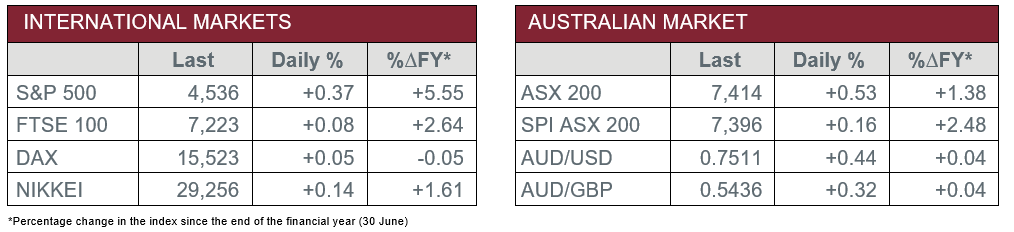

Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Consumer Price Index rose 0.5% in September, which equated to a 3.4% annual rise, in line with estimates.

- Wednesday – UK – Consumer Price Index rose 0.3% in September, which equated to a 3.1% annual rise, lower than expected.

- Thursday – AUS – NAB Business Confidence

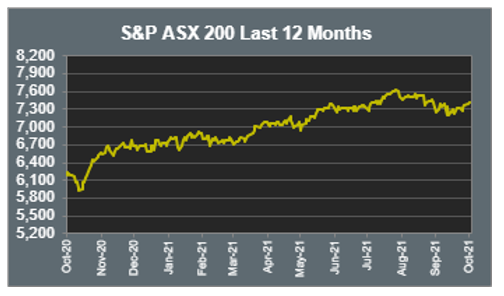

Australian Market

The Australian sharemarket rallied on Wednesday, as the local market closed 0.5% higher. Most sectors advanced, with Energy (-1.0%) and Telecommunications (-0.5%) being the only detractors. Despite this, the Energy sector has surged in the past few months, due to supply shortages and increased demand, as global economic activity recovers from COVID-19. The sector’s index has risen ~12.8% since August, which represents growth of ~9.8% year to date.

Worley Limited (7.5%), a service provider which supports customers in reducing carbon emissions, was a key performer in the session. Its performance was attributed to a significant deal secured with Shell, which led brokers to affirm Worley as a winner from the global energy transition to carbon neutrality.

Online retailer Kogan (6.7%) was another important mover, after it provided a trading update for Q1 FY2022, which indicated gross sales grew by 21.1% year on year, alongside active customers, up 30.7%.

The Financials sector (1.0%) performed strongly, as all major banks advanced, partly attributable to the interest rate environment looking positive for the sector’s future profit margins. Commonwealth Bank led gains, up 1.1%, followed by ANZ (0.9%), Westpac (0.8%) and NAB (0.6%). Meanwhile, Liberty Financial Group (2.3%), Macquarie Bank (2.0%) and Australian Ethical Investment (1.4%) were other important gainers within the sector.

The Australian futures point to a 0.16% rise today.

Overseas Markets

European sharemarkets closed slightly higher on Wednesday, as investors anxiously digest earnings reports amid higher costs due to energy prices, supply chain issues and labour shortfalls. The STOXX Europe 600 rose 0.3%, while the German DAX and UK FTSE 100 both edged 0.1% higher. Swiss food giant Nestlé (2.7%) was a key gainer, attributable to positive earnings results. In London, shares in Rio Tinto fell 3.3%, while BHP lost 0.3%.

US sharemarkets were mostly higher on Wednesday, as investors similarly weighed in on earnings reports alongside the risks associated with high inflationary pressure. The Dow Jones and S&P 500 both gained 0.4%, while the NASDAQ fell 0.1%. Most sectors closed higher, with Information Technology (-0.3%) being the primary laggard. Notable decliners included PayPal (-4.9%) Alphabet (-1.0%) and Visa (-0.9%).

CNIS Perspective

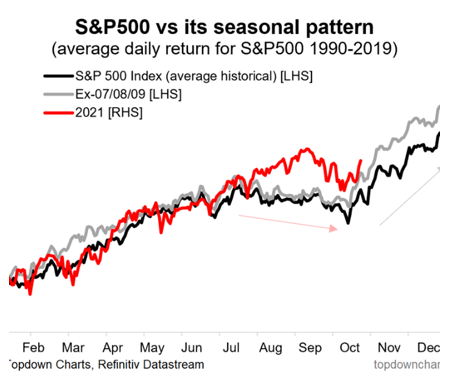

From time to time, it’s important to take a step back and look at what the market has done so far in comparison to previous averages.

While we are just over three quarters through 2021, the seasonality chart below shows just how consistent this year has been, with the one exception, ‘go away in May’, which didn’t ring true.

The US summer is generally one of muted returns, however, this year powered through, despite so many macroeconomic uncertainties to deal with.

Right on cue, September, seasonally the weakest month of the year, was again just that as the US S&P 500 gave up 4.8%.

However, with the US market beginning to regain some lost ground as seasonal headwinds abate in October, it will be interesting to see how the remainder of the year unfolds.

November and December tend to be positive on average, as the ‘Santa Claus rally’ often kicks into gear. However, exceptions do exist, and seasonality factors aren’t all that is at play in markets, but fingers crossed for a strong end to 2021.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.