What doctors in their 30s, 40s & 50s should do with their investments

Wade Johnson, Partner, Investment Services

21 August 2025

10 November 2025

minutes

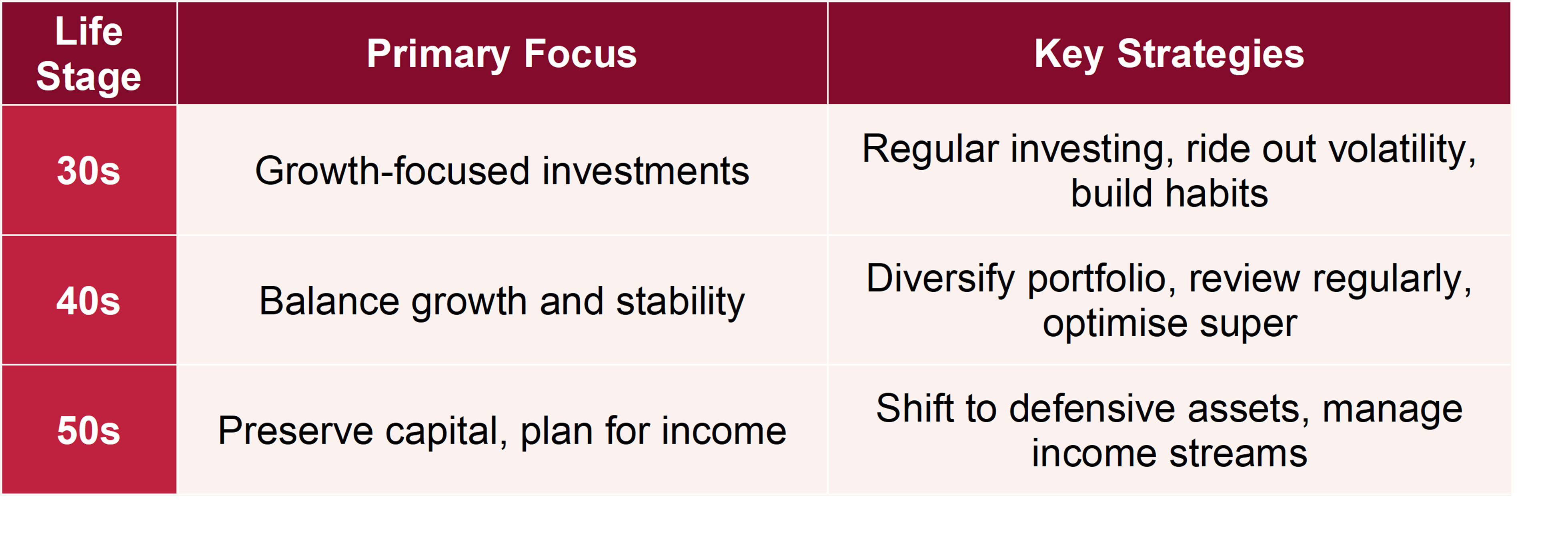

You spend your early years building skills and reputation, but it’s equally important to build wealth along the way. Whether you’re just finding your feet or thinking about winding down, your investment approach should evolve with your life stage, so you can make the most of every opportunity your career creates.

In your 30s: Build momentum and take calculated risks

You’re likely still paying down HELP debt or saving for your first home or practice but don’t let that stop you from investing. With time on your side, this is the best stage to take on growth-focused investments. In your 30s, you can afford to ride out market volatility.

If you’re unsure where to start, a chat with a trusted advisor can help match your risk tolerance to a professionally managed portfolio.

In your 40s: Balance growth with stability

Your 40s are a time of competing priorities. You might be juggling mortgage repayments, kids’ school fees, or saving for a practice acquisition. Investment strategies in this stage should blend growth with some downside protection. Regular reviews, portfolio rebalancing, and tax-effective structures like superannuation and family trusts become increasingly important.

For example, a client, 45-year-old GP, had been heavily weighted towards local shares. After reviewing her goals, we helped her diversify into international equities, bonds and infrastructure assets. She also began making additional super contributions to take advantage of concessional tax rates which is a powerful way to build long-term wealth.

In your 50s: Prioritise preservation and transition planning

As retirement starts to come into view, your focus should shift from wealth accumulation to preservation and income planning. This doesn’t mean pulling out of growth assets altogether, rather it’s about ensuring your portfolio can withstand short-term market swings without jeopardising your retirement timeline.

Let’s say you’re 55 and planning to retire at 65. You might move a portion of your portfolio into defensive assets like fixed interest and cash to cover the first few years of retirement expenses. The rest remains invested in growth assets to support a long retirement (which could last 30+ years).

Stage-Based Advice

At any stage of your medical career, the most powerful investment decision is to start. Whether you’re just beginning or reassessing your strategy, our team at Cutcher & Neale can help you invest with purpose and confidence. Start your journey today by contacting our experts on 1800 988 522 or go to cutcher.com.au.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.