Morning Market Update - 8 October 2021

Cutcher & Neale

07 October 2021

17 July 2023

minutes

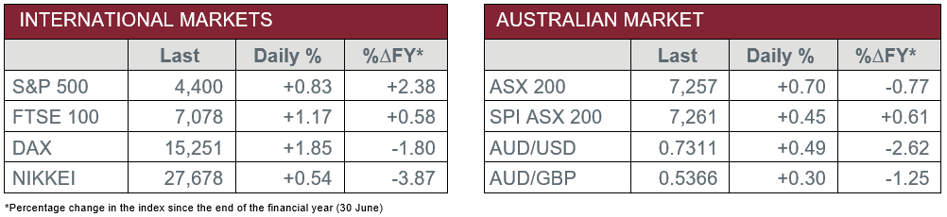

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Weekly Payroll Jobs fell by 0.7% in the fortnight to 11 September, following a revised fall of 1.5% in the previous fortnight.

- Friday – US – Unemployment Rate

Australian Market

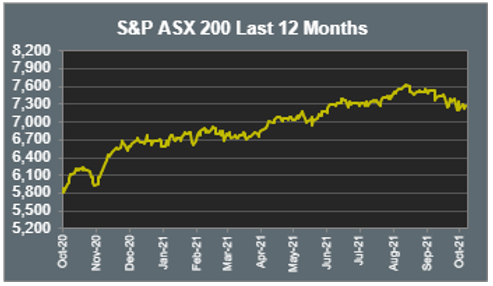

The Australian sharemarket rallied on Thursday, up 0.7%, as 10 out of 11 sectors advanced. The local market followed a solid lead from the US on Wednesday, where concerns over US debt were alleviated.

The Energy sector (-0.8%) was the weakest performer, surprisingly, as the recent surge in global oil and gas prices slowed. This was attributed to Russian President Vladimir Putin’s announcement to increase the country’s supply of gas to global markets. Whitehaven Coal lost ground, down 7.0%, alongside Santos (-2.2%) and Oil Search (-1.8%).

The strongest performer was the Information Technology sector, ahead 2.3%, as most major constituents rose. Afterpay advanced 3.1%, while Xero and WiseTech Global closed between 2.8%-2.9% higher. Another key mover included US-based financial technology company Sezzle, which climbed 14.6%, after its partnership with Target launched ahead of the holiday shopping season.

The Consumer Discretionary sector (0.6%) performed modestly, pushed ahead by one of the session’s top performers, Super Retail Group (7.8%). This came after UBS upgraded it to a ‘buy’ rating, likely based on expected COVID-19 lockdown recovery and the upcoming holiday shopping season.

The Financials sector (1.0%) partly recovered from Wednesday’s dip, as most banks closed ahead. NAB, Westpac and ANZ gained 1.6%, 1.4% and 1.0% respectively, while Commonwealth Bank closed flat.

The Australian futures point to a 0.45% rise today.

Overseas Markets

European sharemarkets recovered strongly overnight, as the German DAX had its best day since May, up 1.9%, while the STOXX Europe 600 and UK FTSE 100 rose 1.6% and 1.2% respectively. All sectors did well, with Energy (0.2%) being the weakest performer. German automaker stocks broadly rose 3.4%, despite data which showed industrial output in August fell 4.0%. London-listed shares in Rio Tinto and BHP grew between 3.5%-3.6%.

US sharemarkets advanced further on Thursday, reinforced by progress on the US debt situation. A deal has been made to increase the ceiling in the short-term, through to early December, to avoid a government default. The Dow Jones, S&P 500 and NASDAQ rose 1.0%, 0.8% and 1.1% respectively. Most sectors closed ahead, led by Consumer Discretionary (1.5%) and Materials (1.3%), while the Utilities sector lagged behind (-0.5%). Key movers included Technology stocks like NVIDIA (1.8%), Fortinet (2.6%) and Amazon (1.2%).

CNIS Perspective

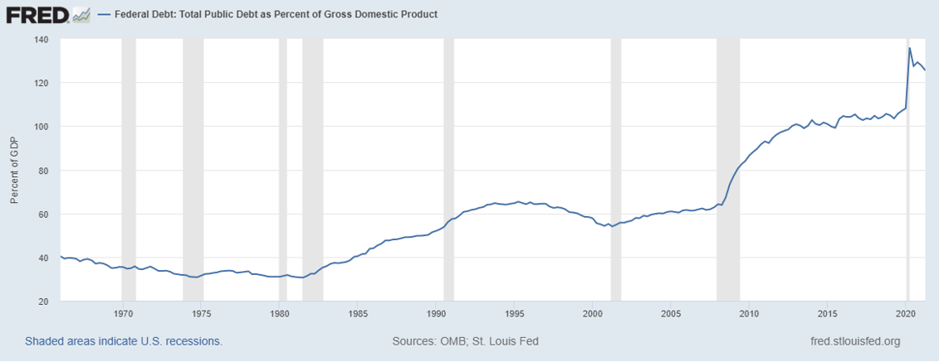

US policy makers have agreed to kick the can down the road, striking a short-term deal between Republicans and Democrats to raise the debt ceiling that has kept financial markets on edge the past week. This will prevent a US government sovereign default that was potentially only weeks away. An extra US$480 billion in borrowing is expected to carry government until the 3rd of December, when the issue will again have to be dealt with.

The catastrophic consequences of the world’s largest economy defaulting on its debt is hard to consider as the Republicans, it would appear, are using this issue as leverage to water down Joe Biden’s infrastructure and welfare spending packages. The US, with debt that currently stands at US$28 trillion, has never before defaulted on its debt obligations. The ceiling was introduced in 1939 to limit how much debt the government can accumulate and has been lifted on more than 100 occasions.

In financial markets you can never say never and with the division in US politics being so extreme, the next debt ceiling showdown in the run up to Christmas will likely see more 11th hour brinkmanship.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.