Morning Market Update - 2 November 2021

Cutcher & Neale

01 November 2021

17 July 2023

minutes

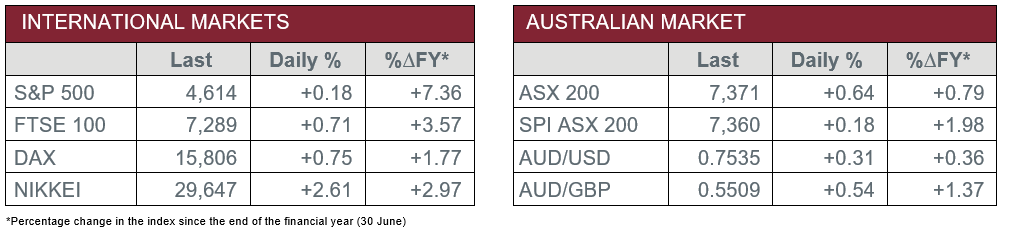

Pre-Open Data

Key Data for the Week

- Monday – CoreLogic Dwelling Prices grew 1.5% in October, making it a 21.6% increase over the year.

- Tuesday – AUS – RBA Interest Rate Decision

Australian Market

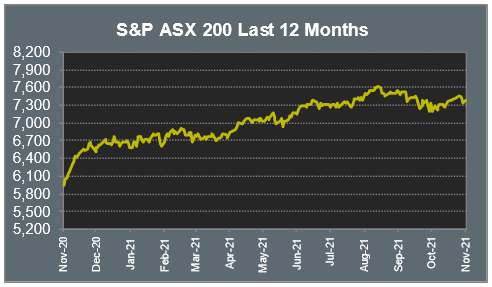

The Australian sharemarket added 0.6% yesterday, as investors showed little sign of worry regarding slowing Chinese economic data. Attention now turns to today’s interest rate decision, along with monetary policy discussions in the US later this week.

The Information Technology sector outperformed, despite a 1.0% drop in Afterpay, with the sector following a solid lead from the US. Accounting software provider, Xero, jumped 4.2%, while WiseTech Global added 5.5%.

A 7.4% fall in Westpac dragged the Financials sector 0.5% lower. This comes as a result of the company’s declining profit margins and rising costs. The company also detailed an off-market share buy-back. Of the other major banks, NAB closed 0.9% lower, while Commonwealth Bank added 1.5% and ANZ eked out a less than 0.1% gain.

In mining, Fortescue Metals and Rio Tinto increased 2.9% and 0.8% respectively, while BHP slipped 0.5%. Gold miners lost ground; Northern Star Resources lost 1.7%, while Evolution Mining closed the session 1.1% lower.

The Australian futures market points to a 0.18% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets closed higher on Monday as expectations for interest rate increases lifted the Financials sector. Deutsche Bank rallied 0.4%, while ING Groep and BNP Paribas lifted 2.1% and 3.1% respectively. By the close of trade, the UK’s FTSE 100 added 0.7% and the German DAX lifted 0.8%, while the STOXX Europe 600 rose 0.7%.

US sharemarkets also gained, boosted by an 8.5% jump in Tesla. The Information Technology sector was relatively mixed, Amazon lost 1.6%, and Google’s parent company, Alphabet, conceded 3.0%, while Spotify lifted 4.0%. By the close of trade, the Dow Jones closed up 0.3%, while the S&P 500 and NASDAQ gained 0.2% and 0.6% respectively.

CNIS Perspective

The rapid rise in the price of housing over the past 12 months has been nothing short of extraordinary, and prices have continued to advance in October, growing by a further 1.5%. Unbelievably, this takes the average Australian house price growth to 21.6% over the past year, the strongest annual growth since 1989 and marks 13 consecutive months of house price increases.

Low interest rates remain undoubtedly the driving force, although lack of supply and the fast recovery in the labour market have also contributed.

While dwelling prices may continue to rise for the remainder of 2021 and into 2022, this level of growth is not able to be sustained for a lengthy period.

Cracks are already beginning to appear in this low interest rate environment, the first stage of APRA tightening bank lending policy has begun and ultimately, we will come to a point where affordability constraints weigh on buyer enthusiasm.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.