Pre-Open Data

Key Data for the Week

- Monday – EUR – Retail Sales in February were stronger than expected, up 3.0%, after a 5.9% decline in January.

- Tuesday – US – Consumer Price Index

Australian Market

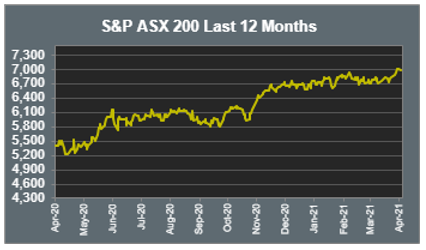

The Australian sharemarket fell 0.3% on Monday with most sectors closing lower. The Materials and REITs sectors led the losses, both down 1.2%, while Health Care and Telecommunications were the only sectors to advance.

The Financials sector closed flat, despite improvements from all major banks, except Commonwealth Bank, which slipped 0.5%. ANZ lifted 0.5%, while NAB and Westpac both gained 0.4%. Asset managers also posted gains; Australian Ethical Investment added 1.5% and Magellan Financial Group rose 0.9%, while Challenger closed up 0.8%.

Losses among mining heavyweights weighed on the Materials sector. Fortescue Metals gave up 1.6%, while BHP and Rio Tinto lost 1.0% and 0.5% respectively. Gold miners also closed weaker; Northern Star shed 2.8% and Newcrest mining lost 2.5%, while Evolution Mining fell 2.4%.

The Health Care sector gained 0.7% yesterday. Cochlear rose 2.4% and biotechnology giant CSL added 0.8%, while Ramsay Health Care lifted 0.4%.

The Information Technology sector slipped 0.1%, dragged lower by weakness among buy-now-pay-later providers. Sezzle fell 1.9% and Afterpay gave up 0.2%, however Zip Co bucked the trend to gain 0.4%. Accounting software provider Xero lifted 1.7%, while Appen rose 0.4%.

The Australian futures market points to a 0.22% rise today.

Overseas Markets

European sharemarkets eased on Monday, as technology, commodity and travel and leisure stocks led the declines. International Airlines Group lost 1.4% and Lufthansa slipped 1.7%, while easyJet gave up 3.9%. Water and waste management companies Veolia and Suez rallied 9.7% and 7.7% respectively, after the companies agreed on a merger deal worth approximately €13 billion.

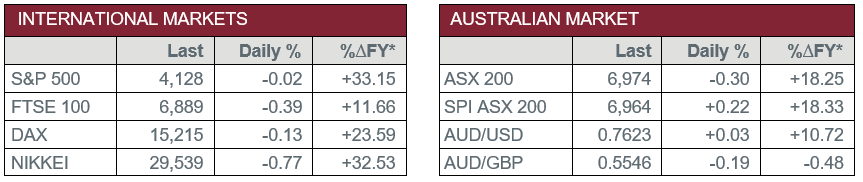

By the close of trade, the STOXX Europe 600 shed 0.5% and the UK FTSE 100 slipped 0.4%, while the German DAX fell 0.1%.

US sharemarkets were also weaker overnight ahead of the release of first-quarter earnings and widely anticipated inflation data. NVIDIA climbed 5.6% after the company hosted its investor day, where it announced that first quarter revenue is tracking higher than previous guidance and that the company will offer its first server microprocessors. Other Information Technology stocks were weaker; Intel shed 4.2% as a result of NVIDIA’s announcements, while Apple gave up 1.3% and Spotify slipped 0.8%.

By the close of trade, the NASDAQ fell 0.4%, while the Dow Jones eased 0.2% and the S&P 500 fell less than 0.1%.

CNIS Perspective

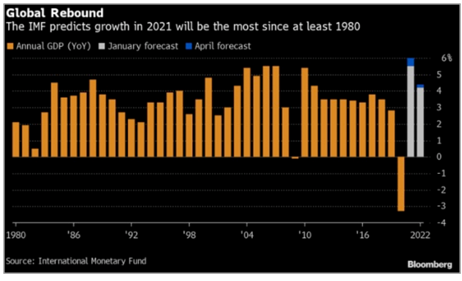

According to the International Monetary Fund (IMF), “even with high uncertainty about the path of the pandemic, a way out of this health and economic crisis is increasingly visible”, as it upgraded its global economic growth forecast for the second time in three months.

The IMF forecasts global growth to expand by 6% this year, up from 5.5% estimated in January, which will be the most growth in four decades of data. This is a significant turnaround from last year’s 3.3% contraction, which was the worst pace of decline since the Great Depression.

The growth forecast does however come with a warning about widening inequality, and a divergence between advanced and lesser developed economies.

Even at the domestic economic level this is evident, with some sectors booming while others continue to struggle.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.