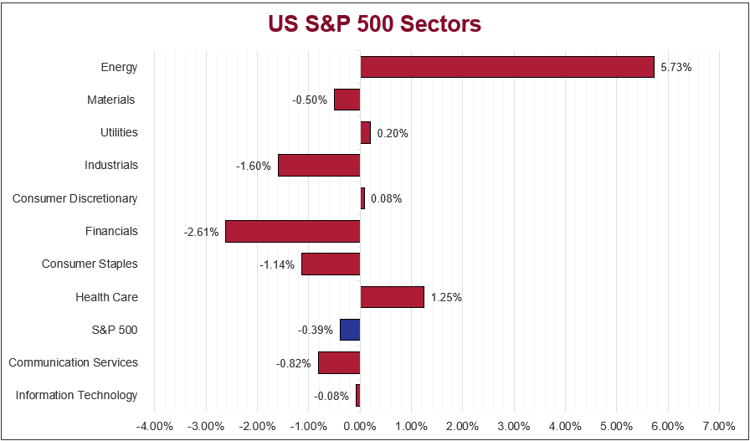

US sharemarkets ended lower last week, after Friday wiped out gains made earlier in the week. Tensions in the Middle East resulted in a risk-off sentiment among markets, causing investors to move away from growth stocks and into defensives. While the US and China were able to come to a trade agreement, minimal beneficial progress was made. From a sector point of view Energy outperformed, adding 5.7%, while Financials and Consumer Staples lagged conceding 2.6% and 1.1% respectively.

European sharemarkets also posted negative performance last week following trade on Friday, driven by the escalation in the Middle East. Additionally, in economic news, GDP disappointed contracting 3.0%, which was worse than expected. The Energy sector was the standout, thanks to rising oil prices, lifting Shell 5.3% and BP 7.2%. Conversely, Retail (-4.9%) and Financials (-4.3%) underperformed, as investors moved out of these cyclical sectors.

Stock & sector movements

What caught our eye

Recent market movements have reminded us just how easy it is to feel unsettled. Talk of economic slowdown, bouts of volatility and general uncertainty can make even the most seasoned investors question their plans.

It brings to mind early 2020, a tough time for markets and for confidence more broadly. The S&P 500 and ASX 200 market indexes fell sharply and sentiment was understandably shaken. Yet, by the end of that same year, those markets had largely recovered and were on a new upward path.

Fast forward to now and, while the situation is clearly different with the pandemic in the rear mirror, some of the same nerves feel familiar. There’s been some volatility, and economic headlines are mixed. It’s only natural to wonder whether changes to your investment approach are needed. However, it’s worth remembering that fluctuations are a regular part of investing and not a signal that something’s broken.

In fact, market pullbacks, while never pleasant, are not unusual. They’re often referred to the price we pay for the long-term growth that equity investing can offer. Over the last 10 years, that offer has been about +13.1% per annum from the S&P 500 and +8.9% per annum from the ASX 200.

As legendary investor John Templeton once put it, “the market climbs a wall of worry”. Meaning, there’s always something to be concerned about, that often 'this time is different' proves only partly true and markets have shown their ability to recover and progress.

Today, the ‘wall of worry’ is perhaps more pronounced than usual. The divisive nature of Trump has its part to play in that. Trump’s tariff policy regime will likely overhang markets throughout his term as President. Their impact on inflation, whether transitory or persistent, will be worth watching. When, and by how much more, will the US Federal Reserve cut interest rates? Will the US be able to wrangle its debt to a more manageable level and how will the US Dollar be affected? Lastly, and perhaps the most nuanced and uncertain, is whether the promise of Artificial Intelligence will be fulfilled in terms of boosting productive growth and improving our modern way of life. This all seems overwhelming and in the present it always does. Recall the early days of COVID-19, which looking back was an exogenous health-related event much more out of anyone’s control.

It’s during these more uncertain periods that having trust in your longer term plan and asset allocation can make all the difference. History suggests that staying invested, with a diversified approach tailored to your goals, is often the most reliable path forward. This is where your trusted advisor comes in to help. Stay focused on the longer term picture, because that’s where your financial goals live.

The week ahead

Locally it is a quiet week for economic data with only labour force data and population growth on Thursday. Expectations point to 20,000 jobs being added and population growth of 1.7%.

Overseas, central bank policy decisions will dominate, with Bank of Japan, US Federal Reserve and Bank of England all set to meet, with expectations for a hold all around.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 10 years of industry experience in accounting and investment advisory roles.

Ryan is our Portfolio Manager, bringing over 15 years of experience in managing multi-asset investment portfolios with a specialisation in fundamental equity analysis.