Morning Market Update - 10 June 2022

Cutcher & Neale

09 June 2022

17 July 2023

minutes

Pre-Open Data

Key Data for the Week

- Thursday – CHINA – Trade Balance ballooned to US$78.6 billion in May, higher than expected, as exports surged 16.9% and imports rose 4.1%.

- Thursday – EUR – ECB Policy Decision – The central bank announced that on 1 July it will end its bond buying program and expects to lift rates by 0.25%.

- Friday – CHINA – Consumer Price Index

- Friday – US – Consumer Price Index

Australian Market

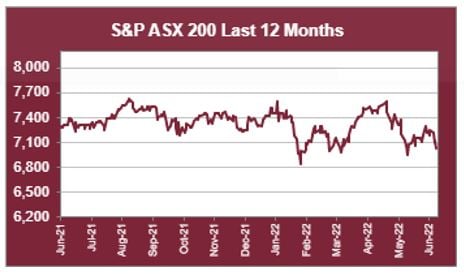

The Australian sharemarket fell 1.4% on Thursday, its lowest level in a month, dragged down by the major banks. It seemed investors remained concerned about the potential impact of bad debt on earnings, given the recent rate hike and pressure on household affordability. The Financials sector conceded 2.1%, which represented its fourth straight loss, to be down ~7.6% this week. Westpac again led losses, down 3.7%, followed by Commonwealth Bank, NAB and ANZ, which all lost between 2.3%-2.6%.

All industry sectors closed in the red, except the Energy sector, which rose 0.6% after oil prices lifted ~2.5% on Wednesday night. Surprisingly, the index heavy Materials sector gave up 2.2%, despite a sixth consecutive day of gains in the price of iron ore. All the major miners lost ground, including BHP Group (-2.4%), Fortescue Metals Group (-0.3%) and Rio Tinto (-1.2%). Other notable movers included lithium stocks Allkem (-4.2%), Pilbara Minerals (-5.4%) and Liontown Resources (-3.4%).

The top performers in yesterday’s session included Magellan Financial Group (2.2%), Megaport (2.0%), Crown Resorts (2.0%), Woodside Energy (1.9%) and Technology One (1.7%). Magellan shares were led higher by news that its co-founder, Hamish Douglass, would return as a company consultant to provide his investment insights.

The Australian futures market points to a 0.79% decline today.

Overseas Markets

European sharemarkets experienced broad-based losses on Thursday, discouraged by the European Central Bank’s statement that inflation would average 6.8% this year and that larger cash rate hikes could be on the horizon. Additionally, the central bank cut its economic growth forecast for the year to 2.8%, down from 3.7%. By the close of trade, the STOXX Europe 600, German DAX and UK FTSE 100 all declined between 1.4%-1.7%.

US sharemarkets sank on Thursday, with all eleven sectors in the red, led by Information Technology (-2.7%) and Communication Services (-2.8%). Notable detractors in the session included Apple (-3.6%), Meta Platforms (-6.4%), Microsoft (-2.0%) and Amazon (-4.2%). By the close of trade, the Dow Jones slipped 1.2%, while the S&P 500 and NASDAQ gave up 2.4% and 2.8% respectively.

CNIS Perspective

If you have been watching foreign exchange markets of late, it has been hard to miss the US Dollar's meteoric rise against the Japanese Yen. Since March, the USD has gained 16.9% against the Yen. This comes as the Bank of Japan holds out on interest rate hikes to spur economic growth. It is worth noting that the inflation picture in Japan is far different than in the US, with CPI rising by just 2.5% year on year in April. In the same period, US CPI rose by 8.3% year on year.

Changes in foreign exchange rates have wide spanning economic implications. Since it now takes fewer USD to acquire Yen, US importers are likely to increase purchases of Japanese products, as they become cheaper in real terms. On the contrary, it becomes much more expensive for Japanese companies to import US goods. This will likely boost GDP growth for Japan, as net exports are likely to rise as imports get more expensive and Japanese products become more financially attractive to the rest of the world.

Over the last ten years, the Japanese Nikkei has averaged a forward P/E multiple of 17.7 and currently trades on 15.9 times forward earnings. On the other hand, the S&P 500 currently trades around its 10-year average earnings multiple of 18.2. This is especially notable given the fact that both central banks are currently embarked on entirely different approaches to monetary policy.

If Japanese stocks were to follow a similar trend as they did ten years ago, when the US Dollar began to rally versus the Yen, the valuation gap between the US and Japan should start to move in the latter's favour.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.