Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – EUR – Industrial Production rose 2.1% in October, up from 0.1% in September.

- Tuesday – AUS – RBA Meeting Minutes

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – US – Industrial Production

Australian Market

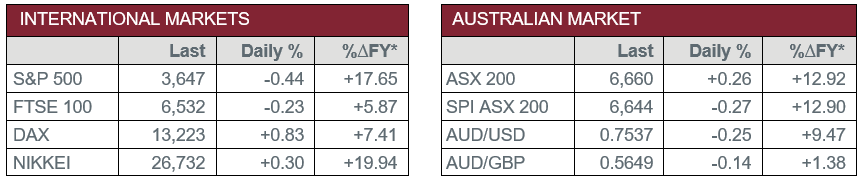

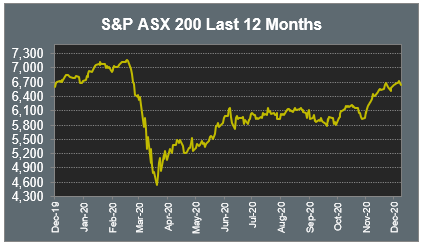

The Australian sharemarket closed up 0.3% on Monday. The market was lifted by strong gains across the Information Technology and Consumer Discretionary sectors, which gained 3.0% and 1.3% respectively.

The Financials sector closed stronger yesterday, led by gains across the major banks. Commonwealth Bank rose 1.9% and ANZ added 1.0%, while NAB and Westpac lifted 0.9% and 0.4% respectively. Insurers also enjoyed gains; NIB rallied 5.0% and QBE Insurance Group gained 1.0%, while Insurance Australia Group closed up 0.8%.

The Information Technology sector advanced on Monday. Buy-now-pay-later companies closed higher; Afterpay surged 8.8% following last week’s announcement that the company will be added to the S&P/ASX 20 Index, while Zip Co and Sezzle lifted 0.4% and 0.2% respectively.

Travel stocks saw losses yesterday despite the announcement that New Zealand has agreed to a Trans-Tasman travel bubble effective from early 2021. Webjet lost 1.4% and Flight Centre fell 2.1%, while Qantas closed down 0.6%.

The Materials sector slumped 0.9% yesterday despite nine-month highs in iron ore prices. Fortescue Metals sunk 3.4%, Rio Tinto slipped 1.8% and BHP fell 0.2%. Goldminers also closed weaker on Monday; Northern Star and Evolution Mining both lost 1.8%, while Saracen Mineral dropped 2.8%.

The Australian futures market points to a 0.27% fall today.

Overseas Markets

European sharemarkets closed higher overnight. The STOXX Europe 600 gained 0.4% despite the introduction of new COVID-19 restrictions in Germany and the UK. German stay-at-home stocks saw gains; online fashion retailer Zalando jumped 6.7%, while food delivery service Delivery Hero added 4.7%.

US sharemarkets were mixed on Monday as investor optimism started high following the launch of a nation-wide COVID-19 vaccine program, however, later weakened on warnings from New York City Mayor Bill De Blasio that the city could experience a “full shutdown” in the near future. Financial services saw strong gains; PayPal climbed 3.1%, while MasterCard and Visa rose 1.1% and 0.5% respectively. By the close of trade, the Dow Jones fell 0.6% and the S&P 500 lost 0.4%, however, the NASDAQ gained 0.5%.

CNIS Perspective

2020 has seen the world’s non-financial firms raise a jaw-dropping US$3.6 trillion in capital from public investors. Issuance of both investment grade and riskier junk bonds set records, of US$2.4 trillion and US$426 billion respectively.

As touched on yesterday, initial public offerings are also near all-time highs, as start-ups hope to cash in on rich valuations. Earlier this month JD Health, a Chinese online pharmacy, raked in US$3.5 billion in Hong Kong. A week later DoorDash and Airbnb both matched it.

In a world of near zero interest rates, it appears investors will bankroll just about anyone, and with stock market valuations propped up by loose monetary policy, many corporates have opted to shore up their balance sheets with new share issues.

Further, with many shareholder dividends reduced, or suspended, until the COVID-19 uncertainty lifts, the cash held by the world’s 3,000 most valuable listed non-financial firms has exploded to US$7.6 trillion, from US$5.7 trillion last year. Even if you exclude the US’s abnormally cash rich technology giants (Apple, Microsoft, Amazon, Alphabet and Facebook), corporate balance sheets are looking very liquid.

It is still too early to tell what firms will do with all the additional cash, however, the merger and acquisition market is showing signs of life after several months of no activity.

For now, capital is likely to keep flowing. The US ten-year treasury yield is below 1% and the spreads between the US Government and corporate bonds have narrowed to pre-pandemic levels.

Investors expecting meaningful returns are therefore eyeing stocks. For the corporate world, the choice between cheap debt and cheap equity is a win-win.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.