Morning Market Update - 29 October 2021

Cutcher & Neale

28 October 2021

17 July 2023

minutes

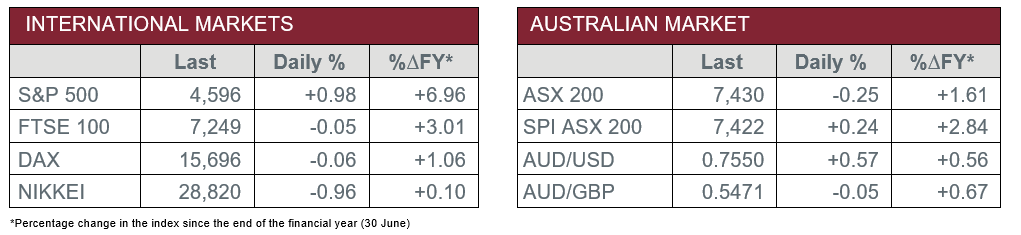

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Trade Price Indices – Export prices rose 6.2%, while import prices climbed 5.4%, in the September quarter.

- Thursday – EUR – Consumer Confidence weakened in October, despite overall business and economic confidence edging higher.

- Thursday – US – Gross Domestic Product expanded by an annualised 2.0%, less than expected.

- Friday – AUS – Retail Sales

- Friday – EUR – Gross Domestic Product

Australian Market

The Australian sharemarket closed down for the first time since last Tuesday, as investors reacted to the prospect of higher interest rates yesterday. Although, analysts note the local market’s resilience despite headwinds generated by tighter monetary policy expectations and elevated energy prices, especially since these two key factors broadly impact business profitability. However, some reprieve was seen yesterday, as commodity prices weakened, particularly global oil prices.

The decline in global oil prices fed through to the Energy sector, which was the session’s weakest performer, down 1.9%. Key movers included Woodside Petroleum (-2.5%) and Santos (-1.9%). Similarly, the Materials sector (-1.2%) suffered from weakened commodity prices, as BHP, Rio Tinto and South32 all lost ground, down 1.7%, 1.5% and 4.0% respectively.

The Financials sector performed well amid general market weakness, up 0.2%, led by Westpac, which advanced 1.1%. ANZ (0.7%) handed down its full year results, which indicated cash profit rose 65%, and announced a $0.72 per share dividend, double that of last year. Commonwealth Bank and NAB also advanced, up 0.7% and 0.5% respectively.

The Australian futures point to a 0.24% rise today.

Overseas Markets

European sharemarkets were mixed on Thursday, after the European Central Bank kept interest rates and its monetary policy unchanged, which reinforced its view that inflationary pressure will be transitory. The European STOXX 600 closed 0.2% higher, driven by Technology and Food and Beverage stocks, which broadly gained 1.3% and 1.6% respectively. Meanwhile, the German DAX and UK FTSE 100 both lost 0.1%, as gains were limited by weak earnings reports from the Energy and Automobile sectors. Oil major, Royal Dutch Shell, conceded 3.0% after it reported third-quarter profit below expectations. Additionally, Volkswagen fell 4.5%, due to lower than expected profit and a weakened delivery outlook. Other notable movers overnight included Veolia Environnement (2.0%) and United Utilities Group (1.2%).

US sharemarkets advanced on Thursday, as the Dow Jones, S&P 500 and NASDAQ gained 0.7%, 1.0% and 1.4% respectively. All eleven of the S&P 500’s industry groups rose, reaching a record high, led by the Real Estate (1.5%) and Consumer Discretionary (1.4%) sectors. Meanwhile, the NASDAQ also climbed to new heights, driven by Apple (2.5%) and Amazon (1.6%), ahead of their earnings reports. Computer chip related stocks performed well, after NVIDIA (2.0%), Teradyne (11.3%) and Taiwan Semiconductor Manufacturing Company (2.0%), all pushed higher. Other key movers included music streamer, Spotify (5.9%), alongside cloud-based commerce platformer Shopify (7.0%).

CNIS Perspective

GDP figures released overnight reveal US economic growth slowed considerably in the third quarter. Economists were forecasting annualised growth of 2.7% to 30 September, however, this figure came in at just 2.0%.

Despite the weaker than expected result, the economy is still in a much better shape than most have expected, with GDP returning to its pre-pandemic levels and most economists still expecting growth to pick up in the final three months of the year.

Furthermore, supply chain disruptions and shortages in goods continue to have a significant impact on consumer spending, which is feeding into rising inflation.

The combination of strong demand and limited supply is pushing up prices. Consumer prices rose 1.3% in the third quarter, slightly slower than in the previous quarter, but still well above the pre-pandemic rate. Prices are up 4.3% from a year earlier.

The combination of slower growth and higher inflation is causing headaches for policymakers. Normally, when an economy slows, central banks can stimulate activity by cutting interest rates or giving cash to households. However, those tools don’t help when the problem is with supply, not demand.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.