Purchasing a dental practice? Get it right!

Shane Morgan Cutcher & Neale Dental Accounting Specialist

09 November 2020

09 November 2020

minutes

November 2020

Purchasing a dental practice is a big investment into your financial future.

Getting it right from the beginning can be crucial in not only limiting your risk but also reducing your future tax implications.

Which entity you purchase your dental practice in is pivotal and can sometimes be overlooked by dental professionals when considering how to purchase.

Understanding how you will be receiving income, and what potential liabilities you may be exposing yourself to needs to be understood when balancing the trade off between asset protection and tax minimisation.

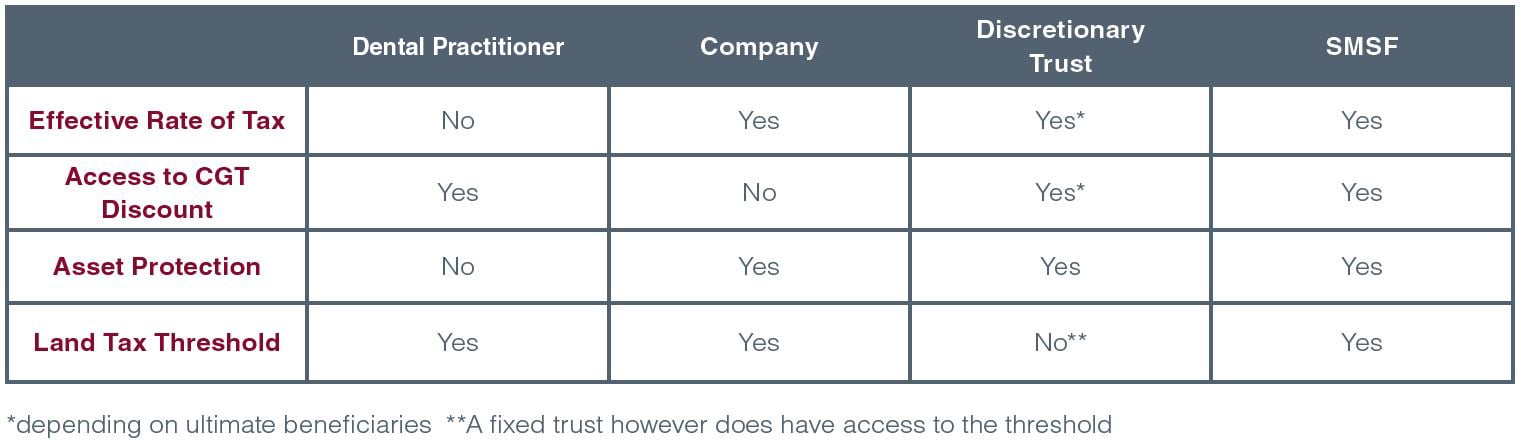

While there is no one-size-fits-all solution when it comes to purchasing your practice premises, there are many factors to consider. So, let’s look at the tax implications of some of the more common structures often considered.

Individual (Dental Practitioner)

Buying in an individual name can sound the most appealing; least expensive and complex to set up, ability to access the 50% Capital Gains Tax Discount (50% reduction on all capital gains held for longer than 12 months) and access to the land tax threshold. However, this may not necessarily be the case.

Buying in the dental practitioners name offers no asset protection, meaning you are not protecting your assets from potential litigation. Despite holding insurances which may mitigate some of these risks to a certain degree, dental practitioners should err on the side of caution when looking at holding assets personally.

If an asset is held by the dental practitioner and there is a significant capital gain on the property it will be taxed in their name at generally a higher rate of tax.

However, if the small business CGT tax concessions apply, the practitioner may be eligible for tax concessions on the capital gain.

Company

A company is a good vehicle for protection as the dental practitioner is protected from liability up to a point. Personal assets are safe from creditors, provided directors duties are adhered to, which provides a layer of asset protection not afforded if holding the premises in their personal name.

A company is assessed for land tax purposes in the same way as an individual.

Companies do provide a capped rate of tax however do not have access to the 50% Capital Gains Tax Discount which could prove to be costly if on the sale of the premises the company realises a significant capital gain.

A company may be eligible for tax concessions on the capital gain if the small business CGT tax concessions apply. However, additional basic conditions need to be satisfied first to access.

Discretionary Trust

Another option is a Discretionary Trust structure. Trusts generally offer an effective form of asset protection as beneficiaries do not own the assets, the trustee does.

Trusts provide flexibility in the way profits can be distributed. It allows consideration of beneficiaries’ specific threshold to achieve a better tax result. Nevertheless, Trusts can’t distribute losses, therefore they are trapped until there is income in the Trust to be offset.

Most discretionary trusts are considered ‘Special Trusts’ for land tax purposes in NSW.

These types of trusts do not receive the land tax threshold which means additional land tax will most likely be due if your dental practice is held in this type of structure.

An alternate option to a discretionary trust may be the utilisation of a Fixed or Unit Trust. Unlike discretionary trusts, Fixed trusts are typically eligible for the land tax threshold.

A fixed trust primarily differs to a discretionary trust as the beneficiaries and their interests are identified in the trust deed according to the proportion of ‘units’ they hold, rather than the distribution at the trustee’s discretion.

A trusts capital gain can be distributed to its beneficiaries in order to access the 50% Capital Gains Tax Discount.

Again, like companies, if a trust can further satisfy the additional basic conditions, they may be eligible for tax concessions on the capital gain if the small business CGT tax concessions apply.

SMSF

A Self-Managed Super Fund (SMSF) can be a tax-effective vehicle for acquiring your dental practice premises. Under the right circumstances and executed correctly, this can be an efficient investment vehicle.

With a low tax rate of 15% (when in accumulation phase), or tax free (when in pension phase) a SMSF certainly provides a concessional tax environment.

A SMSF can also access a one third discount on any capital gain made on the sale of the dental practice if held for more than 12 months.

However, as the rules for purchasing property under the superannuation legislation are quite onerous, advice must be obtained before buying your premises in an SMSF.

In conclusion, strong considerations should be made before purchasing a dental practice.

It is critical to select the appropriate structure for your specific circumstances as well as understanding the income tax consequences and ability to provide asset protection prior to making any significant investment decisions.

For such an important life decision it pays to consult with an expert before you do make your decision.

If you are thinking about buying a dental practice, contact our office for a no-obligation discussion.