Morning Market Update - 11 March 2021

Cutcher & Neale

10 March 2021

17 July 2023

minutes

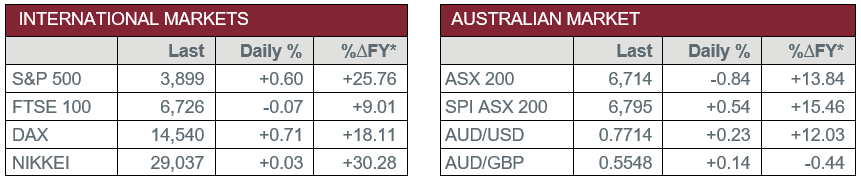

Pre-Open Data

Key Data for the Week

- Wednesday – CHINA – Consumer Price Index fell 0.2% in the year to February, slightly better than a projected 0.3% decline.

- Wednesday – US – Consumer Price Index rose 0.4% in February to an annual rate of 1.7%. The soft result appeared to calm US bond markets, which have seen yields rise on the fear of inflation.

- Thursday – EUR – ECB Interest Rate Decision

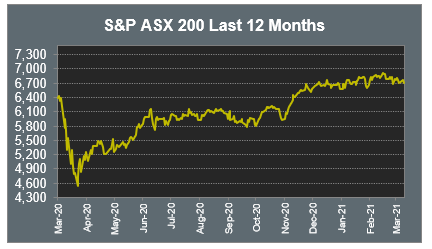

Australian Market

The Australian sharemarket fell 0.8% in a mixed session of trade. The Energy and Materials sectors were the weakest performers, while Information Technology outperformed.

Mining heavyweights weighed on the Materials sector following an over 5% fall in the price of iron ore; Fortescue Metals tumbled 8.3%, Rio Tinto fell 5.5% and BHP lost 2.8%.

The Information Technology sector rebounded from heavy losses on Tuesday. Afterpay led the gains up 7.5% after the company completed the acquisition of Pagantis as part of its expansion into Europe.

The Financials sector weakened as the big four banks all fell between 1.3% and 2.0%. Reserve Bank Governor Phillip Lowe announced at a business conference that he does not expect to lift the cash rate from its record low 0.1% until 2024, when inflation is predicted to be sustainably within the 2-3% target.

Treasury Wine Estates rose 2.9% after the company said it had licensed four brands for use by US company The Wine Group.

The Australian futures market points to a 0.54% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets were higher on Wednesday. Gains in the Telecommunications and Healthcare sectors outweighed losses from mining and travel stocks. German real estate company Vonovia added 1.7%, while meal kit provider HelloFresh slipped 1.2%. The broad based STOXX Europe 600 closed up 0.4% and Germany’s DAX rose 0.7% to close at a record high.

US sharemarkets were mostly higher overnight. Energy and Financials led the gains, while Information Technology was the only sector to close lower as the rotation into value stocks resumed. Apple fell 0.9% after reportedly cutting its first half iPhone production by 20%. Cybersecurity company Fortinet added 2.7%, while competitor CrowdStrike lost 2.1%. Payment providers MasterCard and Visa added 1.4% and 1.3% respectively, while PayPal eked out a 0.1% gain. Aircraft manufacturer Boeing lifted 6.4% after the company’s order book turned positive in February, while news the world's largest aircraft leasing company AerCap signed a US$30 billion deal to acquire General Electric’s Capital Aviation Services company could signal a boom in international travel.

By the close of trade, the Dow Jones rose 1.5% to a record high and the S&P 500 added 0.5%, while the NASDAQ closed marginally lower.

CNIS Perspective

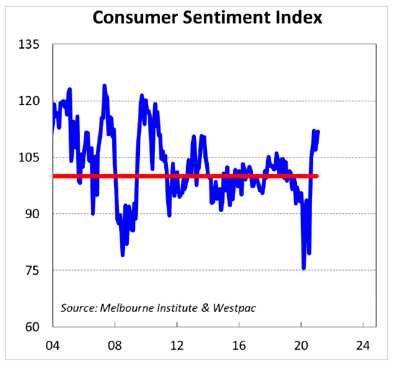

Australia’s post COVID–19 economic recovery is going according to plan, with yesterday’s Consumer Sentiment Index showing consumer confidence is sitting almost 50% higher than a year ago.

With state economies out of lockdown, record low interest rates and the vaccine starting to be rolled out, the all-important cashed up consumer should drive the next leg of the recovery, with consumer spending expected to lift economic activity.

A theme that has been emerging in the survey over recent months has been growing concern over housing affordability.

The ‘time to buy a dwelling’ index slid another 3.6% in February and is now 11.9% below its November peak, suggesting the continued surge in house prices is starting to weigh on purchasing sentiment.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.