Morning Market Update - 26 October 2021

Cutcher & Neale

25 October 2021

17 July 2023

minutes

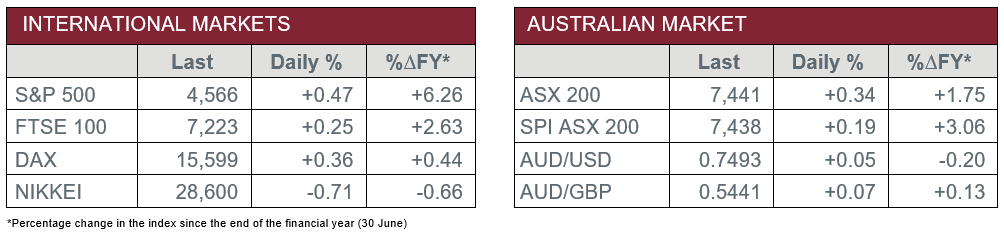

Pre-Open Data

Key Data for the Week

- Tuesday – US – New Home Sales

- Tuesday – US – Consumer Confidence Index

- Wednesday – AUS – Consumer Price Index

- Thursday – AUS – Trade Price Indices

- Thursday – EUR – Consumer Confidence

- Thursday – UK – Nationwide House Prices

- Thursday – US – Gross Domestic Product

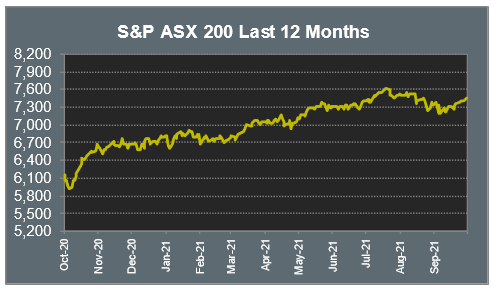

Australian Market

The Australian sharemarket added 0.3% yesterday, as investors showed no signs of worry regarding Wednesday’s inflation data. The main gains were provided by the Energy and Materials sectors, as they added 2.6% and 1.1% respectively.

The Energy sector gained due to a limited supply of oil. Beach Energy enjoyed a 5.1% gain, while Woodside Petroleum and Santos lifted 3.7% and 3.6% respectively. Origin Energy closed the session 3.9% higher after the company announced they are selling a 10% stake in Australia Pacific LNG for $2.12 billion.

Gains by the major miners helped the Materials sector higher. Rio Tinto added 1.5% and Fortescue Metals rose 1.4%, while BHP closed the session 0.7% higher. Goldminers also made gains; Northern Star Resources added 1.9% and Evolution Mining was up 1.3%.

The Information Technology sector was the main laggard yesterday, weakened by a 2.7% drop in Afterpay. Buy-now-pay-later rival, Zip, lost 2.4%, while Sezzle shed 1.4%. Artificial intelligence provider, Appen, lost 0.1%, while accounting software provider, Xero, bucked the downward trend to close 1.4% higher.

The Australian futures market points to a 0.19% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets closed relatively flat overnight as a weaker Industrials sector overshadowed the gains made in the Materials and Energy sectors. Oil prices continued to rise; BP lifted 1.7% and Royal Dutch Shell added 1.6%. By the close of trade, the UK’s FTSE 100 gained 0.3%, and the German DAX lifted 0.4%, while the STOXX Europe 600 closed the session flat.

US sharemarkets lifted overnight, as earnings season leads into one of the busiest weeks of the quarter. Tesla outperformed, as it gained 12.7% following news Hertz had placed an order for 100,000 Tesla vehicles. PayPal rebounded after the company announced they are no longer looking to acquire Pinterest. Pinterest shares were down 12.7% following the announcement.

By the close of trade, the Dow Jones closed up 0.2%, while the S&P 500 and NASDAQ added 0.5% and 0.9% respectively.

CNIS Perspective

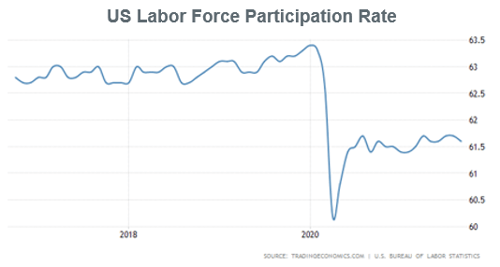

Shortages of all kinds have dominated economic headlines this year, and will likely continue for some time, with supply chains being the major talking point.

However, what is becoming more evident is the part being played in disruptions from a lack of labour supply in major developed countries including the US, the UK and the Eurozone.

Businesses are seeing a significant shortage of workers willing to take jobs at the wages being offered, becoming a corporate headache, with a permanent shrinkage in labour supply (or participation rate) a less than ideal outcome.

These economies with ageing populations are becoming desperate for participation rates among their ‘prime’ age workers (25-54) to return to at least their pre-pandemic highs, a long shot from where they currently sit, despite government support for the unemployed ceasing in recent months.

If the fall in participation rate is structural, and doesn’t reach pre-pandemic levels, expect to see a combination of higher inflation and lower profit margins for companies big and small.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.