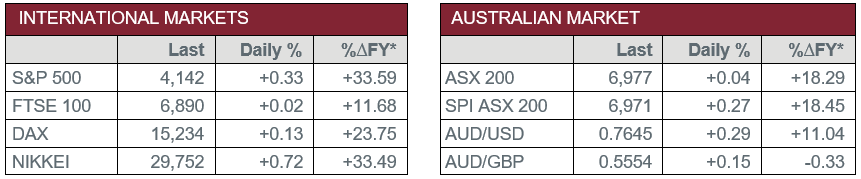

Pre-Open Data

Key Data for the Week

- Tuesday – US – Consumer Price Index was up 0.6% in March, from 0.4% in February.

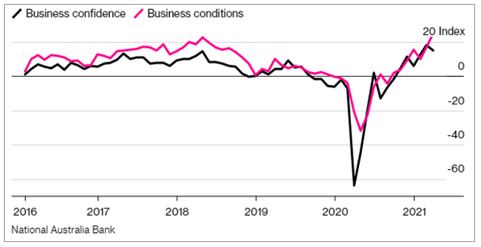

- Tuesday – AUS – NAB Business Confidence fell to 15 in March, from 18 in February.

- Tuesday – AUS – NAB Business Conditions increased to 25 in March, from 17 in February.

- Wednesday – EUR – Industrial Production

Australian Market

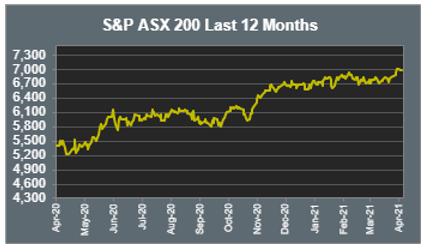

The Australian sharemarket gave up morning gains to finish flat on Tuesday. Sector performance was mixed; Information Technology was the strongest performer, up 2.2%, while Utilities led the losses, down 1.2%.

Strong gains among buy-now-pay-later providers boosted the Information Technology sector. Zip Co rallied 17.0% after the company released its March quarter update, which showed revenue growth of 80% year-on-year. Afterpay gained 3.1% and Sezzle climbed 8.1%, while Splitit jumped 8.3% after the company announced a partnership with Chinese bank card service UnionPay.

The Financials sector added 0.3%, with mixed performances among the major banks; Commonwealth Bank gained 0.5% and ANZ lifted 0.1%, while Westpac closed flat and NAB eased 0.1%. Insurers were mostly higher; NIB closed up 1.3% and QBE Insurance Group rose 0.5%, however, Insurance Australia Group slipped 0.2%.

Weakness among mining heavyweights weighed on the Materials sector, which closed 0.7% lower. Rio Tinto led the losses, down 1.2%, while BHP and Fortescue Metals gave up 1.1% and 0.9% respectively.

The Australian futures market points to a 0.27% rise today.

Overseas Markets

European sharemarkets advanced on Tuesday. Retail stocks outperformed; the UK’s largest sportswear retailer JD Sports gained 3.0% and clothing multinational H&M added 2.1%, while British multinational retailer Marks & Spencer lifted 1.5%. The Financials sector was weaker; Barclays slipped 0.7% and Deutsche Bank fell 1.0%, while HSBC and Lloyds Bank lost 1.3% and 1.4% respectively. By the close of trade, the STOXX Europe 600 and German DAX both added 0.1%, while the UK FTSE 100 was flat.

US sharemarkets were mixed overnight following the release of stronger than expected inflation data. Johnson & Johnson gave up 1.3% after the FDA recommended a pause of its COVID-19 vaccine distribution due to reported cases of blood clotting, with the pause expected to last a week. As a result, competitor pharmaceutical company Moderna climbed 7.4%. The Information Technology sector enjoyed strong gains; Spotify jumped 5.9% and NVIDIA added 3.1%, while Apple and Fortinet lifted 2.4% and 1.5% respectively. By the close of trade, the Dow Jones eased 0.2%, while the S&P 500 added 0.3% and the NASDAQ gained 1.1%.

CNIS Perspective

The strong data on the Australian economy keeps on coming. Yesterday’s NAB Business Conditions index, which measures business hiring, sales and profitability, rose eight points to 25, the highest on record since the survey commenced in 1996.

The results continue to point to an improvement in the outlook for business investment and job creation, with Australia well on track to reach the pre-COVID level of economic activity by the middle of this year.

Over the coming months it is hard to see a deterioration in favourable business conditions. With conditions supported by low interest rates, tax incentives and the potential for targeted support to be announced in May’s Federal Budget for some remaining struggling sectors around the country such as arts, recreation and tourism.

While this data is only an introduction to Thursday’s more crucial employment figures, where economists expect to see the unemployment rate drop to 5.7% from 5.8%, it shows the Australian recovery has played out much faster than economists and policymakers expected.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.